As a heavy vehicle owner or operator, it's essential to be aware of the tax obligations that come with operating a heavy vehicle on public highways. The Heavy Vehicle Use Tax (HVUT) is a federal tax imposed on vehicles with a gross weight of 55,000 pounds or more, and it's essential to file Form 2290 on time to avoid penalties and fines. In this article, we'll provide an in-depth guide on the importance of filing Form 2290, the benefits of filing on time, and a step-by-step guide on how to file.

What is Form 2290?

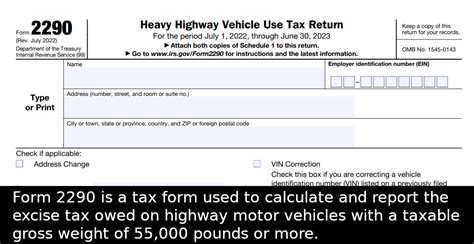

Form 2290 is a federal tax form used to report and pay the Heavy Vehicle Use Tax (HVUT). The form is used to calculate the tax owed on heavy vehicles that operate on public highways and are registered in the owner's name. The tax is based on the vehicle's gross weight, and the amount of tax owed varies depending on the weight and number of vehicles.

Why is it Essential to File Form 2290 on Time?

Filing Form 2290 on time is crucial to avoid penalties and fines. The IRS imposes penalties and interest on late filers, which can add up quickly. Additionally, failure to file Form 2290 can result in the suspension of your vehicle's registration, making it impossible to operate your vehicle on public highways.

Benefits of Filing Form 2290 on Time

Filing Form 2290 on time offers several benefits, including:

- Avoiding penalties and fines

- Ensuring your vehicle's registration is not suspended

- Reducing the risk of audit and examination by the IRS

- Receiving a stamped Schedule 1, which is required to register your vehicle

Who Needs to File Form 2290?

The following individuals and businesses need to file Form 2290:

- Self-employed individuals who own and operate heavy vehicles

- Businesses that own and operate heavy vehicles

- Leasing companies that lease heavy vehicles to others

- Heavy vehicle dealerships

What is the Filing Deadline for Form 2290?

The filing deadline for Form 2290 is typically August 31st of each year. However, if you purchase a new vehicle or start operating a heavy vehicle after the initial deadline, you'll need to file Form 2290 by the last day of the month following the month you started operating the vehicle.

How to File Form 2290

Filing Form 2290 is a straightforward process that can be completed online or by mail. Here's a step-by-step guide on how to file:

- Gather Required Information: Before filing, gather the required information, including:

- Your Employer Identification Number (EIN)

- Your vehicle's Vehicle Identification Number (VIN)

- Your vehicle's gross weight

- The number of vehicles you own or operate

- Choose a Filing Method: You can file Form 2290 online or by mail. Online filing is faster and more convenient, but mail filing is also an option.

- Fill Out Form 2290: Fill out Form 2290, making sure to provide all required information. You can use tax preparation software or work with a tax professional to ensure accuracy.

- Submit Payment: Submit payment for the tax owed. You can pay by check, money order, or electronic funds transfer.

- Receive a Stamped Schedule 1: After filing and paying the tax, you'll receive a stamped Schedule 1, which is required to register your vehicle.

Common Errors to Avoid When Filing Form 2290

When filing Form 2290, avoid the following common errors:

- Incorrect Vehicle Information: Ensure you provide accurate vehicle information, including the VIN and gross weight.

- Incorrect Payment: Ensure you submit the correct payment amount to avoid penalties and fines.

- Late Filing: File Form 2290 on time to avoid penalties and fines.

What to Do if You Miss the Filing Deadline

If you miss the filing deadline, you'll need to file Form 2290 as soon as possible to avoid additional penalties and fines. You'll also need to submit payment for the tax owed, plus any penalties and interest.

Conclusion

Filing Form 2290 on time is essential to avoid penalties and fines. By understanding the importance of filing on time and following the step-by-step guide provided, you can ensure a smooth and efficient filing process. Don't wait until the last minute – file Form 2290 today to avoid any potential issues.

We encourage you to share your experiences and ask questions about filing Form 2290 in the comments below. Don't forget to share this article with others who may benefit from this information.

What is the purpose of Form 2290?

+Form 2290 is used to report and pay the Heavy Vehicle Use Tax (HVUT) on vehicles with a gross weight of 55,000 pounds or more.

Who needs to file Form 2290?

+Self-employed individuals, businesses, leasing companies, and heavy vehicle dealerships need to file Form 2290.

What is the filing deadline for Form 2290?

+The filing deadline for Form 2290 is typically August 31st of each year.