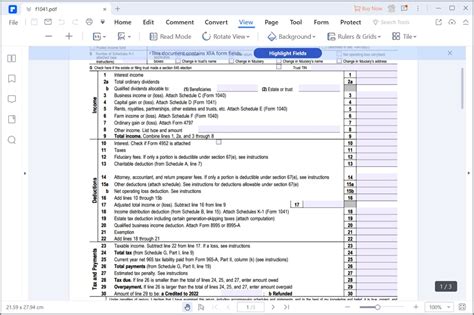

Filing taxes for an estate or trust can be a complex and time-consuming process, especially when dealing with the intricacies of Form 1041. The IRS Form 1041, also known as the U.S. Income Tax Return for Estates and Trusts, is used to report the income, deductions, and credits of an estate or trust. As the tax season approaches, it's essential to be well-prepared to ensure a smooth and hassle-free filing process. Here are five valuable tips to help you navigate the process of filing your 2010 Form 1041.

Tip 1: Understand the Filing Requirements

Before starting the filing process, it's crucial to understand the requirements for filing Form 1041. The IRS requires estates and trusts to file Form 1041 if they have gross income of $600 or more for the tax year. Gross income includes income from various sources, such as interest, dividends, capital gains, and rents. Additionally, even if the estate or trust has no income, a return may still be required if it has any tax withholding or if it's making estimated tax payments.

Types of Estates and Trusts That Must File

- Estates of deceased individuals

- Trusts, including revocable and irrevocable trusts

- Estates of individuals who have been declared incompetent

- Bankruptcy estates

Tip 2: Gather All Necessary Documents

To ensure a smooth filing process, it's essential to gather all necessary documents and information. This includes:

- Form 1099s for interest, dividends, and capital gains

- Form K-1s for partnerships and S corporations

- Schedule K-1s for beneficiaries

- Depreciation records

- Records of charitable donations

- Records of tax payments and estimated tax payments

Benefits of Accurate Record-Keeping

- Reduces the risk of errors and audits

- Ensures accurate reporting of income and deductions

- Helps to identify potential tax savings opportunities

Tip 3: Choose the Correct Filing Status

The filing status of an estate or trust can significantly impact the tax liability. It's essential to choose the correct filing status to ensure accurate reporting and to minimize tax liability.

- Single: Estates and trusts that are not considered married filing jointly

- Married Filing Jointly: Estates and trusts that are considered married filing jointly

- Married Filing Separately: Estates and trusts that are considered married filing separately

Consequences of Incorrect Filing Status

- Inaccurate reporting of income and deductions

- Incorrect tax liability

- Potential for audits and penalties

Tip 4: Take Advantage of Tax Deductions and Credits

Estates and trusts are eligible for various tax deductions and credits that can help minimize tax liability. It's essential to take advantage of these deductions and credits to ensure accurate reporting and to reduce tax liability.

- Deductions for charitable donations

- Deductions for mortgage interest and property taxes

- Credits for tax withheld

- Credits for estimated tax payments

Benefits of Tax Deductions and Credits

- Reduces tax liability

- Increases refund

- Helps to minimize audit risk

Tip 5: Seek Professional Help When Needed

Filing Form 1041 can be a complex and time-consuming process, especially for those who are not familiar with tax laws and regulations. It's essential to seek professional help when needed to ensure accurate reporting and to minimize tax liability.

- Consult with a tax professional or accountant

- Use tax software specifically designed for Form 1041

- Attend tax seminars and workshops

Benefits of Seeking Professional Help

- Ensures accurate reporting and minimizes tax liability

- Helps to identify potential tax savings opportunities

- Reduces the risk of errors and audits

As you prepare to file your 2010 Form 1041, remember to stay organized, take advantage of tax deductions and credits, and seek professional help when needed. By following these valuable tips, you can ensure a smooth and hassle-free filing process.

We encourage you to share your experiences and tips for filing Form 1041 in the comments section below. Your feedback will help others navigate the complex process of filing taxes for estates and trusts.

What is the deadline for filing Form 1041?

+The deadline for filing Form 1041 is typically April 15th of each year. However, if the estate or trust has a fiscal year-end that is not December 31st, the deadline may be different.

Can I file Form 1041 electronically?

+Yes, you can file Form 1041 electronically using the IRS's Modernized e-File (MeF) system. However, you will need to use a tax software specifically designed for Form 1041.

What is the penalty for not filing Form 1041?

+The penalty for not filing Form 1041 can be significant, including fines and interest on any unpaid taxes. It's essential to file Form 1041 on time to avoid any penalties.