Filling out a DE 9C form, also known as the Quarterly Contribution Return and Report of Wages, is a crucial task for employers in California. The form is used to report wages and contributions to the California Employment Development Department (EDD). In this article, we will provide a comprehensive guide on how to fill out a DE 9C form sample, ensuring that you comply with the regulations and avoid any potential penalties.

Understanding the Importance of DE 9C Form

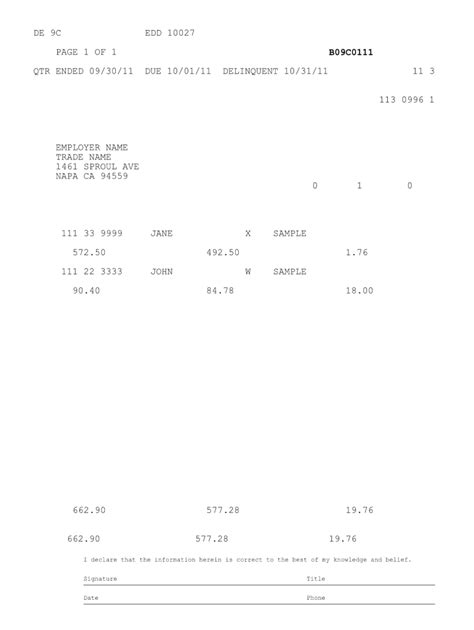

The DE 9C form is a quarterly report that must be submitted by all California employers who are subject to the Unemployment Insurance Code. The form requires employers to report the wages paid to their employees, as well as the contributions made to the state's unemployment insurance fund. The EDD uses this information to determine the employer's tax rate and to ensure compliance with the state's employment laws.

Preparation is Key

Before filling out the DE 9C form, it is essential to gather all the necessary information and documents. This includes:

- Employee wage data, including gross wages, taxable wages, and deductions

- Contribution rates and amounts

- Employer account information, including the account number and tax rate

- Any adjustments or corrections to previous reports

5 Ways to Fill Out a DE 9C Form Sample

1. Online Filing

The EDD offers an online filing system, known as e-Services for Business, which allows employers to submit their DE 9C forms electronically. This method is convenient, fast, and reduces the risk of errors.

To file online, employers need to create an account on the e-Services for Business website and follow the step-by-step instructions.

2. Mail or Fax

Employers can also submit their DE 9C forms by mail or fax. The form can be downloaded from the EDD website and completed manually.

When submitting by mail or fax, employers should ensure that the form is completed accurately and signed by an authorized representative.

3. Payroll Software

Many payroll software programs, such as QuickBooks or ADP, offer DE 9C form filing capabilities. These programs can help employers automate the filing process and reduce errors.

Employers should ensure that their payroll software is updated and compliant with the EDD's filing requirements.

4. Tax Professional or Accountant

Employers can also hire a tax professional or accountant to prepare and file their DE 9C forms. This option can be beneficial for businesses with complex payroll situations or those who need expert advice.

When hiring a tax professional or accountant, employers should ensure that they are experienced in California employment tax law and have a good understanding of the DE 9C form requirements.

5. EDD's Employer Services

The EDD offers employer services, including assistance with DE 9C form filing. Employers can contact the EDD's employer services department for help with completing the form or resolving any issues.

Employers can reach the EDD's employer services department by phone, email, or through the EDD's website.

Tips and Reminders

- Ensure that all information is accurate and complete to avoid errors and penalties.

- Keep records of all DE 9C forms filed, including supporting documentation.

- File the DE 9C form on time to avoid late payment penalties.

- Use the correct tax rates and contribution rates to avoid underpayment or overpayment.

Common Mistakes to Avoid

- Failing to file the DE 9C form on time

- Underreporting or overreporting wages

- Incorrectly calculating contributions

- Failing to maintain accurate records

By following these tips and avoiding common mistakes, employers can ensure that they comply with the regulations and avoid any potential penalties.

Call to Action

If you are an employer in California, it is essential to understand the importance of the DE 9C form and how to fill it out accurately. By following the 5 ways outlined in this article, you can ensure that you comply with the regulations and avoid any potential penalties. If you need help or have questions, don't hesitate to reach out to the EDD or a tax professional.

What is the DE 9C form used for?

+The DE 9C form is used to report wages and contributions to the California Employment Development Department (EDD).

Who is required to file the DE 9C form?

+All California employers who are subject to the Unemployment Insurance Code are required to file the DE 9C form.

What is the deadline for filing the DE 9C form?

+The deadline for filing the DE 9C form is typically the last day of the month following the end of the quarter.