As a resident of Virginia, it's essential to understand the VA-4 tax form, which is a critical document for state income tax purposes. The VA-4 form is used by employers to withhold the correct amount of state income tax from their employees' wages. In this article, we will break down the VA-4 tax form into five easy steps, providing you with a comprehensive understanding of this essential tax document.

Step 1: Understanding the Purpose of the VA-4 Tax Form

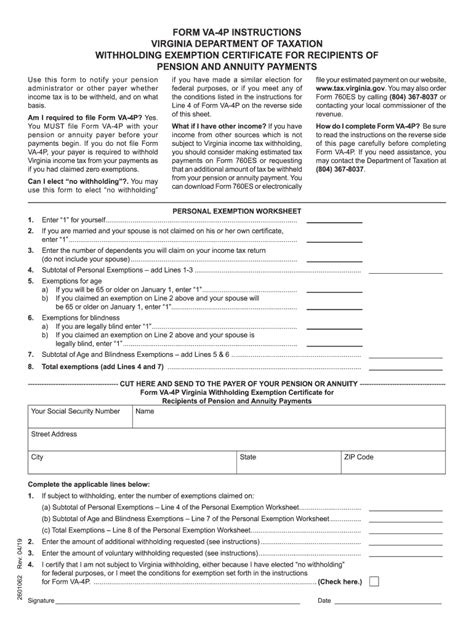

The VA-4 tax form is a certificate of exemption or a withholding exemption certificate that employees must complete and submit to their employer. The primary purpose of this form is to determine the correct amount of state income tax to withhold from an employee's wages. By completing the VA-4 form, employees can ensure that their employer withholds the correct amount of state income tax, avoiding any potential tax liabilities or penalties.

Why is the VA-4 Tax Form Important?

The VA-4 tax form is crucial for both employees and employers. For employees, it ensures that the correct amount of state income tax is withheld from their wages, avoiding any potential tax liabilities or penalties. For employers, it helps them to comply with state tax laws and regulations, avoiding any potential fines or penalties.

Step 2: Completing the VA-4 Tax Form

Completing the VA-4 tax form is a relatively straightforward process. Here are the steps to follow:

- Download and print the VA-4 tax form from the Virginia Department of Taxation's website or obtain a copy from your employer.

- Read the instructions carefully and complete the form accurately.

- Provide your name, address, and social security number.

- Indicate your filing status (single, married, head of household, etc.).

- Claim any dependents or exemptions.

- Sign and date the form.

Common Mistakes to Avoid

When completing the VA-4 tax form, there are several common mistakes to avoid:

- Failing to sign and date the form.

- Providing incorrect or incomplete information.

- Failing to claim dependents or exemptions.

- Not submitting the form to your employer on time.

Step 3: Submitting the VA-4 Tax Form

Once you have completed the VA-4 tax form, you must submit it to your employer. Here are the steps to follow:

- Submit the completed form to your employer's payroll department.

- Ensure that your employer receives the form on time, usually within a few days of starting a new job.

- Keep a copy of the form for your records.

What Happens After Submitting the Form?

After submitting the VA-4 tax form, your employer will use the information to determine the correct amount of state income tax to withhold from your wages. Your employer will also report the withheld tax to the Virginia Department of Taxation.

Step 4: Updating the VA-4 Tax Form

It's essential to update the VA-4 tax form whenever your tax situation changes. Here are some scenarios that may require you to update the form:

- You get married or divorced.

- You have a child or adopt a child.

- You change your filing status.

- You move to a different state.

How to Update the VA-4 Tax Form

To update the VA-4 tax form, you must complete a new form and submit it to your employer. Here are the steps to follow:

- Download and print the VA-4 tax form from the Virginia Department of Taxation's website or obtain a copy from your employer.

- Complete the form accurately, indicating any changes to your tax situation.

- Submit the updated form to your employer's payroll department.

Step 5: Understanding the Impact of the VA-4 Tax Form on Your Tax Liability

The VA-4 tax form has a significant impact on your tax liability. By completing the form accurately, you can ensure that your employer withholds the correct amount of state income tax, avoiding any potential tax liabilities or penalties.

Common Tax Liabilities to Avoid

Here are some common tax liabilities to avoid:

- Underpayment of state income tax.

- Overpayment of state income tax.

- Failure to claim dependents or exemptions.

By following these five easy steps, you can understand the VA-4 tax form and its importance in determining your state income tax liability. Remember to complete the form accurately, submit it to your employer on time, and update it whenever your tax situation changes.

We hope this article has provided you with a comprehensive understanding of the VA-4 tax form. If you have any questions or concerns, please don't hesitate to comment below.

What is the purpose of the VA-4 tax form?

+The VA-4 tax form is a certificate of exemption or a withholding exemption certificate that employees must complete and submit to their employer to determine the correct amount of state income tax to withhold from their wages.

How do I complete the VA-4 tax form?

+Download and print the VA-4 tax form from the Virginia Department of Taxation's website or obtain a copy from your employer. Read the instructions carefully and complete the form accurately, providing your name, address, and social security number, and indicating your filing status, dependents, and exemptions.

What happens if I don't submit the VA-4 tax form to my employer?

+If you don't submit the VA-4 tax form to your employer, you may be subject to penalties and fines. Your employer may also withhold too much state income tax from your wages, resulting in a larger-than-expected tax refund or a smaller-than-expected paycheck.