Are you an Arizona resident dealing with tax-related issues? Or perhaps you're a business owner trying to navigate the complex world of state taxes? If so, you may have come across the Arizona Form 5000A, but do you know what it's used for and how it can impact your financial situation? In this article, we'll delve into the world of Arizona state taxes and explore five essential facts about the AZ Form 5000A that you need to know.

Understanding the AZ Form 5000A

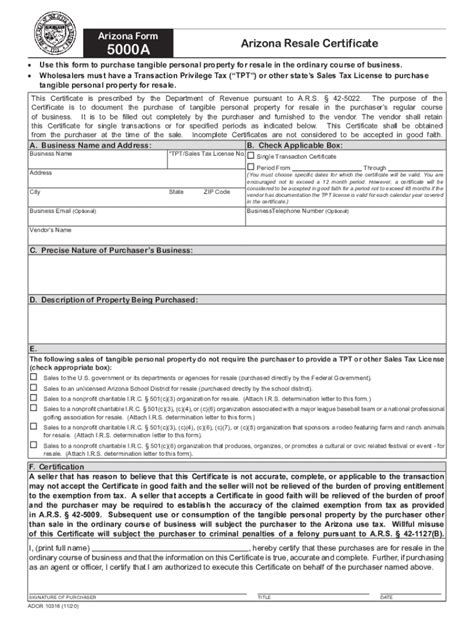

What is the AZ Form 5000A?

The AZ Form 5000A is an Arizona state tax form used for individuals and businesses to report and pay various tax liabilities, including withholding taxes, estimated taxes, and other tax obligations. It's an essential document for anyone who needs to report tax-related information to the Arizona Department of Revenue.

Who needs to file the AZ Form 5000A?

The AZ Form 5000A is typically filed by individuals, businesses, and other entities that have tax obligations in Arizona. This includes:

- Employers who withhold Arizona state income taxes from employee wages

- Individuals who need to make estimated tax payments

- Businesses that have tax liabilities, such as sales tax or withholding tax

- Non-profit organizations and government entities with tax obligations

Key Facts About the AZ Form 5000A

Filing Requirements and Deadlines

The AZ Form 5000A is typically filed on a quarterly basis, with deadlines as follows:

- April 30th for the first quarter (January 1 - March 31)

- July 31st for the second quarter (April 1 - June 30)

- October 31st for the third quarter (July 1 - September 30)

- January 31st for the fourth quarter (October 1 - December 31)

Failure to file or pay taxes by the deadline may result in penalties and interest.

Types of Taxes Reported on the AZ Form 5000A

The AZ Form 5000A is used to report various types of taxes, including:

- Withholding taxes: taxes withheld from employee wages

- Estimated taxes: quarterly payments made by individuals and businesses to prepay tax liabilities

- Sales tax: taxes collected on sales of goods and services

- Use tax: taxes paid on purchases of goods and services not subject to sales tax

Penalties and Interest for Late Filings

If you fail to file or pay taxes by the deadline, you may be subject to penalties and interest. The Arizona Department of Revenue may assess penalties of up to 47% of the unpaid tax amount, plus interest on the unpaid balance.

Avoiding Common Mistakes on the AZ Form 5000A

To avoid common mistakes on the AZ Form 5000A, make sure to:

- File on time to avoid penalties and interest

- Report all tax liabilities accurately and completely

- Keep accurate records of tax payments and filings

- Seek professional help if you're unsure about filing requirements or tax obligations

Conclusion

In conclusion, the AZ Form 5000A is a critical document for individuals and businesses with tax obligations in Arizona. By understanding the filing requirements, types of taxes reported, and potential penalties for late filings, you can avoid common mistakes and ensure compliance with Arizona state tax laws.

Stay Informed and Take Action

If you have any questions or concerns about the AZ Form 5000A or Arizona state taxes, don't hesitate to reach out to the Arizona Department of Revenue or a qualified tax professional. Stay informed and take action to ensure you're meeting your tax obligations and avoiding unnecessary penalties and interest.

FAQ Section:

What is the AZ Form 5000A used for?

+The AZ Form 5000A is used to report and pay various tax liabilities, including withholding taxes, estimated taxes, and other tax obligations.

Who needs to file the AZ Form 5000A?

+The AZ Form 5000A is typically filed by individuals, businesses, and other entities that have tax obligations in Arizona.

What are the filing deadlines for the AZ Form 5000A?

+The AZ Form 5000A is typically filed on a quarterly basis, with deadlines as follows: April 30th, July 31st, October 31st, and January 31st.