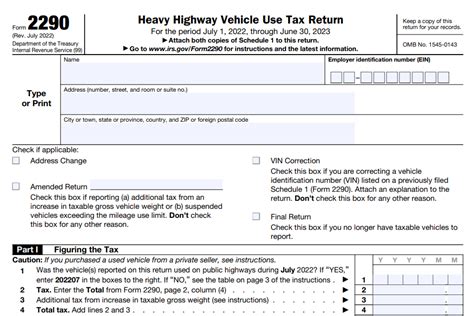

If you've ever had to deal with the complexities of filing Form 2290 for Heavy Vehicle Use Tax (HVUT), you're not alone. The process can be daunting, and errors can occur even with the best of intentions. Fortunately, the IRS provides a way to correct mistakes through Form 2290 amendments. In this article, we'll guide you through the process of filing a Form 2290 amendment for HVUT error corrections, making it easier for you to get back on track.

Why File a Form 2290 Amendment?

Filing a Form 2290 amendment is necessary when you need to correct errors or make changes to your original HVUT return. This can include:

- Correcting mathematical errors or miscalculations

- Changing your vehicle's category or taxable gross weight

- Adding or removing vehicles from your return

- Correcting your Employer Identification Number (EIN) or business name

Failure to file an amendment can result in penalties, fines, and even interest on the amount owed. By filing a Form 2290 amendment, you can avoid these consequences and ensure your HVUT return is accurate and up-to-date.

**Step-by-Step Guide to Filing a Form 2290 Amendment**

Filing a Form 2290 amendment is a relatively straightforward process. Here's a step-by-step guide to help you get started:

- Gather Required Information: Before filing your amendment, make sure you have all the necessary information, including:

- Your original Form 2290 return

- Your EIN and business name

- Vehicle identification numbers (VINs) for all vehicles being amended

- Corrected taxable gross weights or categories for each vehicle

- Choose the Correct Amendment Type: There are two types of amendments:

- Form 2290 Amendment (_correction): Used to correct mathematical errors or miscalculations.

- Form 2290 Amendment (change): Used to make changes to your original return, such as adding or removing vehicles.

- Complete Form 2290: Fill out a new Form 2290, making sure to include all the corrected information. You can download the form from the IRS website or use tax preparation software.

- Explain the Changes: In the "Explanation of Changes" section, provide a clear and concise explanation of the corrections or changes being made.

- Sign and Date the Form: Sign and date the amended return, making sure to include your EIN and business name.

**Electronic Filing vs. Paper Filing**

You can file your Form 2290 amendment electronically or by paper. Electronic filing is generally faster and more convenient, but paper filing may be necessary in certain situations.

- Electronic Filing: Use the IRS's Electronic Federal Tax Payment System (EFTPS) or tax preparation software to file your amendment electronically.

- Paper Filing: Mail your amended return to the IRS address listed in the instructions for Form 2290.

Tips for Avoiding HVUT Errors

While filing a Form 2290 amendment can correct errors, it's always best to avoid mistakes in the first place. Here are some tips to help you avoid common HVUT errors:

- Double-Check Your Math: Make sure to double-check your calculations to avoid mathematical errors.

- Verify Vehicle Information: Ensure all vehicle information, including VINs and taxable gross weights, is accurate and up-to-date.

- Use Tax Preparation Software: Consider using tax preparation software to help you file your HVUT return and avoid errors.

**Conclusion**

Filing a Form 2290 amendment for HVUT error corrections is a relatively straightforward process. By following the steps outlined in this article, you can easily correct mistakes and avoid penalties and fines. Remember to double-check your information, use tax preparation software, and file electronically to make the process even smoother.

Share Your Thoughts

Have you ever had to file a Form 2290 amendment? Share your experiences and tips in the comments below. Don't forget to share this article with others who may benefit from this information.

What is the deadline for filing a Form 2290 amendment?

+The deadline for filing a Form 2290 amendment is the last day of the month following the quarter in which the original return was filed.

Can I file a Form 2290 amendment electronically?

+Yes, you can file a Form 2290 amendment electronically using the IRS's Electronic Federal Tax Payment System (EFTPS) or tax preparation software.

What is the penalty for not filing a Form 2290 amendment?

+The penalty for not filing a Form 2290 amendment can include fines, interest, and even loss of driving privileges.