Filing taxes can be a daunting task, but with the right guidance, it can be a breeze. If you're a Filipino individual or business owner, you're required to file your taxes using the BIR Form 1904, also known as the "Application for Registration Update" form. In this article, we'll break down the process into 5 easy steps to help you fill out the BIR Form 1904 accurately and efficiently.

Step 1: Gather Required Documents and Information

Before you start filling out the BIR Form 1904, make sure you have all the necessary documents and information at hand. These include:

- Your Tax Identification Number (TIN)

- Business name and address (if applicable)

- Type of business or occupation

- Date of birth and contact information

- Certificate of Registration (if already registered with the BIR)

- Other supporting documents, such as proof of income and expenses

Why is this step important?

Having all the required documents and information readily available will save you time and effort in the long run. It will also ensure that you provide accurate and complete information, reducing the risk of errors or delays in the processing of your tax registration.

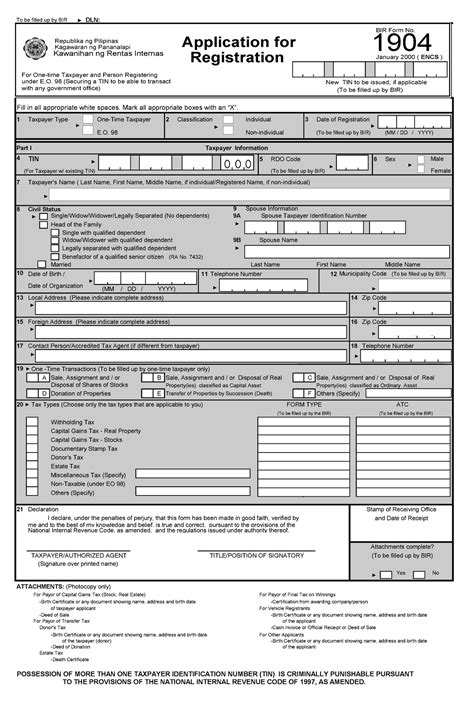

Step 2: Fill Out the BIR Form 1904

Now that you have all the necessary documents and information, it's time to fill out the BIR Form 1904. The form is divided into several sections, including:

- Section 1: TIN and Business Information

- Section 2: Type of Business or Occupation

- Section 3: Contact Information and Date of Birth

- Section 4: Supporting Documents

Make sure to fill out each section accurately and completely, using the information and documents you gathered in Step 1.

Tips and Reminders:

- Use black ink and print clearly

- Avoid erasures and corrections

- Use the correct format for dates and numbers

- Attach all required supporting documents

Step 3: Attach Required Supporting Documents

In addition to the BIR Form 1904, you'll need to attach several supporting documents, including:

- Proof of income and expenses

- Certificate of Registration (if already registered with the BIR)

- Business permit and license (if applicable)

- Other documents required by the BIR

Make sure to attach all the required documents to avoid delays or errors in the processing of your tax registration.

Why is this step important?

Attaching the required supporting documents will help the BIR verify the accuracy of the information you provided in the BIR Form 1904. This will also help you comply with the tax laws and regulations in the Philippines.

Step 4: Submit the BIR Form 1904

Once you've completed the BIR Form 1904 and attached all the required supporting documents, it's time to submit it to the BIR. You can submit the form through:

- Personal appearance at the BIR office

- Mail or courier service

- Electronic submission through the BIR website (if available)

Make sure to follow the BIR's guidelines and requirements for submission to avoid delays or errors.

Tips and Reminders:

- Keep a copy of the BIR Form 1904 and supporting documents for your records

- Verify the BIR's office hours and requirements before submitting the form

- Follow up with the BIR to ensure that your tax registration is processed correctly

Step 5: Follow Up and Verify Your Tax Registration

After submitting the BIR Form 1904, it's essential to follow up with the BIR to ensure that your tax registration is processed correctly. You can:

- Contact the BIR through phone or email to verify the status of your tax registration

- Visit the BIR office to inquire about the status of your tax registration

- Check the BIR website for updates on your tax registration

Make sure to follow up regularly to avoid delays or errors in the processing of your tax registration.

Why is this step important?

Following up and verifying your tax registration will help you ensure that your tax obligations are up to date and accurate. This will also help you avoid penalties and fines associated with late or incorrect tax registration.

By following these 5 easy steps, you can fill out the BIR Form 1904 accurately and efficiently, ensuring that your tax registration is processed correctly and on time.

We hope this article has been helpful in guiding you through the process of filling out the BIR Form 1904. If you have any questions or concerns, please don't hesitate to comment below or share this article with your friends and colleagues.

What is the purpose of the BIR Form 1904?

+The BIR Form 1904 is used to register or update your tax registration with the Bureau of Internal Revenue (BIR).

Who needs to file the BIR Form 1904?

+All individuals and businesses that are required to register with the BIR need to file the BIR Form 1904.

What are the requirements for filing the BIR Form 1904?

+You'll need to provide your Tax Identification Number (TIN), business name and address, type of business or occupation, and other supporting documents.