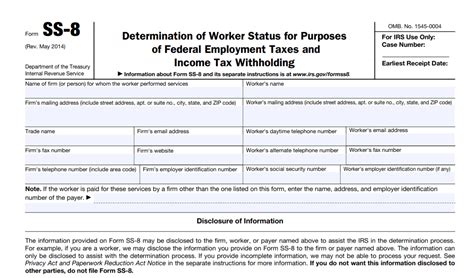

The SS-8 tax form, also known as the "Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding," is a crucial document used by the Internal Revenue Service (IRS) to determine whether a worker is an employee or an independent contractor. This distinction is essential for federal tax purposes, as it affects the worker's tax obligations, benefits, and rights.

In recent years, the gig economy and the rise of freelance work have led to an increase in the number of workers who are classified as independent contractors. However, this classification can be complex, and the IRS has specific guidelines to help determine whether a worker is an employee or an independent contractor.

The SS-8 form is typically filed by employers who are unsure about the classification of their workers or by workers who disagree with their classification. The form requires detailed information about the worker's job duties, work arrangements, and relationship with the employer.

Understanding the SS-8 Form

The SS-8 form is an eight-page document that requires the employer or worker to provide detailed information about the worker's job duties, work arrangements, and relationship with the employer. The form is divided into several sections, each of which addresses a specific aspect of the worker's employment status.

The first section of the form asks for general information about the employer and the worker, including their names, addresses, and social security numbers. The second section asks about the worker's job duties, including a detailed description of their tasks and responsibilities.

The third section of the form asks about the worker's work arrangements, including their schedule, work location, and the amount of control they have over their work. The fourth section asks about the worker's relationship with the employer, including the terms of their employment contract and any benefits they receive.

Factors Used to Determine Worker Status

When determining whether a worker is an employee or an independent contractor, the IRS considers several factors, including:

- The degree of control the employer has over the worker's job duties and work arrangements

- The worker's level of independence and autonomy

- The permanency of the worker's employment status

- The worker's opportunity for profit or loss

- The worker's investment in their work

- The degree of skill required for the worker's job duties

These factors are weighed and considered in conjunction with the information provided on the SS-8 form to determine the worker's employment status.

Benefits of Filing the SS-8 Form

Filing the SS-8 form can provide several benefits for both employers and workers. For employers, filing the form can help to:

- Clarify the employment status of their workers, reducing the risk of misclassification and potential tax penalties

- Ensure compliance with federal tax laws and regulations

- Avoid potential fines and penalties for misclassifying workers

For workers, filing the form can help to:

- Determine their employment status and tax obligations

- Ensure they are receiving the correct tax benefits and deductions

- Avoid potential tax penalties and fines for misreporting their income

Common Scenarios for Filing the SS-8 Form

There are several common scenarios in which the SS-8 form may be filed, including:

- When an employer is unsure about the classification of their workers

- When a worker disagrees with their classification as an employee or independent contractor

- When a worker is seeking clarification on their employment status for tax purposes

- When an employer is seeking to reclassify their workers due to changes in their job duties or work arrangements

How to File the SS-8 Form

To file the SS-8 form, employers or workers must complete the form and submit it to the IRS. The form can be filed electronically or by mail.

When filing the form, it is essential to ensure that all required information is provided and that the form is completed accurately. Failure to provide required information or inaccuracies on the form can delay processing and potentially lead to incorrect determinations.

Tips for Filing the SS-8 Form

Here are some tips for filing the SS-8 form:

- Ensure that all required information is provided

- Complete the form accurately and thoroughly

- Submit the form electronically or by mail to the IRS

- Keep a copy of the form for your records

- Follow up with the IRS to ensure that the form has been processed correctly

Conclusion and Next Steps

In conclusion, the SS-8 form is an essential document for determining worker status for federal tax purposes. By understanding the factors used to determine worker status and following the guidelines for filing the form, employers and workers can ensure that they are in compliance with federal tax laws and regulations.

If you are an employer or worker who is unsure about the classification of your workers or seeking clarification on your employment status, consider filing the SS-8 form. By doing so, you can ensure that you are receiving the correct tax benefits and deductions and avoid potential tax penalties and fines.

We encourage you to share your experiences and insights about filing the SS-8 form in the comments section below. Your feedback can help others who are navigating the complexities of federal tax laws and regulations.

What is the SS-8 form used for?

+The SS-8 form is used to determine whether a worker is an employee or an independent contractor for federal tax purposes.

Who can file the SS-8 form?

+Employers and workers can file the SS-8 form to determine worker status for federal tax purposes.

What are the benefits of filing the SS-8 form?

+Filing the SS-8 form can help employers and workers to clarify their employment status, ensure compliance with federal tax laws and regulations, and avoid potential tax penalties and fines.