As a business owner or accountant, mastering the Schedule O Form 5471 is crucial for accurate and compliant reporting of controlled foreign corporations (CFCs). The Form 5471 is a complex and nuanced document, and even small mistakes can lead to significant penalties and fines. In this article, we will explore five essential tips to help you master the Schedule O Form 5471 and ensure compliance with the IRS regulations.

Understanding the Purpose of Schedule O Form 5471

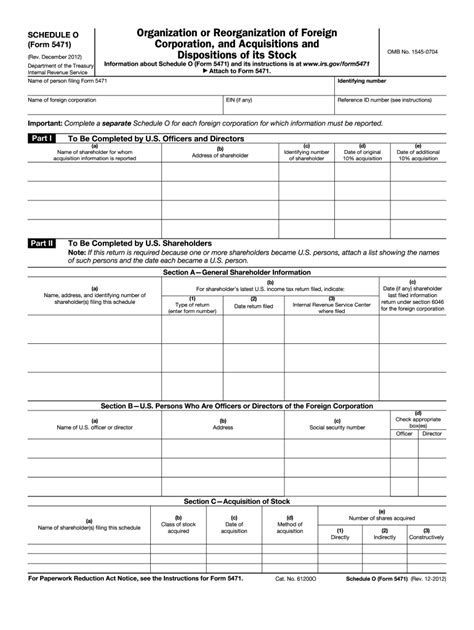

The Form 5471 is an information return used by the IRS to report the activities of CFCs. The Schedule O is a crucial component of the Form 5471, as it provides detailed information about the CFC's organization, ownership, and operations. The Schedule O is used to identify the CFC's ownership structure, including the names and addresses of shareholders, as well as the percentage of ownership held by each shareholder.

Tip 1: Accurately Identify the CFC's Ownership Structure

To complete the Schedule O accurately, you must first identify the CFC's ownership structure. This includes determining the names and addresses of all shareholders, as well as the percentage of ownership held by each shareholder. You must also identify any changes in ownership that occurred during the tax year. To ensure accuracy, it's essential to maintain detailed records of the CFC's ownership structure, including any changes that occur throughout the year.

Understanding the Components of Schedule O Form 5471

The Schedule O consists of several components, including:

- Part I: Identification of Corporation or Entity

- Part II: Shareholders of the Corporation or Entity

- Part III: Statement of Changes in Ownership

- Part IV: Additional Information

Each component requires detailed information, and accuracy is crucial to avoid penalties and fines.

Tip 2: Maintain Accurate Records of Shareholder Information

To complete the Schedule O accurately, you must maintain accurate records of shareholder information. This includes the names and addresses of all shareholders, as well as the percentage of ownership held by each shareholder. You must also keep records of any changes in ownership that occur during the tax year. To ensure accuracy, it's essential to regularly update shareholder information and maintain detailed records of all changes.

Understanding the Reporting Requirements of Schedule O Form 5471

The Schedule O must be filed annually with the IRS, and it's essential to understand the reporting requirements to avoid penalties and fines. The Schedule O must be filed by the due date of the CFC's tax return, and it must be signed by an authorized representative of the CFC.

Tip 3: File the Schedule O on Time to Avoid Penalties

To avoid penalties and fines, it's essential to file the Schedule O on time. The Schedule O must be filed by the due date of the CFC's tax return, and it must be signed by an authorized representative of the CFC. Late filing can result in significant penalties, so it's crucial to maintain accurate records and file the Schedule O on time.

Common Mistakes to Avoid When Completing Schedule O Form 5471

When completing the Schedule O, it's essential to avoid common mistakes that can result in penalties and fines. Some common mistakes include:

- Inaccurate or incomplete shareholder information

- Failure to report changes in ownership

- Late filing or failure to sign the Schedule O

Tip 4: Review the Schedule O Carefully to Avoid Errors

To avoid errors, it's essential to review the Schedule O carefully before filing. Review the Schedule O for accuracy and completeness, and ensure that all required information is included. It's also essential to review the Schedule O for consistency with other tax returns and reports.

Seeking Professional Help When Completing Schedule O Form 5471

Completing the Schedule O can be complex and time-consuming, and it's essential to seek professional help if you're unsure or lack experience. A qualified tax professional can help you navigate the complexities of the Schedule O and ensure compliance with IRS regulations.

Tip 5: Consider Seeking Professional Help to Ensure Compliance

To ensure compliance with IRS regulations, consider seeking professional help when completing the Schedule O. A qualified tax professional can help you navigate the complexities of the Schedule O and ensure that you're meeting all reporting requirements. They can also help you avoid common mistakes and penalties.

In conclusion, mastering the Schedule O Form 5471 requires accuracy, attention to detail, and a deep understanding of IRS regulations. By following these five essential tips, you can ensure compliance with IRS regulations and avoid penalties and fines. Remember to accurately identify the CFC's ownership structure, maintain accurate records of shareholder information, file the Schedule O on time, review the Schedule O carefully, and consider seeking professional help when needed.

What is the purpose of Schedule O Form 5471?

+The Schedule O Form 5471 is used to report the activities of controlled foreign corporations (CFCs) and provide detailed information about the CFC's organization, ownership, and operations.

What is the deadline for filing the Schedule O Form 5471?

+The Schedule O Form 5471 must be filed annually with the IRS by the due date of the CFC's tax return.

What are the consequences of late filing or errors on the Schedule O Form 5471?

+Late filing or errors on the Schedule O Form 5471 can result in significant penalties and fines.