The Fannie Mae Form 1004 is a standardized appraisal report form used by lenders to evaluate the value of residential properties. It's a crucial document in the mortgage lending process, as it provides an objective assessment of a property's value and helps lenders determine whether to approve a loan. In this article, we'll delve into the world of Fannie Mae Form 1004, exploring its history, components, and significance in the mortgage industry.

The Fannie Mae Form 1004 has been a cornerstone of the mortgage industry for decades. Introduced in the 1970s, the form was designed to standardize the appraisal process and provide a consistent framework for evaluating residential properties. Over the years, the form has undergone several revisions to reflect changes in the industry and updates in appraisal best practices.

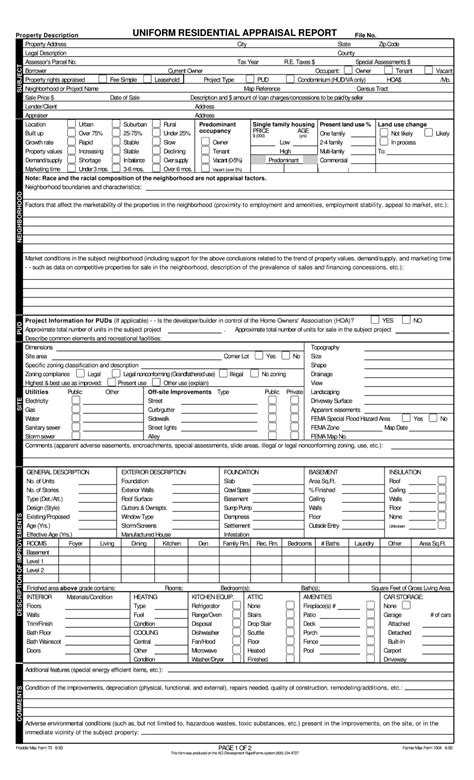

Components of the Fannie Mae Form 1004

The Fannie Mae Form 1004 is a comprehensive document that includes several key sections. These sections provide a detailed analysis of the property's value, including:

- Property Identification: This section includes basic information about the property, such as the address, parcel number, and property type.

- Subject Property: This section provides a detailed description of the property, including its age, size, condition, and amenities.

- Comparable Sales: This section presents a list of recent sales of similar properties in the area, known as "comparables." These sales are used to support the appraiser's opinion of value.

- Approach to Value: This section explains the appraiser's approach to estimating the property's value, including the methods used and the data relied upon.

- Reconciliation: This section reconciles the appraiser's opinion of value with the sales data presented in the comparable sales section.

Benefits of the Fannie Mae Form 1004

The Fannie Mae Form 1004 offers several benefits to lenders, appraisers, and borrowers. These benefits include:

- Standardization: The form provides a standardized framework for evaluating residential properties, ensuring consistency and accuracy.

- Objectivity: The form promotes objectivity in the appraisal process, as appraisers must support their opinions of value with data and analysis.

- Transparency: The form provides transparency into the appraisal process, allowing lenders and borrowers to understand the basis for the appraiser's opinion of value.

- Risk Management: The form helps lenders manage risk by providing a thorough analysis of the property's value and potential risks.

Benefits for Lenders

The Fannie Mae Form 1004 offers several benefits to lenders, including:

- Reduced Risk: The form helps lenders reduce risk by providing a thorough analysis of the property's value and potential risks.

- Improved Decision-Making: The form provides lenders with the information they need to make informed decisions about loan applications.

- Compliance: The form helps lenders comply with regulatory requirements and industry standards.

Best Practices for Completing the Fannie Mae Form 1004

To ensure accuracy and compliance, appraisers and lenders should follow best practices when completing the Fannie Mae Form 1004. These best practices include:

- Thorough Research: Appraisers should conduct thorough research on the property and market to support their opinions of value.

- Accurate Data: Appraisers should use accurate and reliable data to support their opinions of value.

- Clear Communication: Appraisers should clearly communicate their opinions of value and the basis for those opinions.

- Regular Updates: Appraisers should regularly update their knowledge and skills to ensure compliance with industry standards and regulatory requirements.

Common Mistakes to Avoid

When completing the Fannie Mae Form 1004, appraisers and lenders should avoid common mistakes, such as:

- Inaccurate Data: Using inaccurate or outdated data can lead to inaccurate opinions of value.

- Lack of Transparency: Failing to provide clear and transparent explanations of the appraisal process and opinions of value can lead to confusion and disputes.

- Failure to Comply with Regulations: Failing to comply with regulatory requirements and industry standards can lead to fines and penalties.

Conclusion

In conclusion, the Fannie Mae Form 1004 is a critical document in the mortgage industry, providing a standardized framework for evaluating residential properties. By following best practices and avoiding common mistakes, appraisers and lenders can ensure accuracy and compliance. We hope this comprehensive guide has provided you with a deeper understanding of the Fannie Mae Form 1004 and its significance in the mortgage industry.

What is the Fannie Mae Form 1004?

+The Fannie Mae Form 1004 is a standardized appraisal report form used by lenders to evaluate the value of residential properties.

What are the benefits of the Fannie Mae Form 1004?

+The benefits of the Fannie Mae Form 1004 include standardization, objectivity, transparency, and risk management.

What are the best practices for completing the Fannie Mae Form 1004?

+The best practices for completing the Fannie Mae Form 1004 include thorough research, accurate data, clear communication, and regular updates.