Taxes can be a daunting and overwhelming task for many individuals. With numerous forms and regulations to keep track of, it's easy to get lost in the process. One of the most important tax forms for individuals in Spain is the 140 tax form, also known as the "Declaración de la Renta de las Personas Físicas" (Personal Income Tax Return). In this article, we will break down the 140 tax form, its importance, and provide a simplified guide on how to fill it out.

The 140 tax form is a mandatory document for all Spanish residents who earn income from various sources, including employment, self-employment, and investments. The form is used to report the individual's income, deductions, and tax credits to the Spanish tax authorities. Failing to submit the form or providing inaccurate information can result in penalties and fines.

What is the 140 Tax Form Used For?

The 140 tax form is used to report an individual's income from various sources, including:

- Employment income

- Self-employment income

- Investment income (e.g., dividends, interest, and capital gains)

- Rental income

- Income from foreign sources

The form is also used to claim deductions and tax credits, which can reduce the individual's tax liability.

Who Needs to File the 140 Tax Form?

Not everyone needs to file the 140 tax form. The following individuals are required to file the form:

- Spanish residents who earn income from employment or self-employment

- Individuals who earn income from investments, such as dividends, interest, and capital gains

- Individuals who earn rental income

- Individuals who earn income from foreign sources

How to Fill Out the 140 Tax Form

Filling out the 140 tax form can be a complex process, but we will break it down into simple steps.

Step 1: Gather Required Documents

Before filling out the form, you will need to gather the following documents:

- Your NIE (Número de Identificación de Extranjero) or DNI (Documento Nacional de Identidad)

- Your employment contract or self-employment registration

- Your investment statements (e.g., bank statements, dividend statements)

- Your rental income statements

- Your foreign income statements

Step 2: Fill Out the Form

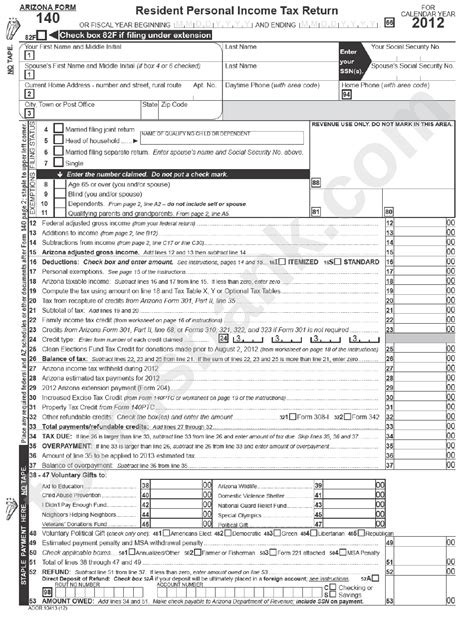

The 140 tax form is divided into several sections. Here is a brief overview of each section:

- Section 1: Personal Details - Fill in your personal details, including your name, address, and NIE or DNI.

- Section 2: Employment Income - Fill in your employment income, including your salary, bonuses, and any other employment-related income.

- Section 3: Self-Employment Income - Fill in your self-employment income, including your business income and expenses.

- Section 4: Investment Income - Fill in your investment income, including dividends, interest, and capital gains.

- Section 5: Rental Income - Fill in your rental income, including any rental income from properties in Spain or abroad.

- Section 6: Foreign Income - Fill in your foreign income, including any income from foreign sources.

- Section 7: Deductions and Tax Credits - Fill in your deductions and tax credits, including any deductions for mortgage interest, charitable donations, or education expenses.

Step 3: Calculate Your Tax Liability

Once you have filled out the form, you will need to calculate your tax liability. You can use the Spanish tax authorities' online calculator or consult a tax professional to help you with this step.

Step 4: Submit the Form

The 140 tax form can be submitted online or in person at a Spanish tax office. The deadline for submitting the form is typically June 30th of each year.

Tips and Reminders

- Make sure to keep accurate records of your income and expenses throughout the year.

- Consult a tax professional if you are unsure about how to fill out the form or calculate your tax liability.

- Take advantage of deductions and tax credits to reduce your tax liability.

- Submit the form on time to avoid penalties and fines.

Conclusion

Filling out the 140 tax form can be a complex process, but by following these simple steps, you can ensure that you are in compliance with Spanish tax regulations. Remember to keep accurate records, consult a tax professional if needed, and take advantage of deductions and tax credits to reduce your tax liability.

We hope this article has provided you with a better understanding of the 140 tax form and how to fill it out. If you have any questions or comments, please feel free to share them below.

Frequently Asked Questions

What is the deadline for submitting the 140 tax form?

+The deadline for submitting the 140 tax form is typically June 30th of each year.

Do I need to file the 140 tax form if I don't have any income?

+No, if you don't have any income, you don't need to file the 140 tax form. However, if you have any tax credits or deductions, you may still need to file the form to claim them.