The TC 721 form is a crucial document in the realm of taxation, and its significance extends beyond the confines of financial professionals. As an individual or business owner, understanding the intricacies of this form can help you navigate the complex world of taxes with greater ease. In this article, we will delve into the essential facts about the TC 721 form, shedding light on its purpose, benefits, and key components.

The TC 721 form is a vital tool for individuals and businesses looking to claim tax credits for research and development (R&D) expenses. By providing a clear and concise breakdown of eligible expenditures, this form enables taxpayers to maximize their tax savings and reinvest in their business. In this section, we will explore the importance of the TC 721 form and its role in the tax credit process.

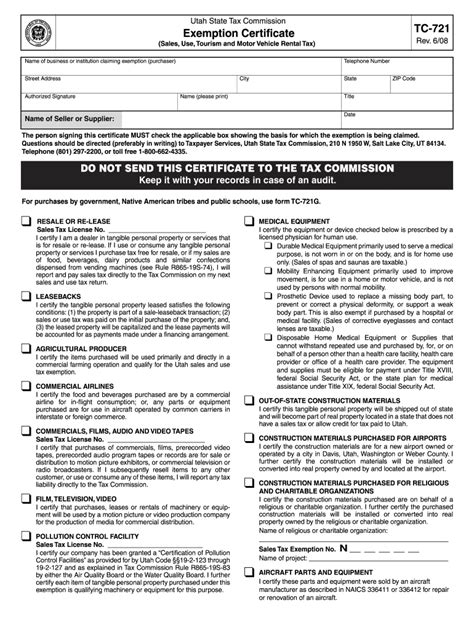

What is the TC 721 Form?

The TC 721 form is an official document used by the Internal Revenue Service (IRS) to claim tax credits for R&D expenses. This form is specifically designed for businesses and individuals who have incurred qualified research and development expenditures during the tax year. By completing and submitting the TC 721 form, taxpayers can claim a tax credit of up to 20% of their eligible R&D expenses.

Benefits of Using the TC 721 Form

The TC 721 form offers numerous benefits to taxpayers, including:

- Increased Tax Savings: By claiming tax credits for R&D expenses, businesses and individuals can significantly reduce their tax liability, resulting in increased tax savings.

- Improved Cash Flow: The tax credits claimed through the TC 721 form can provide a much-needed influx of cash, enabling businesses to reinvest in their operations and fuel growth.

- Enhanced Competitiveness: By taking advantage of tax credits for R&D expenses, businesses can stay competitive in their industry, driving innovation and progress.

Key Components of the TC 721 Form

The TC 721 form is divided into several sections, each requiring specific information and documentation. The key components of this form include:

- Section 1: Taxpayer Information: This section requires taxpayers to provide their name, address, and tax identification number.

- Section 2: R&D Expenditures: This section requires taxpayers to list their qualified R&D expenditures, including salaries, supplies, and contract research expenses.

- Section 3: Tax Credit Calculation: This section requires taxpayers to calculate their tax credit based on their eligible R&D expenditures.

How to Complete the TC 721 Form

Completing the TC 721 form requires careful attention to detail and a thorough understanding of the tax credit process. Here are some steps to follow:

- Gather Required Documents: Taxpayers should gather all relevant documents, including receipts, invoices, and payroll records, to support their R&D expenditures.

- Complete Section 1: Taxpayers should provide their taxpayer information, including their name, address, and tax identification number.

- Complete Section 2: Taxpayers should list their qualified R&D expenditures, including salaries, supplies, and contract research expenses.

- Complete Section 3: Taxpayers should calculate their tax credit based on their eligible R&D expenditures.

Common Mistakes to Avoid

When completing the TC 721 form, taxpayers should avoid common mistakes, including:

- Inaccurate or Incomplete Information: Taxpayers should ensure that all information provided is accurate and complete, as errors or omissions can result in delays or disqualification.

- Failure to Support R&D Expenditures: Taxpayers should ensure that they have sufficient documentation to support their R&D expenditures, as failure to do so can result in disqualification.

Conclusion

The TC 721 form is a vital tool for individuals and businesses looking to claim tax credits for R&D expenses. By understanding the essential facts about this form, taxpayers can navigate the tax credit process with greater ease, maximizing their tax savings and reinvesting in their business.