Filing tax returns can be a daunting task, especially for those who are new to the process. The CT-5.4 form is an essential document that businesses in New York State must submit to report their franchise taxes. In this article, we will delve into the world of CT-5.4 forms, exploring what they are, who needs to file them, and most importantly, how to complete them accurately.

What is a CT-5.4 Form?

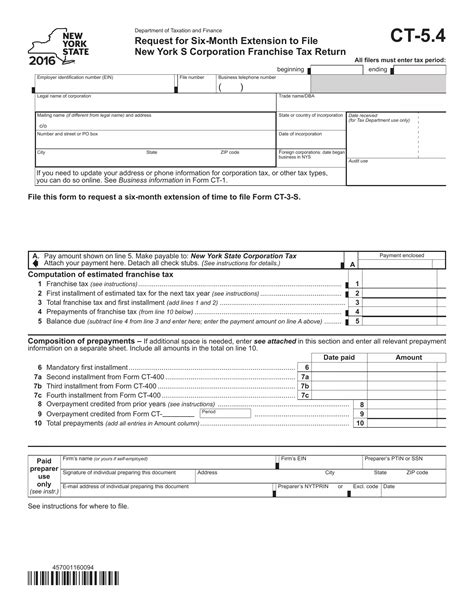

The CT-5.4 form is a tax return document used by businesses in New York State to report their franchise taxes. The form is designed to calculate the amount of tax owed by the business based on its income, assets, and other factors. It is typically filed annually, but the frequency of filing may vary depending on the type of business and its tax obligations.

Who Needs to File a CT-5.4 Form?

Businesses in New York State that are subject to franchise taxes must file a CT-5.4 form. This includes:

- Corporations

- Limited Liability Companies (LLCs)

- Partnerships

- Limited Liability Partnerships (LLPs)

It is essential to note that not all businesses in New York State are required to file a CT-5.4 form. Businesses that are exempt from franchise taxes, such as non-profit organizations and certain types of partnerships, do not need to file this form.

How to Complete a CT-5.4 Form

Completing a CT-5.4 form requires careful attention to detail and a thorough understanding of the tax laws and regulations in New York State. Here are the steps to follow:

- Gather necessary documents: Before starting to fill out the form, make sure you have all the necessary documents, including:

- Business income statements

- Balance sheets

- Tax returns from previous years

- Any other relevant financial documents

- Determine the filing frequency: Depending on the type of business and its tax obligations, the filing frequency may vary. Businesses that are subject to franchise taxes must file a CT-5.4 form annually, but the due date may vary.

- Complete the form: The CT-5.4 form is divided into several sections, including:

- Business information

- Income and expenses

- Assets and liabilities

- Tax calculations

- Payment information

- Calculate the tax owed: Using the information provided in the form, calculate the amount of tax owed by the business. This includes any penalties and interest owed.

- Sign and date the form: Once the form is complete, sign and date it. Make sure to include the name and title of the person signing the form.

Tips for Filing a CT-5.4 Form

Here are some tips to keep in mind when filing a CT-5.4 form:

- File electronically: Filing electronically can help reduce errors and speed up the processing time.

- Use the correct form: Make sure to use the correct form for your business type and tax obligations.

- Double-check calculations: Double-check your calculations to ensure accuracy and avoid any errors.

- Seek professional help: If you are unsure about how to complete the form or need help with tax calculations, seek professional help from a tax accountant or attorney.

Penalties for Not Filing a CT-5.4 Form

Failure to file a CT-5.4 form or paying the franchise tax can result in penalties and interest. The penalties can be substantial, and may include:

- Late filing penalty: A penalty of 5% of the tax owed for each month or part of a month that the form is late.

- Late payment penalty: A penalty of 5% of the tax owed for each month or part of a month that the payment is late.

- Interest: Interest on the tax owed, calculated from the original due date.

Conclusion

Filing a CT-5.4 form is an essential part of doing business in New York State. By understanding what the form is, who needs to file it, and how to complete it accurately, businesses can avoid penalties and interest. Remember to file electronically, use the correct form, double-check calculations, and seek professional help if needed.

If you have any questions or concerns about completing a CT-5.4 form, leave a comment below. Share this article with others who may find it helpful.

What is the due date for filing a CT-5.4 form?

+The due date for filing a CT-5.4 form varies depending on the type of business and its tax obligations. Typically, the form is due on the 15th day of the 4th month after the end of the tax year.

Can I file a CT-5.4 form electronically?

+Yes, you can file a CT-5.4 form electronically through the New York State Department of Taxation and Finance website.

What are the penalties for not filing a CT-5.4 form?

+The penalties for not filing a CT-5.4 form include a late filing penalty of 5% of the tax owed for each month or part of a month that the form is late, a late payment penalty of 5% of the tax owed for each month or part of a month that the payment is late, and interest on the tax owed.