In today's fast-paced world, having adequate health insurance is crucial for maintaining overall well-being. HMSA, or Hawaii Medical Service Association, is one of the largest health insurance providers in Hawaii. If you're looking to enroll in an HMSA plan, understanding the enrollment process is essential. In this article, we will guide you through the 5 easy steps to complete the HMSA enrollment form.

Understanding HMSA Enrollment

Before we dive into the steps, it's essential to understand the basics of HMSA enrollment. HMSA offers a range of health insurance plans, including individual, family, and group plans. The enrollment process typically involves submitting an application, providing required documentation, and selecting a plan that suits your needs.

Step 1: Gather Required Documents

To complete the HMSA enrollment form, you'll need to gather the necessary documents. These typically include:

- Identification documents (driver's license, passport, or state ID)

- Proof of income (pay stub, W-2 form, or tax return)

- Proof of residency (utility bill, lease agreement, or mortgage statement)

- Social Security number or Individual Taxpayer Identification Number (ITIN)

Having these documents readily available will ensure a smooth enrollment process.

Filling Out the HMSA Enrollment Form

Now that you have the required documents, it's time to fill out the HMSA enrollment form.

Step 2: Choose Your Plan

HMSA offers a range of health insurance plans, each with its unique benefits and premiums. Take the time to review the available plans and select the one that suits your needs and budget.

- Consider your health needs and medical expenses

- Evaluate the premium costs and out-of-pocket expenses

- Compare the coverage and benefits offered by each plan

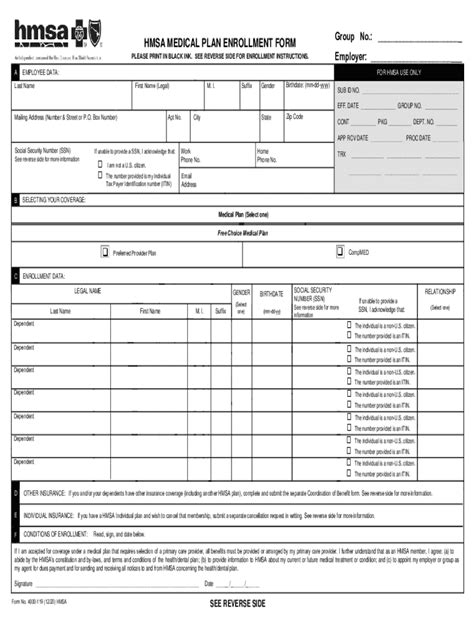

Step 3: Complete the Enrollment Form

Once you've chosen your plan, it's time to complete the HMSA enrollment form. The form will typically ask for:

- Personal and contact information

- Plan selection and effective date

- Payment information (if applicable)

Be sure to review the form carefully and provide accurate information to avoid any delays in processing.

Submitting the HMSA Enrollment Form

Now that you've completed the enrollment form, it's time to submit it.

Step 4: Submit Your Application

You can submit your HMSA enrollment form online, by mail, or in person. Be sure to follow the submission instructions carefully to avoid any delays.

- Online submission: Visit the HMSA website and follow the online application process

- Mail submission: Send the completed form to the address listed on the HMSA website

- In-person submission: Visit an HMSA office or authorized agent to submit your application

Step 5: Review and Confirm

Once you've submitted your application, review and confirm the information to ensure accuracy.

- Review your plan selection and effective date

- Confirm your payment information (if applicable)

- Review and understand the terms and conditions of your plan

By following these 5 easy steps, you can complete the HMSA enrollment form and take the first step towards securing your health and well-being.

Taking Control of Your Health

Completing the HMSA enrollment form is just the first step towards taking control of your health. By understanding the enrollment process and selecting the right plan, you can ensure that you have the coverage you need to maintain your overall well-being.

We encourage you to share your experiences and ask questions in the comments section below. Don't forget to share this article with friends and family who may be looking to enroll in an HMSA plan.

What is the HMSA enrollment period?

+The HMSA enrollment period typically occurs during the open enrollment period, which usually takes place from November to January. However, you may be eligible for special enrollment outside of this period if you experience a qualifying life event, such as a change in employment or marriage.

How do I know which HMSA plan is right for me?

+To determine which HMSA plan is right for you, consider your health needs and medical expenses. Evaluate the premium costs and out-of-pocket expenses, and compare the coverage and benefits offered by each plan. You can also consult with an HMSA representative or authorized agent for guidance.

Can I cancel my HMSA plan at any time?

+You can cancel your HMSA plan, but there may be penalties or fees associated with early cancellation. It's essential to review your plan's terms and conditions to understand the cancellation process and any potential fees.