In today's fast-paced digital age, managing finances efficiently is crucial for individuals and businesses alike. One way to streamline financial transactions is by utilizing direct deposit services. Suncoast Credit Union, a prominent financial institution in the United States, offers a convenient and secure direct deposit service that enables members to receive their salaries, benefits, and other payments directly into their accounts.

What is Direct Deposit and How Does it Work?

Direct deposit is an electronic payment system that allows funds to be transferred directly from a payer's account to a payee's account. This service eliminates the need for paper checks, reducing the risk of lost or stolen payments. Suncoast Credit Union's direct deposit service ensures that members receive their funds promptly and securely.

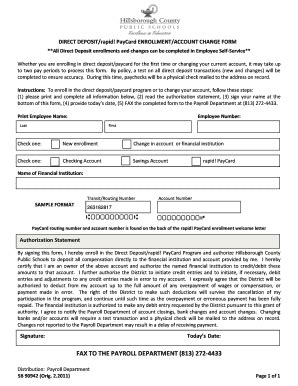

To set up direct deposit with Suncoast Credit Union, members need to provide their employer or payer with their account information, including the routing number and account number. Once the information is verified, the payer will initiate the direct deposit process, and the funds will be transferred into the member's account.

Benefits of Suncoast Credit Union Direct Deposit

Suncoast Credit Union's direct deposit service offers numerous benefits, including:

- Convenience: Direct deposit eliminates the need to visit a branch or ATM to deposit checks, saving time and effort.

- Security: Direct deposit reduces the risk of lost or stolen checks, ensuring that funds are transferred securely.

- Faster Access: Funds are typically available in the account on the same day they are deposited, allowing members to access their money sooner.

- Reduced Errors: Direct deposit minimizes the risk of errors associated with manual check deposits.

- Environmentally Friendly: By reducing the need for paper checks, direct deposit helps minimize waste and promote sustainability.

How to Set Up Suncoast Credit Union Direct Deposit

To set up direct deposit with Suncoast Credit Union, members can follow these steps:

- Obtain the Direct Deposit Form: Download the Suncoast Credit Union Direct Deposit form from the credit union's website or visit a local branch to obtain a copy.

- Gather Required Information: Collect the necessary information, including the account number, routing number, and employer or payer information.

- Complete the Form: Fill out the direct deposit form accurately and thoroughly, ensuring that all required information is provided.

- Submit the Form: Return the completed form to the employer or payer, either in person, by mail, or via email.

Common Uses of Suncoast Credit Union Direct Deposit

Suncoast Credit Union's direct deposit service is commonly used for various purposes, including:

- Payroll: Employees can have their salaries deposited directly into their accounts.

- Benefits: Government agencies and private companies can deposit benefits, such as Social Security payments, into recipients' accounts.

- Refunds: Tax refunds and other types of refunds can be deposited directly into accounts.

Troubleshooting Common Issues with Suncoast Credit Union Direct Deposit

While Suncoast Credit Union's direct deposit service is generally reliable, issues can arise. Some common problems and their solutions include:

- Delayed Deposits: If deposits are delayed, members should contact their employer or payer to verify the payment schedule and ensure that the account information is accurate.

- Incorrect Deposits: If incorrect deposits are made, members should notify the credit union immediately to initiate an investigation and correct the error.

- Technical Issues: Technical issues can be resolved by contacting Suncoast Credit Union's customer support team.

Conclusion

Suncoast Credit Union's direct deposit service offers a convenient, secure, and efficient way to manage finances. By understanding the benefits, setup process, and common uses of direct deposit, members can take advantage of this service to streamline their financial transactions. If issues arise, troubleshooting common problems can help resolve them quickly. By embracing direct deposit, members can enjoy a more streamlined and secure financial experience.What is the routing number for Suncoast Credit Union?

+The routing number for Suncoast Credit Union is 263182841.

How long does it take for direct deposit funds to become available?

+Funds are typically available in the account on the same day they are deposited.