In the world of insurance, the ACORD form is a widely used document that helps facilitate the processing of insurance claims. One of the key components of the ACORD form is the Statement of No Loss, which can be a crucial aspect of the claims process. In this article, we will delve into the world of insurance claims and explore the concept of a Statement of No Loss, its importance, and how it can impact the claims process.

What is a Statement of No Loss?

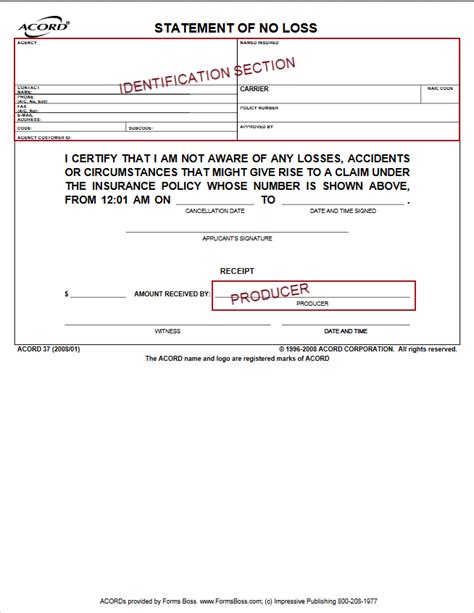

A Statement of No Loss is a declaration made by the policyholder or insured, stating that they have not suffered any loss or damage to their property or assets. This statement is typically made on the ACORD form, which is a standardized document used by insurance companies to gather information about a claim. The Statement of No Loss is usually required when an insured is making a claim for a specific type of loss, such as theft or vandalism.

Why is a Statement of No Loss important?

The Statement of No Loss is a critical component of the claims process because it helps insurance companies verify the validity of a claim. By signing a Statement of No Loss, the insured is attesting that they have not suffered any loss or damage to their property or assets, which can help prevent fraudulent claims. This statement also helps insurance companies to identify potential red flags and investigate claims more efficiently.

How does a Statement of No Loss work?

When an insured makes a claim, they are typically required to complete an ACORD form, which includes a Statement of No Loss. The insured must sign the statement, confirming that they have not suffered any loss or damage to their property or assets. If the insured has indeed suffered a loss, they must provide documentation and evidence to support their claim.

What are the benefits of a Statement of No Loss?

There are several benefits to a Statement of No Loss:

- Prevents fraudulent claims: By requiring a Statement of No Loss, insurance companies can help prevent fraudulent claims from being made.

- Saves time and resources: A Statement of No Loss can help insurance companies identify potential red flags and investigate claims more efficiently, saving time and resources.

- Helps to verify claims: A Statement of No Loss can help insurance companies verify the validity of a claim, ensuring that only legitimate claims are paid out.

What are the consequences of making a false Statement of No Loss?

Making a false Statement of No Loss can have serious consequences, including:

- Policy cancellation: If an insured is found to have made a false Statement of No Loss, their policy may be cancelled.

- Claim denial: If an insured is found to have made a false Statement of No Loss, their claim may be denied.

- Legal action: In some cases, making a false Statement of No Loss can lead to legal action, including fines and penalties.

How to complete a Statement of No Loss

Completing a Statement of No Loss is a straightforward process. Here are the steps to follow:

- Read the statement carefully: Before signing a Statement of No Loss, make sure you read it carefully and understand what you are signing.

- Provide accurate information: Make sure you provide accurate information about your claim and your property or assets.

- Sign the statement: Once you have completed the statement, sign it and date it.

- Return the statement: Return the completed statement to your insurance company, along with any supporting documentation.

Tips for policyholders

Here are some tips for policyholders when completing a Statement of No Loss:

- Be honest: Always be honest when completing a Statement of No Loss. Making a false statement can have serious consequences.

- Provide accurate information: Make sure you provide accurate information about your claim and your property or assets.

- Keep records: Keep records of your claim and any supporting documentation, in case you need to refer to them later.

Common mistakes to avoid

Here are some common mistakes to avoid when completing a Statement of No Loss:

- Inaccurate information: Providing inaccurate information about your claim or property can lead to delays or even claim denial.

- Failure to sign: Failing to sign the statement can lead to delays or even claim denial.

- Failure to return: Failing to return the completed statement can lead to delays or even claim denial.

Conclusion

In conclusion, a Statement of No Loss is an important component of the insurance claims process. By understanding the concept of a Statement of No Loss and how it works, policyholders can ensure that their claims are processed efficiently and accurately. Remember to always be honest and provide accurate information when completing a Statement of No Loss, and avoid common mistakes that can lead to delays or even claim denial.

Call to action

If you have any questions or concerns about completing a Statement of No Loss, contact your insurance company or a licensed insurance professional for guidance. Don't hesitate to reach out if you need help navigating the claims process.

What is a Statement of No Loss?

+A Statement of No Loss is a declaration made by the policyholder or insured, stating that they have not suffered any loss or damage to their property or assets.

Why is a Statement of No Loss important?

+The Statement of No Loss is a critical component of the claims process because it helps insurance companies verify the validity of a claim and prevent fraudulent claims.

What are the consequences of making a false Statement of No Loss?

+Making a false Statement of No Loss can have serious consequences, including policy cancellation, claim denial, and legal action.