Filling out tax exemption forms can be a daunting task, especially for small business owners or individuals who are not familiar with the process. However, for those who shop at Dollar Tree, a tax exemption can be a huge cost-saver. In this article, we will break down the process of filling out the Dollar Tree tax exempt form, also known as the Resale Certificate, into 5 easy-to-follow steps.

Understanding the Dollar Tree Tax Exempt Form

Before we dive into the steps, it's essential to understand what the Dollar Tree tax exempt form is and why it's necessary. The Resale Certificate is a document that certifies a business or individual is purchasing items for resale, rather than personal use. This certificate allows Dollar Tree to exempt the business or individual from paying sales tax on qualifying purchases.

Benefits of Filling Out the Dollar Tree Tax Exempt Form

Filling out the Dollar Tree tax exempt form can save your business or organization a significant amount of money on sales tax. For example, if you purchase $1,000 worth of merchandise from Dollar Tree each month, you could save around $80-$100 per month in sales tax, depending on the state and local tax rates.

Step 1: Gather Required Information

To fill out the Dollar Tree tax exempt form, you will need to gather some required information. This includes:

- Your business or organization's name and address

- Your tax ID number or Employer Identification Number (EIN)

- A description of the types of products you plan to purchase from Dollar Tree

- Your signature and title (if applicable)

Types of Tax ID Numbers

There are several types of tax ID numbers that can be used on the Dollar Tree tax exempt form, including:

- Employer Identification Number (EIN): This is a unique nine-digit number assigned to your business or organization by the IRS.

- Social Security Number (SSN): This is a unique nine-digit number assigned to individuals by the Social Security Administration.

- Sales Tax ID Number: This is a unique number assigned to your business or organization by your state's tax authority.

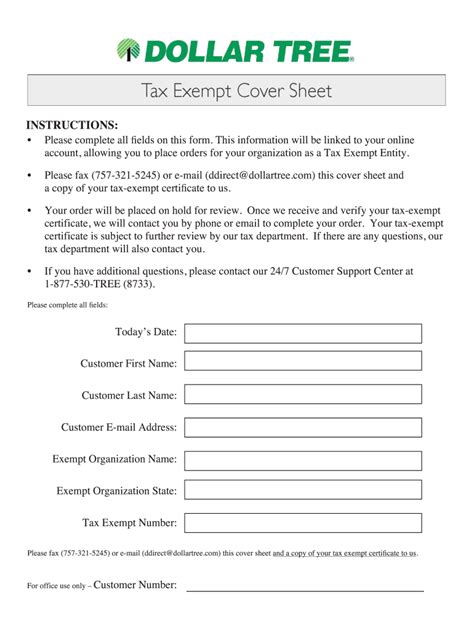

Step 2: Download and Print the Form

Once you have gathered the required information, you can download and print the Dollar Tree tax exempt form from the company's website or by contacting their customer service department.

Where to Find the Form

You can find the Dollar Tree tax exempt form on the company's website by following these steps:

- Go to the Dollar Tree website and click on the "Help" or "Customer Service" link at the top of the page.

- Scroll down to the "Tax Exemption" or "Resale Certificate" section and click on the link.

- Follow the prompts to download and print the form.

Step 3: Fill Out the Form

Once you have downloaded and printed the form, you can begin filling it out. Make sure to follow the instructions carefully and provide all required information.

Common Mistakes to Avoid

When filling out the Dollar Tree tax exempt form, there are several common mistakes to avoid, including:

- Failing to provide all required information

- Using an incorrect tax ID number

- Not signing the form

Step 4: Sign and Date the Form

Once you have completed the form, you will need to sign and date it. Make sure to use a blue or black pen and sign your name clearly.

Who Should Sign the Form?

The person who signs the form should be an authorized representative of the business or organization. This could be the owner, manager, or someone with the power to make purchasing decisions.

Step 5: Submit the Form to Dollar Tree

Finally, you will need to submit the completed and signed form to Dollar Tree. You can do this by:

- Faxing the form to the company's tax exemption department

- Emailing the form to the company's tax exemption department

- Mailing the form to the company's tax exemption department

How Long Does it Take to Process the Form?

The time it takes to process the form can vary depending on the company's workload and processing times. However, it typically takes around 2-4 weeks for the form to be processed and for your account to be updated.

What is the Dollar Tree tax exempt form?

+The Dollar Tree tax exempt form, also known as the Resale Certificate, is a document that certifies a business or individual is purchasing items for resale, rather than personal use.

What information do I need to provide on the form?

+You will need to provide your business or organization's name and address, tax ID number, a description of the types of products you plan to purchase, and your signature and title (if applicable).

How long does it take to process the form?

+The time it takes to process the form can vary depending on the company's workload and processing times, but it typically takes around 2-4 weeks.

We hope this article has provided you with a comprehensive guide on how to fill out the Dollar Tree tax exempt form. If you have any further questions or concerns, please don't hesitate to reach out to us. Don't forget to share this article with your friends and colleagues who may also benefit from this information.