As a Virginia taxpayer, it's essential to understand the various tax forms and their purposes to ensure compliance with state tax laws. One such form is the 760C, also known as the Underpayment of Estimated Tax by Individuals and Fiduciaries. In this article, we'll delve into the details of the 760C tax form, its significance, and how to navigate it.

The 760C tax form is used to calculate and report underpayment of estimated tax by individuals and fiduciaries in Virginia. It's a critical form that helps taxpayers avoid penalties and interest on underpaid taxes. As a Virginia taxpayer, it's crucial to understand when and how to use this form to ensure you're meeting your tax obligations.

Why is the 760C tax form important?

The 760C tax form serves several purposes:

- It helps taxpayers calculate and report underpayment of estimated tax.

- It enables taxpayers to avoid penalties and interest on underpaid taxes.

- It provides a clear picture of a taxpayer's estimated tax liability.

- It facilitates accurate tax planning and compliance.

Who needs to file the 760C tax form?

The following individuals and entities need to file the 760C tax form:

- Individuals who are required to make estimated tax payments.

- Fiduciaries, such as trusts and estates.

- Businesses that are required to make estimated tax payments.

When is the 760C tax form due?

The 760C tax form is due on the same date as the taxpayer's individual income tax return (Form 760). For most taxpayers, this is April 15th of each year.

How to complete the 760C tax form

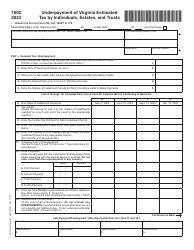

To complete the 760C tax form, follow these steps:

- Gather necessary information: You'll need your previous year's tax return, your current year's estimated tax payments, and any other relevant tax documents.

- Calculate your estimated tax liability: Use the worksheet provided on the 760C form to calculate your estimated tax liability.

- Report underpayment of estimated tax: If you've underpaid your estimated tax, report the underpayment on the 760C form.

- Calculate penalties and interest: If you've underpaid your estimated tax, calculate the penalties and interest due.

Common mistakes to avoid

When completing the 760C tax form, avoid the following common mistakes:

- Incorrect calculation of estimated tax liability: Double-check your calculations to ensure accuracy.

- Failure to report underpayment of estimated tax: Make sure to report any underpayment of estimated tax to avoid penalties and interest.

- Inaccurate calculation of penalties and interest: Use the correct formulas to calculate penalties and interest due.

Best practices for completing the 760C tax form

To ensure accurate completion of the 760C tax form, follow these best practices:

- Use the correct form: Ensure you're using the most recent version of the 760C tax form.

- Gather all necessary information: Collect all relevant tax documents and information before starting the form.

- Double-check calculations: Verify your calculations to ensure accuracy.

- Seek professional help if needed: If you're unsure about any aspect of the form, consider consulting a tax professional.

Conclusion

The 760C tax form is an essential document for Virginia taxpayers who need to report underpayment of estimated tax. By understanding the form's purpose, who needs to file it, and how to complete it accurately, taxpayers can avoid penalties and interest on underpaid taxes. By following best practices and avoiding common mistakes, taxpayers can ensure compliance with Virginia tax laws and maintain a clean tax record.

What is the purpose of the 760C tax form?

+The 760C tax form is used to calculate and report underpayment of estimated tax by individuals and fiduciaries in Virginia.

Who needs to file the 760C tax form?

+Individuals who are required to make estimated tax payments, fiduciaries, and businesses that are required to make estimated tax payments need to file the 760C tax form.

When is the 760C tax form due?

+The 760C tax form is due on the same date as the taxpayer's individual income tax return (Form 760), which is typically April 15th of each year.