The world of insurance claims can be a complex and overwhelming place, especially when dealing with the aftermath of an unexpected event. If you're reading this, chances are you're trying to navigate the process of filing a DCF Loss of Income Form. Don't worry, we've got you covered. In this article, we'll break down the process into a step-by-step guide, making it easier for you to understand and complete the form.

The DCF Loss of Income Form is a crucial document for individuals who have experienced a loss of income due to circumstances beyond their control. Whether you're dealing with a job loss, illness, or injury, this form helps you document your financial situation and potentially receive compensation. However, filling out the form can be a daunting task, especially if you're not familiar with the process.

In this article, we'll take a closer look at the DCF Loss of Income Form, its purpose, and the benefits of filling it out. We'll also provide a detailed, step-by-step guide on how to complete the form, including the necessary documentation and tips to avoid common mistakes.

Understanding the DCF Loss of Income Form

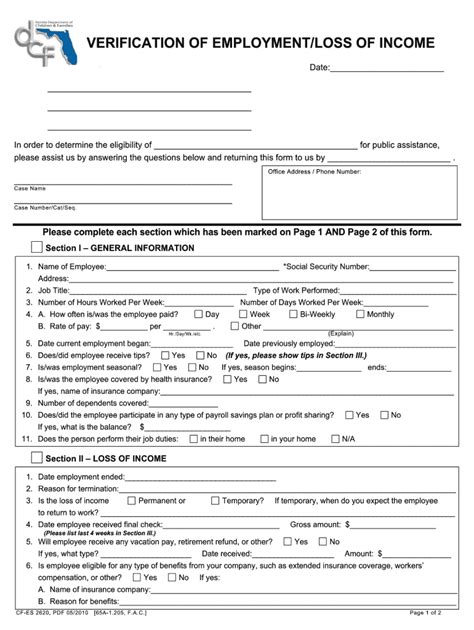

The DCF Loss of Income Form is a standardized document used by insurance companies and government agencies to assess an individual's financial situation after a loss of income. The form is designed to gather information about your employment history, income, expenses, and any other relevant financial details.

Benefits of Filing a DCF Loss of Income Form

Filing a DCF Loss of Income Form can have several benefits, including:

- Financial compensation: By documenting your loss of income, you may be eligible for financial compensation from your insurance provider or government agency.

- Tax benefits: The form can help you claim tax deductions or credits related to your loss of income.

- Record-keeping: The form provides a clear and concise record of your financial situation, which can be useful for future reference.

Step-by-Step Guide to Filing a DCF Loss of Income Form

Now that we've covered the basics, let's dive into the step-by-step guide on how to complete the DCF Loss of Income Form.

Step 1: Gather necessary documentation

Before starting the form, make sure you have the following documents ready:

- Identification: Driver's license, passport, or state ID

- Employment records: Pay stubs, W-2 forms, and any other relevant employment documents

- Income records: Bank statements, tax returns, and any other relevant income documents

- Expense records: Rent/mortgage statements, utility bills, and any other relevant expense documents

Step 2: Fill out Section 1 - Claimant Information

In this section, you'll need to provide personal and contact information, including:

- Name

- Address

- Phone number

- Email address

Step 3: Fill out Section 2 - Employment History

In this section, you'll need to provide detailed information about your employment history, including:

- Employer names

- Job titles

- Dates of employment

- Reason for leaving

Step 4: Fill out Section 3 - Income Information

In this section, you'll need to provide detailed information about your income, including:

- Gross income

- Net income

- Income sources

Step 5: Fill out Section 4 - Expense Information

In this section, you'll need to provide detailed information about your expenses, including:

- Rent/mortgage

- Utilities

- Food

- Transportation

Step 6: Review and sign the form

Once you've completed the form, review it carefully to ensure accuracy and completeness. Sign and date the form, and make sure to keep a copy for your records.

Tips and Common Mistakes to Avoid

When filling out the DCF Loss of Income Form, keep the following tips and common mistakes in mind:

- Be accurate and truthful: Provide accurate and truthful information to avoid delays or rejection of your claim.

- Keep records: Keep detailed records of your income, expenses, and employment history to support your claim.

- Avoid incomplete forms: Make sure to complete all sections of the form to avoid delays or rejection of your claim.

Conclusion

Filing a DCF Loss of Income Form can be a complex and time-consuming process, but with this step-by-step guide, you'll be well on your way to completing the form accurately and efficiently. Remember to gather all necessary documentation, fill out the form carefully, and review it thoroughly before submitting it. Don't hesitate to reach out to a professional if you need help or have questions about the process.

We hope this article has been helpful in guiding you through the process of filing a DCF Loss of Income Form. If you have any further questions or concerns, please don't hesitate to comment below.

What's Next?

Now that you've completed the DCF Loss of Income Form, what's next? Here are some steps you can take:

- Submit the form: Submit the completed form to your insurance provider or government agency.

- Follow up: Follow up with your insurance provider or government agency to ensure your claim is being processed.

- Seek professional help: If you need help or have questions about the process, consider seeking professional help from a financial advisor or attorney.

Frequently Asked Questions

Still have questions about the DCF Loss of Income Form? Here are some frequently asked questions and answers:

What is the purpose of the DCF Loss of Income Form?

+The DCF Loss of Income Form is used to assess an individual's financial situation after a loss of income. The form helps determine eligibility for financial compensation or other benefits.

What documentation do I need to complete the form?

+You'll need identification, employment records, income records, and expense records to complete the form.

How long does it take to process the form?

+The processing time varies depending on the insurance provider or government agency. It's best to follow up with them to ensure your claim is being processed.