Certified payroll reports are an essential requirement for construction contractors and subcontractors working on federally funded projects. The report is used to verify compliance with the Davis-Bacon Act, which requires paying workers prevailing wages and benefits. Filling out the certified payroll report form can be a daunting task, but it can be broken down into five easy steps.

Step 1: Gather Required Information and Documents

Before starting to fill out the certified payroll report form, it's crucial to gather all the necessary information and documents. This includes:

- Project information: project name, project number, contract number, and location

- Employee information: names, social security numbers, occupations, and classifications

- Payroll records: hours worked, wages paid, benefits, and deductions

- Certification documents: federal ID number, state license number, and any other relevant certifications

What to Include in Employee Information

When gathering employee information, make sure to include the following:

- Full name and social security number

- Occupation and classification

- Number of hours worked each day and total hours worked for the week

- Gross wages paid, including any overtime pay

- Net wages paid after deductions

- Benefits paid, such as health insurance and pension contributions

- Deductions made, including taxes and union dues

Step 2: Choose the Correct Form and Frequency

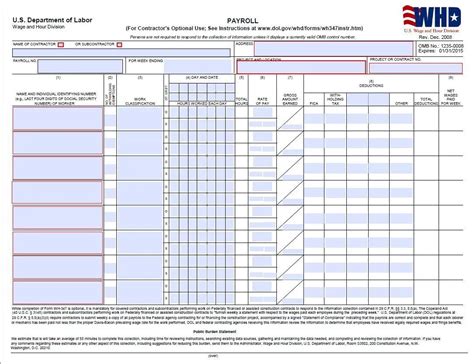

There are different types of certified payroll report forms, and the frequency of submission varies depending on the project and the agency overseeing it. The most common form is the WH-347, which is used for most federally funded projects.

- Determine the correct form to use for your project

- Check the frequency of submission required for your project

- Make sure to submit the form on time to avoid penalties and delays

What to Check Before Submitting the Form

Before submitting the certified payroll report form, double-check the following:

- Ensure all employee information is accurate and complete

- Verify that all hours worked and wages paid are correctly recorded

- Check that all benefits and deductions are properly accounted for

- Make sure to sign and date the form

Step 3: Complete Section 1 - Project Information

Section 1 of the certified payroll report form requires project information. This includes:

- Project name and project number

- Contract number and location

- Federal ID number and state license number

- Project start and end dates

What to Include in Project Information

When completing Section 1, make sure to include the following:

- Project name and project number as specified in the contract

- Contract number and location as specified in the contract

- Federal ID number and state license number as registered with the relevant authorities

- Project start and end dates as specified in the contract

Step 4: Complete Section 2 - Employee Information

Section 2 of the certified payroll report form requires employee information. This includes:

- Employee name and social security number

- Occupation and classification

- Number of hours worked each day and total hours worked for the week

- Gross wages paid, including any overtime pay

- Net wages paid after deductions

- Benefits paid, such as health insurance and pension contributions

- Deductions made, including taxes and union dues

What to Include in Employee Information

When completing Section 2, make sure to include the following:

- Employee name and social security number as registered with the Social Security Administration

- Occupation and classification as specified in the contract

- Number of hours worked each day and total hours worked for the week

- Gross wages paid, including any overtime pay

- Net wages paid after deductions

- Benefits paid, such as health insurance and pension contributions

- Deductions made, including taxes and union dues

Step 5: Review, Sign, and Submit the Form

After completing the certified payroll report form, review it carefully to ensure accuracy and completeness. Sign and date the form, and submit it to the relevant authorities on time.

What to Check Before Submitting the Form

Before submitting the certified payroll report form, double-check the following:

- Ensure all employee information is accurate and complete

- Verify that all hours worked and wages paid are correctly recorded

- Check that all benefits and deductions are properly accounted for

- Make sure to sign and date the form

By following these five easy steps, you can ensure that your certified payroll report form is accurate, complete, and submitted on time.

We'd love to hear from you! Share your experiences and tips for filling out certified payroll report forms in the comments below.

FAQ Section:

What is a certified payroll report form?

+A certified payroll report form is a document used to verify compliance with the Davis-Bacon Act, which requires paying workers prevailing wages and benefits on federally funded projects.

What information is required on a certified payroll report form?

+The form requires project information, employee information, and payroll records, including hours worked, wages paid, benefits, and deductions.

How often do I need to submit a certified payroll report form?

+The frequency of submission varies depending on the project and the agency overseeing it. Check with the relevant authorities to determine the required frequency.