Understanding the Importance of BB1 Forms in Hawaii

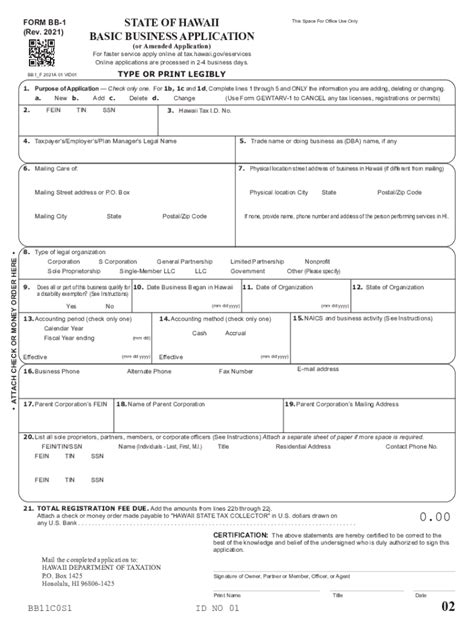

The BB1 form, also known as the "Basic Business Application" form, is a crucial document required for businesses operating in Hawaii. It serves as a registration form for new businesses, allowing them to obtain necessary licenses and permits. In this article, we will delve into the world of BB1 forms, explaining their significance, the filing process, and providing valuable tips to ensure a smooth experience.

The state of Hawaii requires all businesses to register with the Department of Commerce and Consumer Affairs (DCCA) to operate legally. The BB1 form is the first step in this registration process, and it's essential to understand its components and requirements. Whether you're a new entrepreneur or an established business owner, this guide will walk you through the process of filing a BB1 form with ease.

Benefits of Filing a BB1 Form

Filing a BB1 form provides several benefits to businesses in Hawaii. Some of the most significant advantages include:

- Obtaining necessary licenses and permits to operate a business

- Registering with the state's business database

- Complying with state regulations and laws

- Establishing credibility with customers and suppliers

- Accessing state resources and support services

The BB1 Form Filing Process

The BB1 form filing process involves several steps, which are outlined below:

- Determine Your Business Structure: Before filing the BB1 form, you need to determine your business structure. This can be a sole proprietorship, partnership, limited liability company (LLC), or corporation.

- Gather Required Documents: You'll need to gather the required documents, including your business name, address, and ownership information.

- Complete the BB1 Form: The BB1 form can be downloaded from the DCCA website or completed online. Ensure you fill out the form accurately and thoroughly.

- Submit the Form: Once you've completed the form, submit it to the DCCA along with the required filing fee.

- Wait for Approval: After submitting the form, wait for approval from the DCCA. This may take several days or weeks, depending on the workload.

Required Documents and Information

When filing the BB1 form, you'll need to provide the following documents and information:

- Business name and address

- Ownership information (including names, addresses, and percentages of ownership)

- Business structure (sole proprietorship, partnership, LLC, or corporation)

- Federal tax ID number (if applicable)

- State tax ID number (if applicable)

Tips for a Smooth Filing Experience

To ensure a smooth filing experience, follow these tips:

- Double-Check Your Information: Ensure all information is accurate and complete to avoid delays or rejection.

- Use the Correct Filing Fee: Use the correct filing fee to avoid delays or rejection.

- Submit the Form Online: Submitting the form online can speed up the process and reduce errors.

- Seek Professional Help: If you're unsure about any aspect of the filing process, seek professional help from an attorney or accountant.

Common Mistakes to Avoid

When filing the BB1 form, avoid the following common mistakes:

- Inaccurate Information: Ensure all information is accurate and complete to avoid delays or rejection.

- Insufficient Filing Fee: Use the correct filing fee to avoid delays or rejection.

- Incomplete Form: Ensure the form is complete and thoroughly filled out to avoid delays or rejection.

Conclusion

Filing a BB1 form is a crucial step in registering your business in Hawaii. By understanding the importance of the form, the filing process, and providing accurate information, you can ensure a smooth experience. Remember to double-check your information, use the correct filing fee, and seek professional help if needed. With this guide, you'll be well on your way to successfully filing your BB1 form and starting your business in Hawaii.

What is the purpose of the BB1 form?

+The BB1 form is a registration form for new businesses in Hawaii, allowing them to obtain necessary licenses and permits.

What documents do I need to file the BB1 form?

+You'll need to provide your business name, address, ownership information, business structure, federal tax ID number (if applicable), and state tax ID number (if applicable).

How long does it take to process the BB1 form?

+The processing time for the BB1 form may take several days or weeks, depending on the workload of the DCCA.