Understanding CA Withholding Tax Form: Importance and Benefits

If you're a business owner or an individual in California, you're likely familiar with the concept of withholding tax. Withholding tax, also known as "pay-as-you-earn" tax, is a requirement by the state to deduct a portion of income earned by non-residents or non-corporate entities from certain types of income. The CA withholding tax form is a crucial document used to report and pay these taxes. In this article, we'll provide a step-by-step guide on how to navigate the CA withholding tax form, its importance, and benefits.

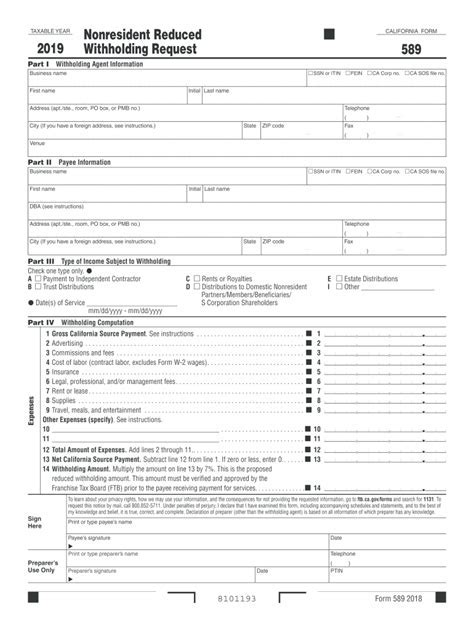

What is CA Withholding Tax Form?

The CA withholding tax form, also known as Form 592, is used to report and pay withholding taxes on certain types of income earned by non-residents or non-corporate entities in California. This includes income from real estate transactions, dividends, interest, rents, and royalties. The form is used to report the amount of tax withheld and the amount of tax paid to the state.

Why is CA Withholding Tax Form Important?

The CA withholding tax form is essential for several reasons:

- Compliance with state laws: Withholding tax is a requirement by the state, and failure to comply can result in penalties and fines.

- Prevents tax evasion: Withholding tax helps prevent tax evasion by ensuring that non-residents and non-corporate entities pay their fair share of taxes.

- Reduces tax burden: By deducting taxes from income earned, withholding tax reduces the tax burden on individuals and businesses.

Benefits of CA Withholding Tax Form

The CA withholding tax form offers several benefits, including:

- Streamlined tax reporting: The form provides a simple and efficient way to report and pay withholding taxes.

- Reduced paperwork: By using the CA withholding tax form, businesses and individuals can reduce the amount of paperwork required for tax reporting.

- Improved accuracy: The form helps ensure accuracy in tax reporting, reducing the risk of errors and penalties.

Step-by-Step Guide to CA Withholding Tax Form

Here's a step-by-step guide to completing the CA withholding tax form:

- Obtain the form: You can download the CA withholding tax form (Form 592) from the California Franchise Tax Board (FTB) website or obtain it from a tax professional.

- Gather required information: You'll need to gather information about the income earned, including the type of income, amount earned, and withholding tax rate.

- Complete the form: Fill out the form accurately and completely, using the required information.

- Calculate withholding tax: Calculate the withholding tax using the correct rate and amount earned.

- Pay withholding tax: Pay the withholding tax using the payment voucher (Form 592-V).

- File the form: File the completed form with the FTB by the due date.

Common Mistakes to Avoid

When completing the CA withholding tax form, common mistakes to avoid include:

- Incorrect withholding tax rate: Using an incorrect withholding tax rate can result in underpayment or overpayment of taxes.

- Inaccurate income reporting: Inaccurate income reporting can result in penalties and fines.

- Late filing: Failing to file the form by the due date can result in penalties and fines.

CA Withholding Tax Form Deadlines and Penalties

The CA withholding tax form deadlines and penalties are as follows:

- Deadlines: The form is due on the 15th day of the 4th month after the close of the calendar year (April 15th for calendar-year taxpayers).

- Penalties: Failure to file the form by the due date can result in penalties and fines, including a penalty of 5% per month or part of a month, up to a maximum of 25%.

Conclusion

The CA withholding tax form is a crucial document used to report and pay withholding taxes on certain types of income earned by non-residents or non-corporate entities in California. By following the step-by-step guide and avoiding common mistakes, businesses and individuals can ensure compliance with state laws and reduce their tax burden. If you have any questions or concerns about the CA withholding tax form, consult with a tax professional or contact the California Franchise Tax Board (FTB) for assistance.

What is the purpose of the CA withholding tax form?

+The CA withholding tax form is used to report and pay withholding taxes on certain types of income earned by non-residents or non-corporate entities in California.

Who is required to file the CA withholding tax form?

+Businesses and individuals who earn income from real estate transactions, dividends, interest, rents, and royalties are required to file the CA withholding tax form.

What is the deadline for filing the CA withholding tax form?

+The form is due on the 15th day of the 4th month after the close of the calendar year (April 15th for calendar-year taxpayers).