As a homeowner in Texas, understanding the process of filing a property tax protest can be overwhelming, especially when dealing with complex forms like the Texas Form 50-114. The 50-114 form, also known as the Notice of Protest, is a crucial document that allows property owners to dispute their appraised property values with the county appraisal district. In this article, we will provide a step-by-step guide on how to fill out and file the Texas Form 50-114, making it easier for you to navigate the process.

Why File a Property Tax Protest?

Before we dive into the filing process, it's essential to understand why filing a property tax protest is important. If you believe that your property's appraised value is incorrect, filing a protest can help you reduce your property taxes. An incorrect appraised value can lead to higher taxes, which can be a significant financial burden. By filing a protest, you can ensure that your property is valued fairly, and your taxes are reduced accordingly.

Understanding the Texas Form 50-114

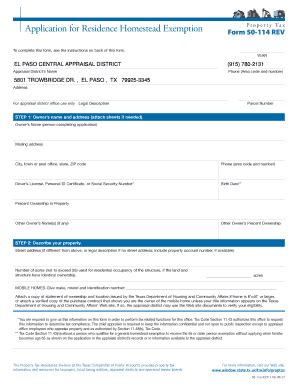

The Texas Form 50-114 is a standardized form used by property owners to protest their appraised property values. The form requires you to provide specific information about your property, including its location, description, and value. It's crucial to fill out the form accurately and completely to ensure that your protest is processed correctly.

Step 1: Gather Required Information

Before filling out the form, gather the following required information:

- Your property's location, including the county, city, and street address

- Your property's description, including the type of property (residential, commercial, etc.)

- Your property's appraised value, as stated on your appraisal notice

- The reason for your protest (e.g., incorrect appraised value, unequal appraisal, etc.)

Step 2: Fill Out the Form

Once you have gathered the required information, fill out the Texas Form 50-114 as follows:

- Section 1: Property Information

- Fill in your property's location, including the county, city, and street address

- Fill in your property's description, including the type of property

- Section 2: Appraised Value and Reason for Protest

- Fill in your property's appraised value, as stated on your appraisal notice

- Select the reason for your protest (e.g., incorrect appraised value, unequal appraisal, etc.)

- Section 3: Property Owner Information

- Fill in your name and contact information, including your address and phone number

- Section 4: Additional Comments

- Provide any additional comments or explanations to support your protest

Step 3: Attach Supporting Documents

Attach any supporting documents that may be relevant to your protest, such as:

- A copy of your appraisal notice

- Photos of your property

- Evidence of similar properties in the area with lower appraised values

- Any other documentation that supports your reason for protest

Step 4: File the Form

Once you have completed the form and attached any supporting documents, file the form with the county appraisal district. You can file the form in person, by mail, or by email, depending on the district's policies.

Step 5: Follow Up

After filing your protest, follow up with the county appraisal district to ensure that your protest is being processed. You can check the status of your protest online or by contacting the district directly.

Benefits of Filing a Property Tax Protest

Filing a property tax protest can have several benefits, including:

- Reduced property taxes

- Fairer appraised value

- Increased property value

- Potential for a refund of overpaid taxes

Common Mistakes to Avoid

When filing a property tax protest, there are several common mistakes to avoid, including:

- Failing to file the protest on time

- Failing to provide required information

- Failing to attach supporting documents

- Failing to follow up with the county appraisal district

Conclusion

Filing a property tax protest in Texas can be a complex process, but with the right guidance, it can be done successfully. By following the steps outlined in this guide, you can ensure that your protest is filed correctly and that your property is valued fairly. Remember to gather required information, fill out the form accurately, attach supporting documents, file the form, and follow up with the county appraisal district.

FAQs

What is the deadline for filing a property tax protest in Texas?

+The deadline for filing a property tax protest in Texas is typically May 15th, but it may vary depending on the county and the type of protest.

What information do I need to provide on the Texas Form 50-114?

+You will need to provide your property's location, description, and appraised value, as well as the reason for your protest and your contact information.

Can I file a property tax protest online?

+It depends on the county appraisal district. Some districts may allow online filing, while others may require in-person or mail filing.