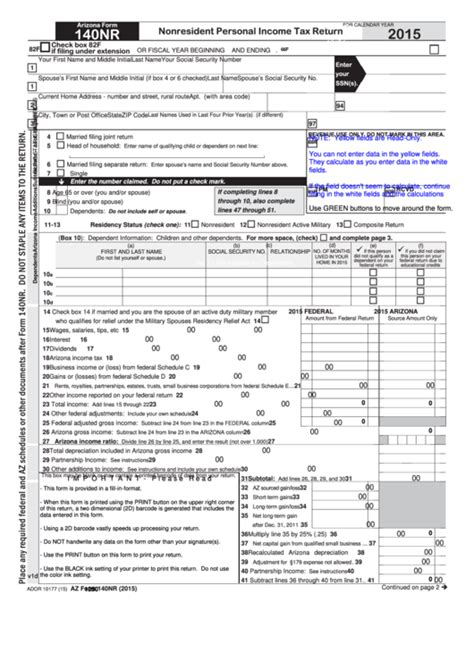

Filing taxes can be a daunting task, especially when dealing with specific state forms like the Arizona 140NR. The Arizona Non-Resident Personal Income Tax Return form is used by individuals who are not residents of Arizona but have income from sources within the state. To ensure accuracy and avoid potential delays or penalties, it's essential to complete the form correctly. Here are five ways to help you fill out the Arizona 140NR form correctly.

Understanding the Form's Purpose and Requirements

Before starting to fill out the form, it's crucial to understand its purpose and requirements. The Arizona 140NR form is used to report income earned from Arizona sources, such as rental income, wages, or self-employment income. You'll need to gather all necessary documents, including your federal income tax return, W-2 forms, and 1099 forms. Make sure you have all the required information before beginning the filing process.

Gather Required Documents and Information

To complete the Arizona 140NR form correctly, you'll need to gather the following documents and information:

- Your federal income tax return (Form 1040)

- W-2 forms for Arizona-sourced wages

- 1099 forms for Arizona-sourced income (e.g., interest, dividends, capital gains)

- Arizona-sourced business income (e.g., self-employment income, rental income)

- Any other relevant tax documents or schedules

Step-by-Step Instructions for Completing the Form

Once you have gathered all the necessary documents and information, follow these step-by-step instructions to complete the Arizona 140NR form:

- Enter your identification information: Start by entering your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Report your federal income tax information: Transfer the information from your federal income tax return (Form 1040) to the corresponding lines on the Arizona 140NR form.

- Report your Arizona-sourced income: Enter your Arizona-sourced income from W-2 forms, 1099 forms, and other relevant tax documents or schedules.

- Calculate your Arizona tax liability: Use the Arizona tax tables or tax calculator to determine your tax liability based on your reported income.

- Claim any applicable credits or deductions: Claim any applicable credits or deductions, such as the Arizona standard deduction or itemized deductions.

Tips for Avoiding Common Errors

To avoid common errors when completing the Arizona 140NR form, keep the following tips in mind:

- Double-check your math: Make sure to double-check your math calculations to ensure accuracy.

- Use the correct tax tables: Use the correct tax tables or tax calculator to determine your tax liability.

- Report all income: Report all Arizona-sourced income, including wages, self-employment income, and rental income.

- Claim all applicable credits and deductions: Claim all applicable credits and deductions to minimize your tax liability.

Electronic Filing Options

The Arizona Department of Revenue offers electronic filing options for the 140NR form. You can file electronically through the Arizona Department of Revenue's website or through a tax software provider. Electronic filing can help reduce errors and speed up the filing process.

Benefits of Electronic Filing

Electronic filing offers several benefits, including:

- Reduced errors: Electronic filing can help reduce errors by performing automatic calculations and checking for completeness.

- Faster refunds: Electronic filing can help speed up the refund process.

- Convenience: Electronic filing can be done from the comfort of your own home, 24/7.

Additional Resources

If you need additional help or have questions about completing the Arizona 140NR form, consider the following resources:

- Arizona Department of Revenue website: The Arizona Department of Revenue website offers a wealth of information, including instructions, forms, and FAQs.

- Tax software providers: Tax software providers, such as TurboTax or H&R Block, offer guidance and support for completing the Arizona 140NR form.

- Tax professionals: Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), can provide personalized guidance and support.

By following these five ways to complete the Arizona 140NR form correctly, you can ensure accuracy and avoid potential delays or penalties. Remember to gather all necessary documents and information, follow step-by-step instructions, and take advantage of electronic filing options.

We hope this article has been helpful in guiding you through the process of completing the Arizona 140NR form. If you have any further questions or concerns, please don't hesitate to comment below.

FAQ Section:

Who needs to file the Arizona 140NR form?

+The Arizona 140NR form is used by individuals who are not residents of Arizona but have income from sources within the state.

What is the deadline for filing the Arizona 140NR form?

+The deadline for filing the Arizona 140NR form is typically April 15th of each year.