The arrival of tax season can be a daunting time for students and their families, as they navigate the complex process of filing taxes and claiming educational expenses. However, for students who attend Clayton State University, the process just got a whole lot easier. In this article, we will delve into the world of the Clayton State 1098-T form, exploring its purpose, benefits, and how it can make tax season a breeze.

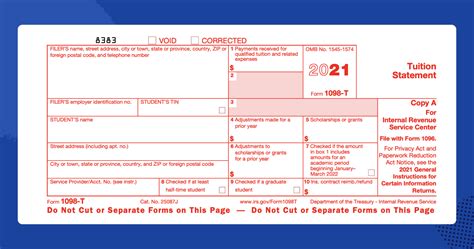

Every year, the IRS requires educational institutions to provide students with a 1098-T form, also known as the Tuition Statement. This form reports the amount of tuition and fees paid by the student during the tax year, as well as any scholarships or grants received. The 1098-T form is a crucial document for students and their families, as it can help them claim valuable tax credits and deductions.

What is the Clayton State 1098-T Form?

The Clayton State 1098-T form is a Tuition Statement provided by Clayton State University to its students. The form reports the amount of tuition and fees paid by the student during the tax year, as well as any scholarships or grants received. The 1098-T form is typically mailed to students by January 31st of each year, and it can also be accessed online through the university's student portal.

Why is the Clayton State 1098-T Form Important?

The Clayton State 1098-T form is important for several reasons:

- Tax Credits: The 1098-T form provides students with the necessary documentation to claim tax credits, such as the American Opportunity Tax Credit and the Lifetime Learning Credit.

- Tax Deductions: The form also reports the amount of tuition and fees paid by the student, which can be used to claim tax deductions.

- Scholarships and Grants: The 1098-T form reports any scholarships or grants received by the student, which can impact the student's tax liability.

How to Access the Clayton State 1098-T Form

Students can access their 1098-T form in several ways:

- Online: Students can log in to the university's student portal to access their 1098-T form.

- Mail: The university will mail the 1098-T form to students by January 31st of each year.

- Student Accounts Office: Students can also contact the Student Accounts Office to request a copy of their 1098-T form.

Tips for Filing Taxes with the Clayton State 1098-T Form

Here are some tips for filing taxes with the Clayton State 1098-T form:

- Keep Records: Keep a copy of your 1098-T form, as well as any other tax-related documents, in a safe and secure location.

- Consult a Tax Professional: If you are unsure about how to file your taxes or claim tax credits and deductions, consider consulting a tax professional.

- File Electronically: Filing taxes electronically can help reduce errors and speed up the refund process.

Common Questions About the Clayton State 1098-T Form

Here are some common questions about the Clayton State 1098-T form:

- What is the deadline for receiving the 1098-T form? The university is required to provide the 1098-T form to students by January 31st of each year.

- Can I access my 1098-T form online? Yes, students can log in to the university's student portal to access their 1098-T form.

- What if I have questions about my 1098-T form? Students can contact the Student Accounts Office for assistance with any questions or concerns about their 1098-T form.

Conclusion

The Clayton State 1098-T form is an essential document for students and their families, providing the necessary information to claim tax credits and deductions. By understanding the purpose and benefits of the 1098-T form, students can make tax season a breeze. Remember to keep records, consult a tax professional if needed, and file electronically to speed up the refund process.

We hope this article has provided you with valuable information about the Clayton State 1098-T form. If you have any further questions or concerns, please don't hesitate to reach out.

What is the purpose of the 1098-T form?

+The 1098-T form reports the amount of tuition and fees paid by the student during the tax year, as well as any scholarships or grants received.

How do I access my 1098-T form?

+Students can log in to the university's student portal to access their 1098-T form, or contact the Student Accounts Office for assistance.

What tax credits can I claim with the 1098-T form?

+The 1098-T form provides students with the necessary documentation to claim tax credits, such as the American Opportunity Tax Credit and the Lifetime Learning Credit.