As a Florida homeowner, you're likely aware of the importance of exemptions on your property taxes. One such exemption is the Dr-14 exemption, also known as the "Senior Exemption" or "Senior Citizen Exemption." This exemption is designed to provide tax relief to eligible senior citizens who own and occupy their primary residence in Florida. However, to take advantage of this exemption, you'll need to complete the Dr-14 exemption form.

What is the Dr-14 Exemption Form?

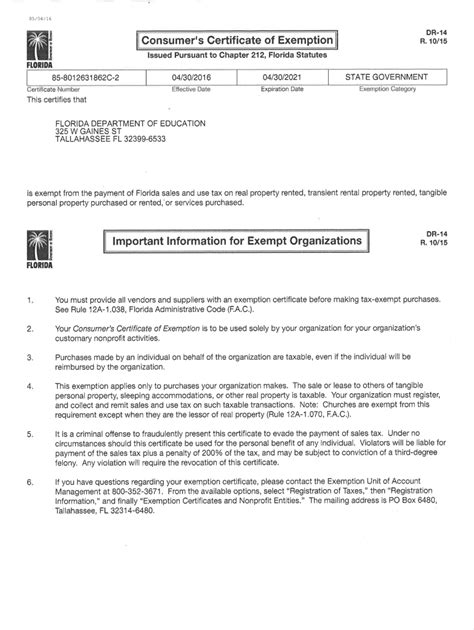

The Dr-14 exemption form is a document required by the Florida Department of Revenue to apply for the Senior Exemption. The form requires you to provide personal and property information to determine your eligibility for the exemption. Completing the form accurately and submitting it on time is crucial to ensure you receive the exemption and reduce your property tax liability.

Who is Eligible for the Dr-14 Exemption?

To be eligible for the Dr-14 exemption, you must:

- Be a Florida resident

- Be 65 years or older as of January 1st of the tax year

- Own and occupy the property as your primary residence

- Have a limited income (the income limit is adjusted annually)

5 Ways to Complete the Dr-14 Exemption Form

While the Dr-14 exemption form may seem daunting, there are several ways to complete it. Here are five options to consider:

1. Online Filing through the Florida Department of Revenue Website

You can complete and submit the Dr-14 exemption form online through the Florida Department of Revenue website. This is the most convenient option, as you can fill out the form from the comfort of your own home and submit it electronically.

- Go to the Florida Department of Revenue website ()

- Click on "Exemptions" and select "Dr-14 Exemption"

- Fill out the form and submit it electronically

2. Mail or Fax the Completed Form

If you prefer to complete the form manually, you can download and print the Dr-14 exemption form from the Florida Department of Revenue website. Once completed, you can mail or fax the form to the address or fax number listed on the form.

- Download and print the Dr-14 exemption form from the Florida Department of Revenue website

- Complete the form accurately and sign it

- Mail or fax the form to the address or fax number listed on the form

3. Visit a Local Property Appraiser's Office

You can also visit a local property appraiser's office to complete the Dr-14 exemption form. The staff will guide you through the process and ensure you complete the form accurately.

- Find your local property appraiser's office

- Visit the office and ask for assistance with completing the Dr-14 exemption form

- Staff will guide you through the process and ensure you complete the form accurately

4. Hire a Professional to Assist with the Form

If you're not comfortable completing the Dr-14 exemption form yourself, you can hire a professional to assist you. A tax professional or attorney can help you complete the form and ensure you're eligible for the exemption.

- Research and hire a tax professional or attorney

- Provide them with the necessary documentation and information

- They will complete the form and submit it on your behalf

5. Contact a Senior Citizen Organization for Assistance

Some senior citizen organizations, such as the AARP, offer assistance with completing the Dr-14 exemption form. These organizations may have volunteers or staff who can guide you through the process.

- Research and contact a senior citizen organization

- Ask if they offer assistance with completing the Dr-14 exemption form

- They may have volunteers or staff who can guide you through the process

Additional Tips and Reminders

When completing the Dr-14 exemption form, keep the following tips and reminders in mind:

- Ensure you meet the eligibility requirements before applying

- Complete the form accurately and sign it

- Submit the form by the deadline (usually March 1st of each year)

- Keep a copy of the completed form for your records

- Follow up with the Florida Department of Revenue to ensure your application is processed correctly

Conclusion

Completing the Dr-14 exemption form is a crucial step in taking advantage of the Senior Exemption in Florida. By following the five options outlined above, you can ensure you complete the form accurately and submit it on time. Remember to keep the additional tips and reminders in mind to ensure a smooth application process.

What is the deadline to submit the Dr-14 exemption form?

+The deadline to submit the Dr-14 exemption form is usually March 1st of each year.

Can I submit the Dr-14 exemption form electronically?

+Yes, you can submit the Dr-14 exemption form electronically through the Florida Department of Revenue website.

What is the income limit for the Dr-14 exemption?

+The income limit for the Dr-14 exemption is adjusted annually. You can check the Florida Department of Revenue website for the current income limit.