Understanding Code Eh On Form 8949: A Comprehensive Guide

When it comes to filing taxes, accuracy is crucial to avoid any unnecessary delays or penalties. One common issue taxpayers face is the "Code Eh" error on Form 8949, which can be frustrating and confusing. In this article, we will delve into the world of Form 8949, explore the meaning of Code Eh, and provide a step-by-step guide on how to fix it.

What is Form 8949?

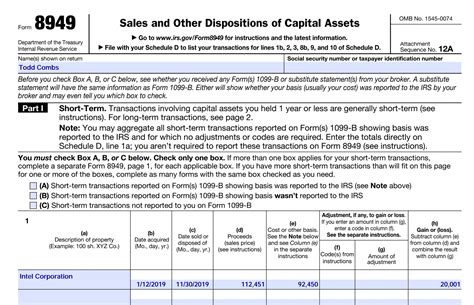

Form 8949 is a tax form used by the Internal Revenue Service (IRS) to report sales and other dispositions of capital assets. This form is typically used to report the sale of stocks, bonds, mutual funds, and other investment securities. The form is divided into two parts: Part I for short-term transactions and Part II for long-term transactions.

What Does Code Eh Mean On Form 8949?

Code Eh on Form 8949 indicates that the reported proceeds from the sale of a capital asset are less than the reported cost or other basis. This can happen when the sale price of an asset is lower than its original purchase price or when there are errors in reporting the proceeds or basis.

Why is Code Eh a Problem?

Code Eh can cause problems because it may trigger an audit or delay the processing of your tax return. The IRS may question the accuracy of the reported proceeds or basis, leading to additional scrutiny and potentially resulting in penalties or interest.

5 Ways to Fix Code Eh On Form 8949

Fortunately, fixing Code Eh on Form 8949 is relatively straightforward. Here are five ways to resolve the issue:

1. Review and Correct Proceeds and Basis

The first step is to review the reported proceeds and basis for the affected asset. Check your records and ensure that the proceeds and basis are accurate. If you find any errors, correct them and refile Form 8949.

2. Check for Wash Sales

A wash sale occurs when you sell a security at a loss and purchase a substantially identical security within 30 days before or after the sale. If you have a wash sale, you may need to adjust the basis of the replacement security. Review your transactions to ensure that you have not triggered a wash sale.

3. Verify Accuracy of Reporting

Double-check that you have accurately reported the proceeds and basis on Form 8949. Ensure that you have not missed any transactions or incorrectly reported the dates of sale or purchase.

4. Consider Amending Your Tax Return

If you have already filed your tax return and received a notice from the IRS regarding Code Eh, you may need to amend your return. File Form 1040X to correct the error and provide additional documentation to support the corrected proceeds and basis.

5. Seek Professional Help

If you are unsure about how to fix Code Eh or need assistance with correcting your tax return, consider seeking help from a tax professional. They can review your records, identify the error, and provide guidance on how to resolve the issue.

Additional Tips and Reminders

- Always keep accurate records of your investment transactions, including proceeds and basis.

- Double-check your math and ensure that you have correctly reported all transactions on Form 8949.

- If you receive a notice from the IRS regarding Code Eh, respond promptly and provide additional documentation to support your corrected proceeds and basis.

- Consider consulting a tax professional if you are unsure about how to fix Code Eh or need assistance with correcting your tax return.

Conclusion and Next Steps

Fixing Code Eh on Form 8949 requires attention to detail and a thorough review of your investment transactions. By following the steps outlined in this article, you can resolve the issue and avoid any potential penalties or delays. Remember to keep accurate records, double-check your math, and seek professional help if needed.

What is the purpose of Form 8949?

+Form 8949 is used to report sales and other dispositions of capital assets, such as stocks, bonds, and mutual funds.

What does Code Eh on Form 8949 mean?

+Code Eh indicates that the reported proceeds from the sale of a capital asset are less than the reported cost or other basis.

How do I fix Code Eh on Form 8949?

+Review and correct proceeds and basis, check for wash sales, verify accuracy of reporting, consider amending your tax return, and seek professional help if needed.