Colorado Dr 1778 is a vital document that plays a crucial role in the state's court system, particularly in cases involving divorce, separation, and child custody. The DR 1778, also known as the Sworn Financial Statement, is a sworn statement that requires parties to disclose their financial information, assets, debts, and other relevant details. Filing this document accurately and comprehensively is essential to ensure that the court has all the necessary information to make informed decisions. In this article, we will discuss five essential filing tips for Colorado DR 1778 to help you navigate the process efficiently.

Understanding the Purpose of DR 1778

The primary purpose of DR 1778 is to provide the court with a comprehensive financial picture of both parties involved in the case. This document helps the court to:

- Determine the division of assets and debts

- Calculate spousal maintenance and child support

- Assess the financial needs of both parties

- Make informed decisions regarding property distribution

Tip 1: Gather All Necessary Documents and Information

Before starting the filing process, it's essential to gather all necessary documents and information. This includes:

- Pay stubs and W-2 forms

- Tax returns (personal and business)

- Bank statements and account information

- Investment accounts and retirement plans

- Credit card statements and loan documents

- Real estate deeds and property valuations

- Vehicle titles and loan documents

- Insurance policies and retirement accounts

Having all the necessary documents and information readily available will help you complete the DR 1778 accurately and efficiently.

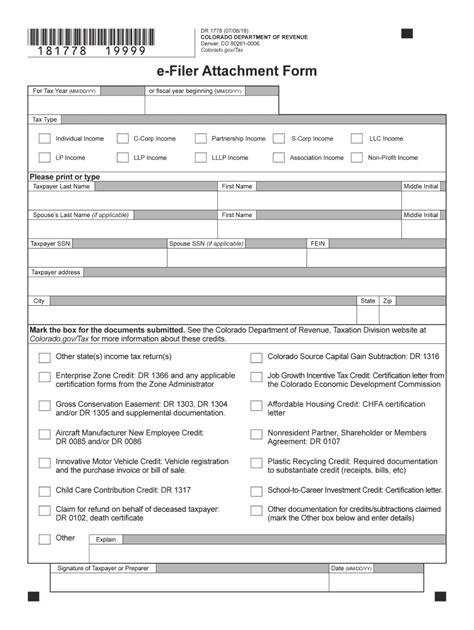

Completing the DR 1778 Form

The DR 1778 form consists of several sections that require you to provide detailed financial information. Here are some tips to keep in mind while completing the form:

- Be thorough and accurate: Ensure that you provide all the necessary information and that it is accurate.

- Use the correct format: Use the format specified in the form to ensure that your information is presented clearly.

- Attach supporting documents: Attach supporting documents, such as pay stubs and bank statements, to validate the information provided.

Tip 2: Disclose All Assets and Debts

Disclosing all assets and debts is crucial when completing the DR 1778 form. This includes:

- Real estate properties

- Vehicles

- Bank accounts and investments

- Retirement accounts and pension plans

- Business interests and partnerships

- Credit card debt and loans

Failure to disclose any assets or debts can lead to severe consequences, including fines and penalties.

Calculating Income and Expenses

Calculating income and expenses is a critical component of the DR 1778 form. Here are some tips to keep in mind:

- Include all sources of income: This includes employment income, self-employment income, and investment income.

- Calculate monthly expenses: Calculate your monthly expenses, including rent/mortgage, utilities, food, and transportation.

- Be realistic: Ensure that your income and expense calculations are realistic and accurate.

Tip 3: Seek Professional Help if Necessary

Completing the DR 1778 form can be a complex and time-consuming process, especially if you have complex financial situations. If you're unsure about any aspect of the form, consider seeking professional help from:

- Attorneys

- Accountants

- Financial advisors

They can help you navigate the process and ensure that your form is completed accurately and comprehensively.

Timing and Filing Requirements

Timing and filing requirements are critical when it comes to the DR 1778 form. Here are some key dates and deadlines to keep in mind:

- Filing deadline: The DR 1778 form must be filed within the time frame specified by the court, usually 42 days after the initial filing.

- Service requirements: The form must be served on the opposing party, usually via certified mail or personal service.

Tip 4: Review and Edit Carefully

Before filing the DR 1778 form, review and edit it carefully to ensure that it is accurate and comprehensive. Check for:

- Mathematical errors

- Incomplete information

- Inconsistencies

A thorough review and edit can help you avoid mistakes and ensure that your form is filed correctly.

Consequences of Inaccurate or Incomplete Filing

Inaccurate or incomplete filing of the DR 1778 form can have severe consequences, including:

- Fines and penalties

- Delayed court proceedings

- Adverse court decisions

- Loss of credibility

It's essential to take the filing process seriously and ensure that your form is completed accurately and comprehensively.

Tip 5: Keep Records and Supporting Documents

Finally, it's essential to keep records and supporting documents related to your DR 1778 form. This includes:

- Pay stubs and W-2 forms

- Tax returns and financial statements

- Bank statements and account information

- Investment accounts and retirement plans

Keeping accurate records and supporting documents can help you track changes and updates to your financial situation and ensure that your form is filed correctly.

What is the purpose of the DR 1778 form in Colorado?

+The primary purpose of the DR 1778 form is to provide the court with a comprehensive financial picture of both parties involved in the case.

What documents do I need to gather before completing the DR 1778 form?

+You will need to gather documents such as pay stubs, W-2 forms, tax returns, bank statements, investment accounts, and retirement plans.

What are the consequences of inaccurate or incomplete filing of the DR 1778 form?

+Inaccurate or incomplete filing of the DR 1778 form can result in fines and penalties, delayed court proceedings, adverse court decisions, and loss of credibility.

We hope this article has provided you with valuable insights and tips on completing the Colorado DR 1778 form accurately and comprehensively. If you have any further questions or concerns, please don't hesitate to reach out to us.