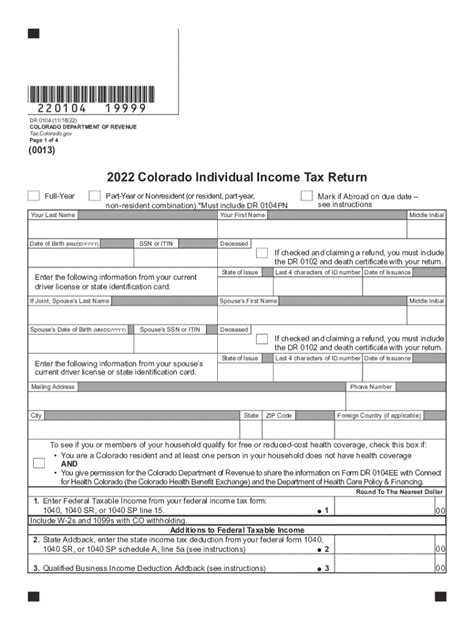

The Colorado Form DR 0104, also known as the "Individual Income Tax Return" form, is a crucial document that Colorado residents must fill out and submit to the Colorado Department of Revenue each year. The form is used to report an individual's income, claim deductions and credits, and calculate the amount of state income tax owed. In this article, we will guide you through the 8 steps to complete the Colorado Form DR 0104 accurately and efficiently.

Why is it Important to Complete the Colorado Form DR 0104 Correctly?

Completing the Colorado Form DR 0104 correctly is crucial to avoid errors, delays, and potential penalties. The Colorado Department of Revenue uses the information provided on the form to determine the amount of state income tax owed. If the form is not completed correctly, it may lead to errors, which can result in delayed refunds or even additional taxes owed. Moreover, accurate completion of the form ensures that you are taking advantage of all the deductions and credits available to you, which can help reduce your tax liability.

Step 1: Gather Required Documents and Information

Before starting to complete the Colorado Form DR 0104, gather all the required documents and information. This includes:

- Your social security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's social security number or ITIN (if filing jointly)

- Dependents' social security numbers or ITINs (if claiming)

- W-2 forms from your employer(s)

- 1099 forms for self-employment income, freelance work, or other income

- Interest statements from banks and investments (1099-INT)

- Dividend statements (1099-DIV)

- Charitable donation receipts

- Medical expense receipts

- Mortgage interest statements (1098)

Step 2: Choose the Correct Filing Status

Your filing status determines the tax rates and deductions you are eligible for. Choose the correct filing status from the following options:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Step 3: Report Income

Report all your income from various sources, including:

- Wages, salaries, and tips

- Self-employment income

- Freelance work

- Interest and dividends

- Capital gains and losses

- Rent and royalty income

- Unemployment benefits

- Social Security benefits

Step 4: Claim Deductions

Claim deductions to reduce your taxable income. Common deductions include:

- Standard deduction

- Itemized deductions (such as medical expenses, mortgage interest, and charitable donations)

- Personal exemption

- Dependent exemption

Step 5: Claim Credits

Claim credits to reduce your tax liability. Common credits include:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits (such as the American Opportunity Tax Credit)

- Retirement savings contribution credit

Step 6: Calculate Tax Liability

Calculate your tax liability by subtracting deductions and credits from your taxable income. Use the tax tables or schedules to determine your tax liability.

Step 7: Complete Additional Schedules and Forms

Complete additional schedules and forms, if required, such as:

- Schedule A (Itemized Deductions)

- Schedule B (Interest and Dividend Income)

- Schedule C (Business Income and Expenses)

- Form 8962 (Premium Tax Credit)

Step 8: Sign and Submit the Form

Sign and submit the completed form to the Colorado Department of Revenue. You can submit the form electronically or by mail. Make sure to keep a copy of the form for your records.

Conclusion

Completing the Colorado Form DR 0104 accurately and efficiently requires attention to detail and careful planning. By following the 8 steps outlined above, you can ensure that you are taking advantage of all the deductions and credits available to you, which can help reduce your tax liability. If you are unsure about any part of the process, consider consulting a tax professional or seeking guidance from the Colorado Department of Revenue.

What is the deadline for submitting the Colorado Form DR 0104?

+The deadline for submitting the Colorado Form DR 0104 is typically April 15th of each year. However, if you need more time, you can file for an extension by submitting Form 1040ES.

Can I e-file the Colorado Form DR 0104?

+Yes, you can e-file the Colorado Form DR 0104 using the Colorado Department of Revenue's online portal or through a tax preparation software.

What if I made a mistake on my Colorado Form DR 0104?

+If you made a mistake on your Colorado Form DR 0104, you can file an amended return using Form 1040X. You can also contact the Colorado Department of Revenue for guidance.