Changing a 529 beneficiary is a relatively straightforward process that can be completed with a simple form update. A 529 plan is a tax-advantaged savings plan designed to help families save for higher education expenses. One of the key benefits of a 529 plan is its flexibility, including the ability to change the beneficiary as needed. In this article, we will explore the process of changing a 529 beneficiary and provide guidance on how to complete the necessary form updates.

Why Change a 529 Beneficiary?

There are several reasons why you may need to change the beneficiary of a 529 plan. Some common scenarios include:

- A child decides not to attend college, and you want to transfer the funds to a different beneficiary.

- A beneficiary graduates from college and you want to use the remaining funds for a different family member.

- You have a new child or grandchild and want to transfer the funds to their name.

Who Can Be a 529 Beneficiary?

A 529 beneficiary can be anyone, including:

- A family member, such as a child, grandchild, or sibling.

- A non-family member, such as a friend or distant relative.

- Even yourself, if you plan to pursue higher education.

How to Change a 529 Beneficiary

Changing a 529 beneficiary typically involves completing a simple form update. The specific steps may vary depending on the 529 plan administrator, but here is a general outline of the process:

- Review the plan documents: Before making any changes, review the 529 plan documents to understand the rules and requirements for changing beneficiaries.

- Gather required information: You will need to provide information about the new beneficiary, including their name, address, and social security number or taxpayer identification number.

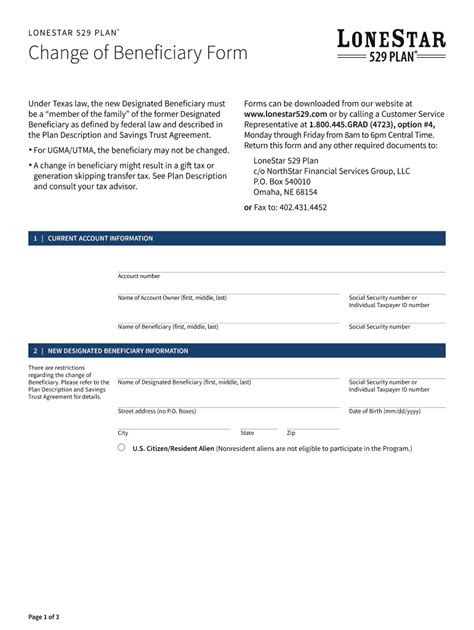

- Complete the beneficiary change form: Obtain the beneficiary change form from the 529 plan administrator or download it from their website. Complete the form with the required information and sign it.

- Submit the form: Submit the completed form to the 529 plan administrator, either online, by mail, or by fax, depending on the plan's requirements.

Things to Consider When Changing a 529 Beneficiary

Before making a beneficiary change, consider the following:

- Tax implications: Changing a beneficiary may have tax implications, such as income tax or penalties. Consult with a tax professional to understand the potential impact.

- Impact on financial aid: Changing a beneficiary may affect the beneficiary's eligibility for financial aid. Consider consulting with a financial aid expert to understand the potential impact.

- Investment options: Changing a beneficiary may affect the investment options available to the new beneficiary. Review the plan's investment options and consider consulting with a financial advisor.

529 Beneficiary Change Form

The 529 beneficiary change form is typically a simple, one-page document that requires basic information about the new beneficiary. Here is a sample outline of the form:

- Section 1: Current Beneficiary Information

- Name

- Address

- Social security number or taxpayer identification number

- Section 2: New Beneficiary Information

- Name

- Address

- Social security number or taxpayer identification number

- Section 3: Certification

- Signature

- Date

Common Mistakes to Avoid

When changing a 529 beneficiary, avoid the following common mistakes:

- Failing to update the beneficiary information: Make sure to update the beneficiary information on the plan documents and with the plan administrator.

- Not considering tax implications: Consult with a tax professional to understand the potential tax implications of changing a beneficiary.

- Not reviewing investment options: Review the plan's investment options and consider consulting with a financial advisor to ensure the new beneficiary's investment options are suitable.

Conclusion

Changing a 529 beneficiary is a relatively straightforward process that can be completed with a simple form update. By understanding the rules and requirements for changing beneficiaries and avoiding common mistakes, you can ensure a smooth transition and maximize the benefits of your 529 plan.

We invite you to comment below with any questions or concerns about changing a 529 beneficiary. Share this article with friends and family who may be considering a beneficiary change.

FAQ Section

Can I change the beneficiary of a 529 plan at any time?

+Yes, you can change the beneficiary of a 529 plan at any time, but there may be tax implications or penalties depending on the circumstances.

Who can be a beneficiary of a 529 plan?

+A beneficiary can be anyone, including a family member, friend, or even yourself if you plan to pursue higher education.

What information do I need to provide to change a 529 beneficiary?

+You will need to provide information about the new beneficiary, including their name, address, and social security number or taxpayer identification number.