Understanding the Credit Limit Worksheet for Form 2441

When it comes to claiming the child and dependent care credit on Form 2441, one of the crucial steps is completing the Credit Limit Worksheet. This worksheet helps you determine the maximum credit amount you are eligible for, based on your income and qualified care expenses. In this article, we will provide a simplified guide to understanding and completing the Credit Limit Worksheet for Form 2441.

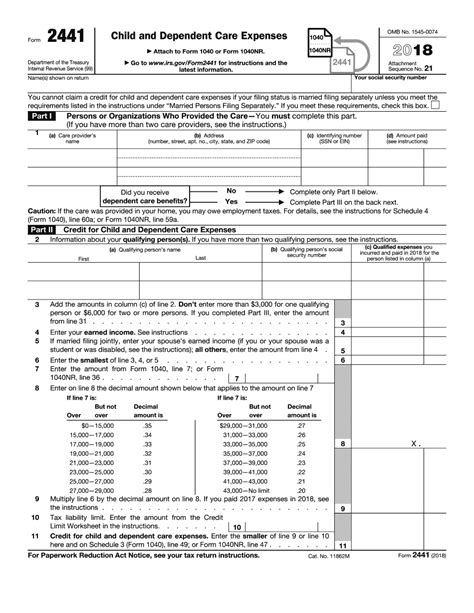

The child and dependent care credit is a tax credit designed to help working individuals or couples pay for childcare or adult care expenses, allowing them to work or look for work. The credit is calculated based on a percentage of qualified care expenses, up to a maximum amount. To claim this credit, you must file Form 2441 with your tax return.

Why is the Credit Limit Worksheet Important?

The Credit Limit Worksheet is essential because it helps you calculate the maximum credit amount you can claim. The worksheet takes into account your income, qualified care expenses, and the number of dependents you are claiming. By completing the worksheet, you can ensure that you are claiming the correct credit amount and avoid any potential errors or audits.

Step-by-Step Guide to Completing the Credit Limit Worksheet

To complete the Credit Limit Worksheet, follow these steps:

- Gather necessary information: You will need to gather your qualified care expenses, your income, and the number of dependents you are claiming.

- Determine your adjusted gross income (AGI): Your AGI is your total income minus any deductions and exemptions. You can find your AGI on your tax return.

- Complete the Credit Limit Worksheet: Use the worksheet provided on Form 2441 to calculate your credit limit. The worksheet will ask you to input your AGI, qualified care expenses, and the number of dependents you are claiming.

- Calculate your credit percentage: Based on your AGI, you will be assigned a credit percentage. This percentage will be used to calculate your credit amount.

- Calculate your credit amount: Multiply your qualified care expenses by your credit percentage to get your credit amount.

- Apply the credit limit: The worksheet will also calculate the maximum credit amount you can claim, based on your income and number of dependents.

Tips for Completing the Credit Limit Worksheet

- Make sure to accurately report your qualified care expenses and income.

- Use the correct credit percentage based on your AGI.

- Do not exceed the maximum credit amount allowed.

- Keep records of your qualified care expenses and income, in case of an audit.

Common Mistakes to Avoid When Completing the Credit Limit Worksheet

When completing the Credit Limit Worksheet, there are several common mistakes to avoid:

- Inaccurate income reporting: Make sure to report your income accurately, as this will affect your credit percentage and amount.

- Incorrect credit percentage: Use the correct credit percentage based on your AGI.

- Exceeding the maximum credit amount: Do not claim more than the maximum credit amount allowed.

- Not keeping records: Keep records of your qualified care expenses and income, in case of an audit.

Conclusion

Completing the Credit Limit Worksheet for Form 2441 is a crucial step in claiming the child and dependent care credit. By following the steps outlined in this guide, you can ensure that you are claiming the correct credit amount and avoiding any potential errors or audits. Remember to accurately report your income and qualified care expenses, use the correct credit percentage, and do not exceed the maximum credit amount allowed.

What is the Credit Limit Worksheet for Form 2441?

+The Credit Limit Worksheet is a tool used to calculate the maximum credit amount you can claim for the child and dependent care credit on Form 2441.

How do I complete the Credit Limit Worksheet?

+To complete the Credit Limit Worksheet, gather your qualified care expenses, income, and number of dependents, and follow the steps outlined in the worksheet provided on Form 2441.

What are common mistakes to avoid when completing the Credit Limit Worksheet?

+Common mistakes to avoid include inaccurate income reporting, incorrect credit percentage, exceeding the maximum credit amount, and not keeping records.