As an employer, navigating the complex world of tax forms and compliance can be overwhelming. One crucial form that requires attention is the USPS Form 1094, also known as the Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns. This form plays a critical role in the Affordable Care Act (ACA) reporting requirements, and employers must understand its purpose, filing instructions, and deadlines to avoid penalties.

The importance of accurate and timely reporting cannot be overstated, as it directly affects an employer's compliance with the ACA. In this article, we will delve into the details of USPS Form 1094, providing a comprehensive guide for employers to ensure they meet the necessary requirements.

What is USPS Form 1094?

What is USPS Form 1094?

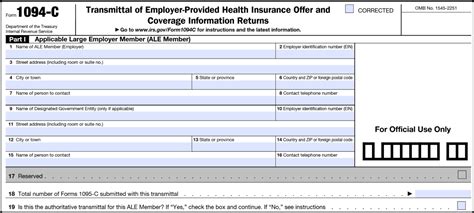

USPS Form 1094, officially known as the Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns, is a tax form used by employers to report information about the health insurance coverage they offer to their employees. The form serves as a summary of the data reported on Form 1095-C, which is completed for each employee.

The primary purpose of Form 1094 is to:

- Certify that the employer has complied with the ACA's employer shared responsibility provisions

- Report the number of full-time employees and the number of employees who were offered health insurance coverage

- Provide a summary of the data reported on Form 1095-C

Who Needs to File USPS Form 1094?

Who Needs to File USPS Form 1094?

Employers who are required to file Form 1094 are those with 50 or more full-time employees, including full-time equivalent employees. These employers are known as Applicable Large Employers (ALEs). ALEs must file Form 1094-C, which is the transmittal form, along with Form 1095-C, which is the employee statement.

How to Complete USPS Form 1094

How to Complete USPS Form 1094

To complete Form 1094, employers will need to gather the following information:

- Employer Identification Number (EIN)

- Business name and address

- Total number of full-time employees

- Total number of employees who were offered health insurance coverage

- Certification of compliance with the ACA's employer shared responsibility provisions

Employers will also need to complete Form 1095-C for each employee, which requires the following information:

- Employee's name, address, and Social Security number

- Employer's name, address, and EIN

- Health insurance coverage information, including the months of coverage and the amount of the employee's contribution

Filing Deadlines and Penalties

Filing Deadlines and Penalties

The deadline for filing Form 1094-C is typically January 31st of each year, while the deadline for furnishing Form 1095-C to employees is also January 31st. Employers who fail to meet these deadlines may be subject to penalties, which can range from $260 to $540 per return, depending on the circumstances.

Best Practices for USPS Form 1094 Compliance

Best Practices for USPS Form 1094 Compliance

To ensure compliance with Form 1094 requirements, employers should:

- Maintain accurate records of employee data and health insurance coverage information

- Use a reliable and secure system for filing and transmitting forms

- Double-check forms for errors and completeness before submission

- Stay informed about changes to ACA reporting requirements and deadlines

- Consider consulting with a tax professional or benefits administrator for guidance

Conclusion

As an employer, it is essential to understand the requirements and deadlines associated with USPS Form 1094. By following the guidelines and best practices outlined in this article, employers can ensure compliance with the ACA's reporting requirements and avoid costly penalties. Remember to stay informed, maintain accurate records, and seek professional guidance when needed.

Call to Action

We encourage you to share your experiences and questions about USPS Form 1094 in the comments section below. If you have any further questions or concerns, please don't hesitate to reach out to us. We are committed to providing accurate and informative content to help employers navigate the complex world of tax compliance.

FAQ Section

What is the purpose of USPS Form 1094?

+The primary purpose of Form 1094 is to certify that the employer has complied with the ACA's employer shared responsibility provisions, report the number of full-time employees and the number of employees who were offered health insurance coverage, and provide a summary of the data reported on Form 1095-C.

Who needs to file USPS Form 1094?

+Employers with 50 or more full-time employees, including full-time equivalent employees, are required to file Form 1094-C.

What is the deadline for filing USPS Form 1094?

+The deadline for filing Form 1094-C is typically January 31st of each year.