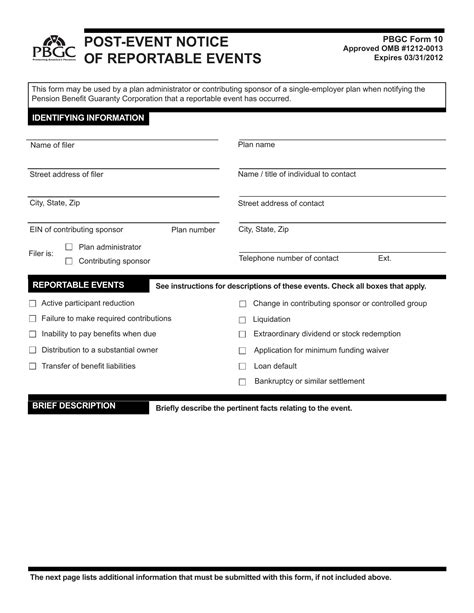

Employers who sponsor pension plans are required to file certain forms with the Pension Benefit Guaranty Corporation (PBGC) to ensure compliance with the Employee Retirement Income Security Act (ERISA). One of the key forms that employers must file is the PBGC Form 10, also known as the "Annual Form for Single-Employer Plans." In this article, we will delve into the details of the PBGC Form 10, including its purpose, requirements, and instructions for completion.

What is the PBGC Form 10?

The PBGC Form 10 is an annual filing requirement for single-employer pension plans. It is designed to provide the PBGC with information about the plan's financial condition, investment holdings, and other relevant details. The form is typically due by the 15th day of the 10th month following the plan year-end.

Why is the PBGC Form 10 important?

The PBGC Form 10 is crucial for employers who sponsor pension plans because it helps the PBGC to:

- Monitor the financial health of pension plans and identify potential risks.

- Ensure compliance with ERISA requirements.

- Calculate the plan's funding status and determine any required contributions.

Failure to file the PBGC Form 10 or providing inaccurate information can result in penalties and fines.

Who needs to file the PBGC Form 10?

Employers who sponsor single-employer pension plans are required to file the PBGC Form 10 annually. This includes:

- Defined benefit plans

- Money purchase plans

- Target benefit plans

- Stock bonus plans

What information is required on the PBGC Form 10?

The PBGC Form 10 requires employers to provide detailed information about the plan, including:

- Plan identification information (e.g., plan name, EIN, plan number)

- Plan year-end date and filing deadline

- Number of participants and beneficiaries

- Plan assets and liabilities

- Investment holdings (e.g., stocks, bonds, real estate)

- Funding status and required contributions

- Actuarial assumptions and methods

- Plan amendments and changes

How to complete the PBGC Form 10

To complete the PBGC Form 10, employers should:

- Review the instructions and requirements carefully.

- Gather all necessary information and documentation.

- Complete the form accurately and thoroughly.

- Attach required supporting schedules and documents.

- File the form electronically through the PBGC's online portal.

Common mistakes to avoid when completing the PBGC Form 10

- Inaccurate or incomplete information

- Failure to attach required supporting schedules and documents

- Incorrect plan year-end date or filing deadline

- Failure to report changes to the plan or investment holdings

- Insufficient or incomplete actuarial assumptions and methods

Consequences of non-compliance

Failure to file the PBGC Form 10 or providing inaccurate information can result in:

- Penalties and fines

- Plan disqualification

- Loss of tax benefits

- Increased scrutiny from the PBGC and IRS

Best practices for PBGC Form 10 compliance

- Establish a process for gathering and reviewing required information.

- Ensure accurate and complete reporting.

- Attach all required supporting schedules and documents.

- File the form electronically through the PBGC's online portal.

- Review and update the form annually to reflect changes to the plan or investment holdings.

Frequently Asked Questions

What is the deadline for filing the PBGC Form 10?

+The PBGC Form 10 is typically due by the 15th day of the 10th month following the plan year-end.

Who is required to file the PBGC Form 10?

+Employers who sponsor single-employer pension plans are required to file the PBGC Form 10 annually.

What information is required on the PBGC Form 10?

+The PBGC Form 10 requires employers to provide detailed information about the plan, including plan identification information, plan year-end date, number of participants and beneficiaries, plan assets and liabilities, investment holdings, funding status, and required contributions.

By understanding the requirements and instructions for completing the PBGC Form 10, employers can ensure compliance with ERISA and avoid potential penalties and fines.