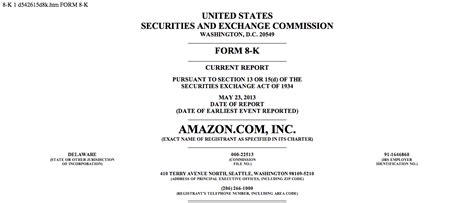

In the world of corporate finance, regulatory compliance is a top priority for publicly traded companies. One crucial aspect of this compliance is the timely and accurate filing of reports with the Securities and Exchange Commission (SEC). Among these reports, the Form 8-K is a vital component, providing immediate notification to investors and the SEC of significant events that may impact the company's financial condition or operations. Understanding the Item 5.02 Form 8-K filing requirements is essential for companies to navigate the complex landscape of SEC regulations.

For publicly traded companies, the Form 8-K is a critical tool for disclosing material events that occur between quarterly and annual reporting periods. These events can significantly impact the company's financial performance, business operations, or management structure, making it essential for investors to be informed promptly. The SEC requires companies to file a Form 8-K within four business days after the occurrence of a reportable event, ensuring that the investing public has access to timely and accurate information.

Understanding Item 5.02 Form 8-K Filing Requirements

Item 5.02 of the Form 8-K pertains to the departure or resignation of certain officers, including the company's principal executive officer, principal financial officer, and principal accounting officer. When one of these officers leaves the company, it can signal significant changes in the company's leadership or financial management, which may impact its future performance. As such, companies must disclose these events promptly to maintain transparency and ensure compliance with SEC regulations.

Key Requirements for Item 5.02 Form 8-K Filings

When filing a Form 8-K under Item 5.02, companies must provide specific information, including:

- The date of the officer's departure or resignation

- The officer's position and title

- The reason for the officer's departure or resignation, if applicable

- Any arrangements or agreements related to the officer's departure or resignation

- The identity of the new officer, if applicable

This information is crucial for investors to assess the potential impact of the officer's departure on the company's future performance and to make informed investment decisions.

Consequences of Non-Compliance

Failure to comply with the Form 8-K filing requirements, including Item 5.02, can result in severe consequences for publicly traded companies. These consequences may include:

- SEC enforcement actions, including fines and penalties

- Delisting from stock exchanges

- Loss of investor confidence and reputation damage

- Increased scrutiny from regulators and investors

To avoid these consequences, companies must ensure that they have robust internal controls and procedures in place to monitor and report significant events, including officer departures and resignations, in a timely and accurate manner.

Best Practices for Compliance

To ensure compliance with the Form 8-K filing requirements, companies should:

- Establish clear policies and procedures for reporting significant events

- Designate a responsible officer or department to monitor and report these events

- Provide regular training to employees on SEC regulations and reporting requirements

- Conduct regular audits and reviews to ensure compliance with SEC regulations

By following these best practices, companies can minimize the risk of non-compliance and maintain transparency with investors and the SEC.

Conclusion

In conclusion, understanding the Item 5.02 Form 8-K filing requirements is essential for publicly traded companies to maintain compliance with SEC regulations. By providing timely and accurate disclosure of significant events, including officer departures and resignations, companies can ensure transparency with investors and the SEC. Failure to comply with these requirements can result in severe consequences, including SEC enforcement actions and reputational damage. By establishing clear policies and procedures, providing regular training, and conducting regular audits, companies can minimize the risk of non-compliance and maintain a strong reputation in the market.

We encourage you to share your thoughts and experiences with Form 8-K filings and SEC compliance in the comments section below. Your feedback is valuable to us, and we look forward to engaging with you on this important topic.

What is the purpose of the Form 8-K filing requirement?

+The Form 8-K filing requirement is designed to provide immediate notification to investors and the SEC of significant events that may impact the company's financial condition or operations.

What types of events are reportable under Item 5.02 of the Form 8-K?

+Item 5.02 of the Form 8-K pertains to the departure or resignation of certain officers, including the company's principal executive officer, principal financial officer, and principal accounting officer.

What are the consequences of non-compliance with the Form 8-K filing requirements?

+Failure to comply with the Form 8-K filing requirements can result in severe consequences, including SEC enforcement actions, delisting from stock exchanges, loss of investor confidence, and reputational damage.