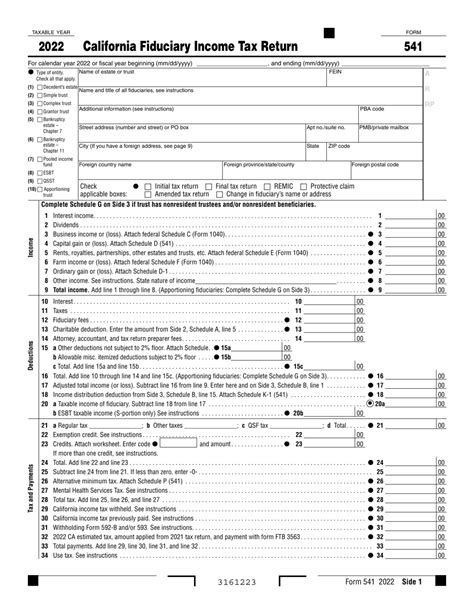

The California Form 541, also known as the "California Adjustment for State Adjustments" form, is a crucial document for taxpayers in California. This form is used to report adjustments to income, deductions, and credits that are specific to California and are not reported on the federal tax return. In this article, we will guide you through the process of completing the California Form 541 with ease.

Step 1: Gather Necessary Information

Before starting to fill out the California Form 541, gather all the necessary information and documents. This includes your federal tax return, W-2 forms, 1099 forms, and any other relevant tax documents. Make sure to have all the required information readily available to avoid any delays or errors.

Required Documents

- Federal tax return (Form 1040)

- W-2 forms

- 1099 forms

- Other relevant tax documents

Step 2: Identify California Adjustments

Identify the adjustments that are specific to California and need to be reported on the Form 541. These adjustments may include:

- California income adjustments (e.g., California lottery winnings)

- California deduction adjustments (e.g., mortgage interest deductions)

- California credit adjustments (e.g., California earned income tax credit)

Step 3: Complete Section A – Income Adjustments

Section A of the Form 541 is used to report income adjustments that are specific to California. This includes adjustments to gross income, such as:

- California lottery winnings

- Prizes and awards

- Other income adjustments

Section A Instructions

- List each income adjustment separately

- Enter the amount of each adjustment

- Total all income adjustments

Step 4: Complete Section B – Deduction Adjustments

Section B of the Form 541 is used to report deduction adjustments that are specific to California. This includes adjustments to itemized deductions, such as:

- Mortgage interest deductions

- Property tax deductions

- Charitable contribution deductions

Step 5: Complete Section C – Credit Adjustments

Section C of the Form 541 is used to report credit adjustments that are specific to California. This includes adjustments to credits, such as:

- California earned income tax credit

- Child and dependent care credit

- Other credit adjustments

Section C Instructions

- List each credit adjustment separately

- Enter the amount of each credit adjustment

- Total all credit adjustments

Step 6: Complete Section D – Summary of Adjustments

Section D of the Form 541 is used to summarize all the adjustments reported on the form. This includes:

- Total income adjustments

- Total deduction adjustments

- Total credit adjustments

Section D Instructions

- Total all income adjustments from Section A

- Total all deduction adjustments from Section B

- Total all credit adjustments from Section C

Step 7: Review and Submit the Form

Once you have completed all the sections of the Form 541, review the form for accuracy and completeness. Make sure to sign and date the form, and submit it with your California tax return.

By following these 7 steps, you can easily complete the California Form 541 and ensure that you are taking advantage of all the available tax adjustments and credits.

If you have any questions or concerns about the Form 541, feel free to ask in the comments below.

What is the California Form 541?

+The California Form 541 is a tax form used to report adjustments to income, deductions, and credits that are specific to California and are not reported on the federal tax return.

What are some common California adjustments?

+Some common California adjustments include California lottery winnings, mortgage interest deductions, and California earned income tax credit.

How do I submit the California Form 541?

+The Form 541 should be submitted with your California tax return. You can file your tax return electronically or by mail.