Understanding the ATA Carnet: What is the ATA Form 106?

The ATA Carnet, also known as the "passport for goods," is an international customs document that allows for the temporary export and import of goods without the need for duties or taxes. One of the key components of the ATA Carnet system is the ATA Form 106, also known as the "claim form." In this article, we will delve into the world of ATA Carnets and explore five essential things to know about the ATA Form 106.

The ATA Carnet system was established in 1963 by the World Customs Organization (WCO) and the International Chamber of Commerce (ICC) to facilitate international trade. Today, the ATA Carnet is accepted in over 75 countries and territories, making it a widely recognized and respected customs document. However, despite its widespread use, the ATA Form 106 remains a mystery to many. In this article, we will shed light on the ATA Form 106, its purpose, and its significance in the ATA Carnet system.

What is the Purpose of the ATA Form 106?

The ATA Form 106 is a claim form that is used to notify the guaranteeing association of any claims or discrepancies related to the use of an ATA Carnet. The form is typically used in situations where the holder of the ATA Carnet has failed to comply with the terms and conditions of the Carnet, resulting in a claim being made against the guaranteeing association. The ATA Form 106 serves as a formal notification of the claim, providing details of the incident, including the date, time, and location of the event.

The ATA Form 106 is an essential component of the ATA Carnet system, as it provides a standardized mechanism for reporting claims and discrepancies. By using the ATA Form 106, guaranteeing associations can efficiently process claims and take necessary actions to resolve any issues that may arise. The form also serves as a record-keeping tool, allowing guaranteeing associations to track and monitor claims related to ATA Carnets.

Who is Required to Use the ATA Form 106?

The ATA Form 106 is required to be used by the guaranteeing association in situations where a claim is made against them. The guaranteeing association is typically a national committee or organization that is responsible for issuing ATA Carnets and providing guarantees to customs authorities. When a claim is made against the guaranteeing association, they are required to complete the ATA Form 106 and submit it to the relevant authorities.

In addition to the guaranteeing association, the ATA Form 106 may also be used by customs authorities, chambers of commerce, and other organizations involved in the ATA Carnet system. These organizations may use the form to report claims or discrepancies related to the use of ATA Carnets, ensuring that all parties involved in the system are aware of any issues that may arise.

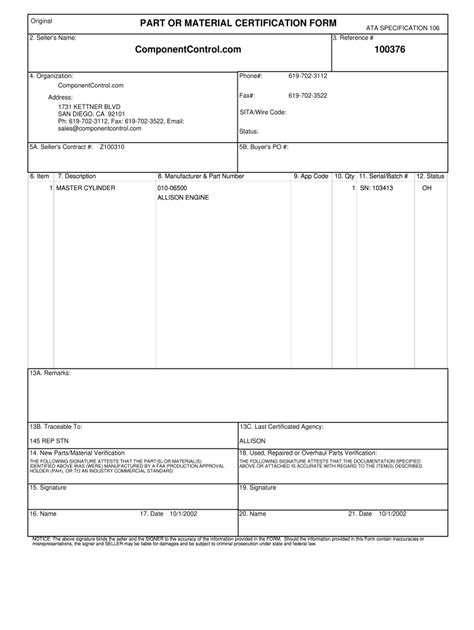

What Information is Required on the ATA Form 106?

The ATA Form 106 requires specific information to be provided, including:

- Details of the claim, including the date, time, and location of the incident

- Description of the goods involved in the claim

- Details of the ATA Carnet, including the Carnet number and the name of the holder

- Information about the guaranteeing association, including their name and address

- Signature of the guaranteeing association or authorized representative

The ATA Form 106 also includes a section for additional comments or remarks, allowing the guaranteeing association to provide any additional information that may be relevant to the claim.

How is the ATA Form 106 Used in the ATA Carnet System?

The ATA Form 106 plays a critical role in the ATA Carnet system, serving as a formal notification of claims and discrepancies. When a claim is made against the guaranteeing association, the ATA Form 106 is completed and submitted to the relevant authorities. The form provides a standardized mechanism for reporting claims, ensuring that all parties involved in the system are aware of any issues that may arise.

The ATA Form 106 is typically used in conjunction with other documents, such as the ATA Carnet and the commercial invoice. The form provides a record of the claim, which can be used to track and monitor claims related to ATA Carnets. By using the ATA Form 106, guaranteeing associations can efficiently process claims and take necessary actions to resolve any issues that may arise.

What are the Benefits of Using the ATA Form 106?

The ATA Form 106 offers several benefits to guaranteeing associations and other organizations involved in the ATA Carnet system. Some of the key benefits include:

- Standardized mechanism for reporting claims: The ATA Form 106 provides a standardized mechanism for reporting claims, ensuring that all parties involved in the system are aware of any issues that may arise.

- Efficient processing of claims: The ATA Form 106 allows guaranteeing associations to efficiently process claims, reducing the risk of errors and discrepancies.

- Improved record-keeping: The ATA Form 106 provides a record of the claim, which can be used to track and monitor claims related to ATA Carnets.

- Enhanced transparency: The ATA Form 106 promotes transparency and accountability, ensuring that all parties involved in the system are aware of any issues that may arise.

In conclusion, the ATA Form 106 is an essential component of the ATA Carnet system, providing a standardized mechanism for reporting claims and discrepancies. By understanding the purpose, requirements, and benefits of the ATA Form 106, guaranteeing associations and other organizations involved in the system can efficiently process claims and resolve any issues that may arise.

What's Next?

If you have any questions or concerns about the ATA Form 106 or the ATA Carnet system, please don't hesitate to comment below. We'd be happy to help you understand the process better. Additionally, if you're looking for more information on ATA Carnets or have any other questions related to international trade, please feel free to ask.

What is the purpose of the ATA Form 106?

+The ATA Form 106 is a claim form used to notify the guaranteeing association of any claims or discrepancies related to the use of an ATA Carnet.

Who is required to use the ATA Form 106?

+The guaranteeing association is required to use the ATA Form 106 in situations where a claim is made against them.

What information is required on the ATA Form 106?

+The ATA Form 106 requires specific information, including details of the claim, description of the goods involved, and information about the guaranteeing association.