The DR-15EZ form is a crucial document for Floridian businesses, particularly those dealing with tangible personal property. As a business owner, it's essential to understand what this form is, its purpose, and how to complete it accurately. In this article, we'll delve into the world of the DR-15EZ form, exploring its significance, benefits, and a step-by-step guide on how to fill it out.

What is the DR-15EZ Form?

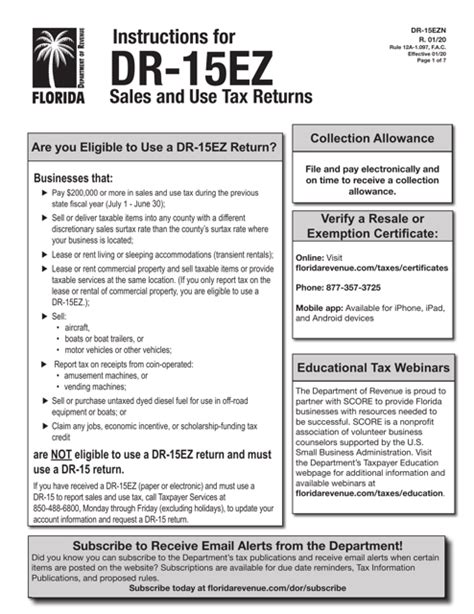

The DR-15EZ form is a Tangible Personal Property Tax Return, specifically designed for businesses in Florida. It's a simplified version of the standard DR-405 form, making it easier for companies to report and pay taxes on their tangible personal property. This form is used to declare the value of business assets, such as equipment, furniture, and other non-real estate property.

Why is the DR-15EZ Form Important?

The DR-15EZ form is crucial for several reasons:

- Tax Compliance: It ensures that businesses comply with Florida's tax laws and regulations, avoiding penalties and fines.

- Property Valuation: The form helps assess the value of business assets, which is essential for tax purposes.

- Record-Keeping: By completing the DR-15EZ form, businesses maintain accurate records of their assets, making it easier to track inventory and depreciation.

Benefits of the DR-15EZ Form

Using the DR-15EZ form offers several benefits to businesses:

- Simplified Reporting: The form is designed to be easy to understand and complete, reducing the administrative burden on businesses.

- Reduced Paperwork: By using the simplified form, businesses can minimize the amount of paperwork required for tax purposes.

- Faster Processing: The DR-15EZ form is typically processed faster than the standard DR-405 form, allowing businesses to receive their tax bills and make payments more efficiently.

Step-by-Step Guide to Completing the DR-15EZ Form

To complete the DR-15EZ form accurately, follow these steps:

Step 1: Gather Required Information

- Business Information: Ensure you have the business's name, address, and Federal Employer Identification Number (FEIN) readily available.

- Asset Information: Gather details about the business's tangible personal property, including the type, cost, and year of acquisition.

Step 2: Determine the Filing Status

- New Business: If you're a new business, you'll need to file the DR-15EZ form as a "new" filer.

- Existing Business: If you've filed the form previously, you'll need to file as an "existing" filer.

Step 3: Complete the Form

- Section 1: Business Information: Fill in the business's name, address, and FEIN.

- Section 2: Asset Information: List the business's tangible personal property, including the type, cost, and year of acquisition.

- Section 3: Total Value: Calculate the total value of the business's assets.

Step 4: Sign and Date the Form

- Authorized Signature: Ensure the form is signed by an authorized representative of the business.

- Date: Include the date the form was signed.

Step 5: Submit the Form

- Filing Deadline: Submit the form by the required deadline to avoid penalties and fines.

- Submission Methods: The form can be submitted online, by mail, or in person.

Common Mistakes to Avoid

When completing the DR-15EZ form, be sure to avoid the following common mistakes:

- Inaccurate Information: Ensure all information is accurate and up-to-date.

- Missing Signatures: Verify that the form is signed by an authorized representative of the business.

- Late Submission: Submit the form by the required deadline to avoid penalties and fines.

By following these steps and avoiding common mistakes, businesses can ensure accurate and timely completion of the DR-15EZ form.

Additional Resources

For more information on the DR-15EZ form, businesses can consult the following resources:

- Florida Department of Revenue: The official website of the Florida Department of Revenue provides detailed information on the DR-15EZ form, including filing instructions and deadlines.

- Business Tax Guides: The Florida Department of Revenue offers business tax guides that provide step-by-step instructions on completing the DR-15EZ form.

By understanding the DR-15EZ form and its significance, businesses can ensure compliance with Florida's tax laws and regulations, avoiding penalties and fines.