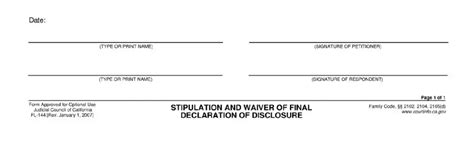

In California, Form FL-144, also known as the Declaration for Waiver of Appraisement Fee, plays a crucial role in various family law cases, especially when dealing with property divisions. This form is used to declare the estimated value of community property that is being divided, helping the court determine whether an appraisal fee is required or waived. Filling out Form FL-144 accurately is essential to ensure a smooth legal process. Here are five tips to guide you through filling out this form.

Understanding Form FL-144

Form FL-144 is a legal document required in certain family law proceedings in California. It is designed to provide an estimate of the value of community assets that are part of a marital settlement or separation agreement. The purpose of this form is to help the court decide whether the asset's estimated value justifies waiving the appraisal fee.

Why Accuracy Matters

Accuracy in filling out Form FL-144 is crucial. Providing incorrect or misleading information can lead to delays in your case, additional costs, or even legal repercussions. Therefore, it's essential to understand the form's requirements and the implications of your declarations.

Tips for Filling Out Form FL-144

1. Gather All Necessary Documents and Information

Before starting to fill out Form FL-144, gather all relevant documents and information regarding the community property. This may include:

- Property deeds or titles

- Recent appraisals (if any)

- Financial statements

- Photographs or detailed descriptions of the property

Having all the necessary information at hand will ensure that you fill out the form accurately and efficiently.

2. Understand the Definitions

It's crucial to understand the definitions used in the form, especially terms like "community property" and "estimated value." In California, community property typically includes assets acquired during the marriage, except for gifts or inheritances. The estimated value should be based on the best available evidence, considering the current market conditions.

3. Be Thorough in Describing the Property

When describing the community property, be as detailed as possible. This includes providing the exact address, a detailed description of the property (for real estate), or a specific identification of the asset (for other types of property). Accuracy in this section is vital for the court's decision-making process.

4. Use a Logical Basis for Your Estimated Value

Your estimated value of the community property should be based on logical reasoning and evidence. If you're estimating the value of real estate, consider recent sales of similar properties in the area. For other assets, look at their purchase price, condition, and any professional appraisals. Always document your reasoning, as this may be requested by the court.

5. Seek Professional Advice If Necessary

If you're unsure about any aspect of filling out Form FL-144, consider seeking advice from a professional, such as a family law attorney or an appraiser. They can provide guidance tailored to your specific situation and ensure that you're complying with all legal requirements.

Final Considerations

Filling out Form FL-144 accurately and completely is crucial for your family law case. By understanding the form's requirements, gathering all necessary information, and possibly seeking professional advice, you can ensure a smoother legal process. Remember, accuracy and honesty are key when completing this form.

Invitation to Comment

Have you had experience with Form FL-144? Share your insights and any tips you might have for others going through a similar process. Your comments and experiences can provide valuable help to those navigating family law proceedings in California.

What is Form FL-144 used for?

+Form FL-144, or the Declaration for Waiver of Appraisement Fee, is used in California family law cases to estimate the value of community property and determine whether an appraisal fee is required or waived.

Why is accuracy important when filling out Form FL-144?

+Accuracy is crucial because providing incorrect or misleading information can lead to delays, additional costs, or legal repercussions.

Should I seek professional advice when filling out Form FL-144?

+If you're unsure about any aspect of filling out the form, consider seeking advice from a family law attorney or an appraiser to ensure compliance with all legal requirements.