As a vehicle owner, selling your car can be a daunting task, especially when it comes to the paperwork involved. One crucial document that is often overlooked is the motor vehicle bill of sale form. In the state of California, the Department of Motor Vehicles (DMV) requires a specific form, known as the DR2173, to be used for all vehicle sales. In this article, we will provide a comprehensive guide to understanding and completing the DR2173 motor vehicle bill of sale form.

What is a Motor Vehicle Bill of Sale Form?

A motor vehicle bill of sale form is a document that proves the transfer of ownership of a vehicle from one party to another. It serves as a receipt for the buyer and a record of the sale for the seller. The form includes essential details about the vehicle, such as the make, model, year, and Vehicle Identification Number (VIN), as well as the sale price and payment terms.

Why is a Motor Vehicle Bill of Sale Form Important?

A motor vehicle bill of sale form is crucial for several reasons:

- It provides proof of ownership transfer, which is required by the DMV to register the vehicle in the buyer's name.

- It protects both the buyer and seller from potential disputes or liabilities.

- It serves as a record of the sale, which can be useful for tax purposes or in case of any future issues.

Understanding the DR2173 Motor Vehicle Bill of Sale Form

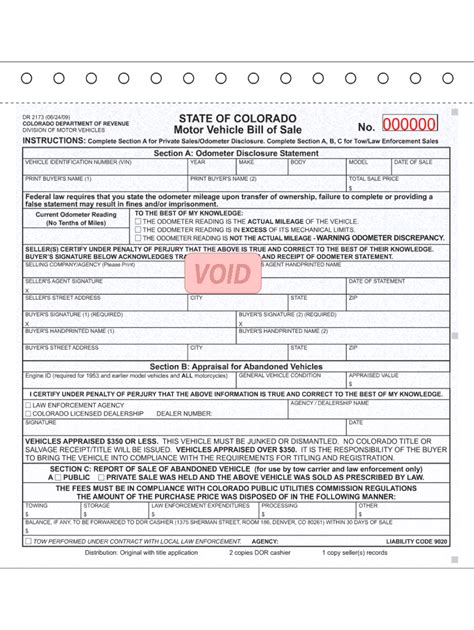

The DR2173 motor vehicle bill of sale form is a standardized document provided by the California DMV. It consists of two parts: the buyer's copy and the seller's copy. The form requires the following information:

- Vehicle details: make, model, year, and VIN

- Sale price and payment terms

- Buyer's and seller's information: names, addresses, and signatures

- Odometer reading (if applicable)

How to Complete the DR2173 Motor Vehicle Bill of Sale Form

To complete the DR2173 motor vehicle bill of sale form, follow these steps:

- Fill in the vehicle details: make, model, year, and VIN.

- Enter the sale price and payment terms.

- Provide the buyer's and seller's information: names, addresses, and signatures.

- Record the odometer reading (if applicable).

- Ensure both parties sign the form.

Additional Requirements for Vehicle Sales in California

In addition to the DR2173 motor vehicle bill of sale form, California requires the following documents for vehicle sales:

- Title: The seller must provide the buyer with the vehicle title, which must be free of any liens or loans.

- Smog Certificate: The seller must provide a smog certificate, which ensures the vehicle meets California's emissions standards.

- Registration: The buyer must register the vehicle in their name within 10 days of the sale.

Consequences of Not Using the DR2173 Motor Vehicle Bill of Sale Form

Failure to use the DR2173 motor vehicle bill of sale form can result in:

- Delays in the registration process

- Fines and penalties

- Disputes between the buyer and seller

Conclusion

In conclusion, the DR2173 motor vehicle bill of sale form is a crucial document for vehicle sales in California. By understanding and completing the form correctly, buyers and sellers can ensure a smooth transfer of ownership and avoid potential issues. We encourage you to share your experiences with using the DR2173 form in the comments below. If you have any questions or concerns, please don't hesitate to reach out.

What is the purpose of the DR2173 motor vehicle bill of sale form?

+The DR2173 motor vehicle bill of sale form is a document that proves the transfer of ownership of a vehicle from one party to another. It serves as a receipt for the buyer and a record of the sale for the seller.

What information is required on the DR2173 motor vehicle bill of sale form?

+The DR2173 motor vehicle bill of sale form requires the following information: vehicle details (make, model, year, and VIN), sale price and payment terms, buyer's and seller's information (names, addresses, and signatures), and odometer reading (if applicable).

What are the consequences of not using the DR2173 motor vehicle bill of sale form?

+Failure to use the DR2173 motor vehicle bill of sale form can result in delays in the registration process, fines and penalties, and disputes between the buyer and seller.