As a resident of Minnesota, understanding the state's tax withholding requirements is crucial to avoid any penalties or fines. The Minnesota Tax Withholding Form is a vital document that employers and employees must complete accurately to ensure correct tax withholding. In this article, we will provide a comprehensive guide on how to file the Minnesota Tax Withholding Form correctly, ensuring you comply with the state's tax laws.

The Importance of Accurate Tax Withholding

Accurate tax withholding is essential to avoid underpayment or overpayment of taxes. If you underpay your taxes, you may face penalties and fines when filing your tax return. On the other hand, overpaying taxes means you will have to wait for a refund, which can be a lengthy process. By completing the Minnesota Tax Withholding Form correctly, you can ensure that the right amount of taxes is withheld from your paycheck, avoiding any potential issues.

Who Needs to File the Minnesota Tax Withholding Form?

The Minnesota Tax Withholding Form is required for all employees who work in Minnesota, including:

- Resident employees who work for Minnesota employers

- Non-resident employees who work for Minnesota employers

- Employees who receive income from Minnesota sources, such as rent, royalties, or investments

Employers must also complete the form for all employees who claim Minnesota withholding allowances.

Understanding the Minnesota Tax Withholding Form

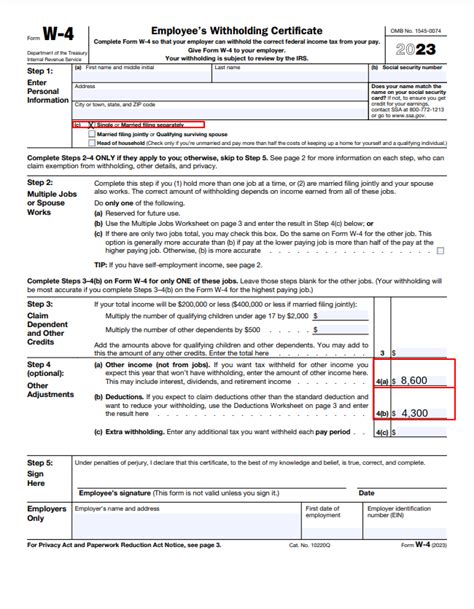

The Minnesota Tax Withholding Form is also known as Form W-4MN. The form is used to determine the correct amount of Minnesota state income tax to withhold from an employee's wages. The form consists of two parts:

- Part 1: Employee's Withholding Allowance Certificate

- Part 2: Employer's Withholding Certificate

Part 1 of the form requires employees to provide personal and financial information, including:

- Name and Social Security number

- Address and phone number

- Number of allowances claimed

- Filing status (single, married, head of household, etc.)

- Number of dependents

Part 2 of the form requires employers to provide information about the employee's wages and withholding, including:

- Employee's name and Social Security number

- Employer's name and address

- Employee's wages and withholding amounts

Completing the Minnesota Tax Withholding Form

To complete the Minnesota Tax Withholding Form correctly, follow these steps:

- Determine Your Filing Status: Choose your filing status from the options provided on the form. This will affect the number of allowances you can claim.

- Claim Allowances: Claim the number of allowances you are eligible for based on your filing status and number of dependents. Each allowance reduces the amount of taxes withheld from your paycheck.

- Provide Employer Information: Provide your employer's name and address, as well as your own name and Social Security number.

- Calculate Withholding Amounts: Calculate the correct withholding amounts based on your wages and allowances claimed.

Minnesota Tax Withholding Allowances

Minnesota tax withholding allowances reduce the amount of taxes withheld from your paycheck. The number of allowances you can claim depends on your filing status and number of dependents. Here are the allowances you can claim:

- Single: 1 allowance

- Married: 2 allowances (1 for each spouse)

- Head of Household: 2 allowances (1 for yourself and 1 for your dependents)

- Qualifying Widow(er): 2 allowances (1 for yourself and 1 for your dependents)

Additional allowances can be claimed for each dependent, including:

- Children under the age of 19

- Children under the age of 24 who are full-time students

- Disabled children

- Elderly dependents

Minnesota Tax Withholding Rates

Minnesota has a progressive tax system, with tax rates ranging from 5.35% to 9.85%. The tax rate you pay depends on your income and filing status. Here are the tax rates for the 2022 tax year:

- 5.35%: $0 - $40,100

- 7.05%: $40,101 - $80,250

- 8.25%: $80,251 - $164,700

- 9.85%: $164,701 and above

Deadlines and Penalties

The deadline for filing the Minnesota Tax Withholding Form is typically January 31st of each year. Employers must file the form with the Minnesota Department of Revenue by this date to avoid penalties.

Failure to file the form or filing incorrect information can result in penalties and fines, including:

- $50 penalty for each employee who is not provided with a completed Form W-4MN

- $100 penalty for each employer who fails to file the form with the Minnesota Department of Revenue

Tips for Accurate Filing

To ensure accurate filing of the Minnesota Tax Withholding Form, follow these tips:

- Review the form carefully before submitting it to your employer

- Use the correct form and version (W-4MN)

- Claim the correct number of allowances based on your filing status and dependents

- Calculate withholding amounts correctly

Conclusion

Filing the Minnesota Tax Withholding Form correctly is essential to avoid any penalties or fines. By understanding the form's requirements and following the tips provided in this article, you can ensure accurate tax withholding and compliance with Minnesota's tax laws. Remember to review the form carefully, claim the correct number of allowances, and calculate withholding amounts correctly. If you have any questions or concerns, consult with your employer or a tax professional.

What is the deadline for filing the Minnesota Tax Withholding Form?

+The deadline for filing the Minnesota Tax Withholding Form is typically January 31st of each year.

How many allowances can I claim on the Minnesota Tax Withholding Form?

+The number of allowances you can claim depends on your filing status and number of dependents. See the article for more information.

What are the penalties for failing to file the Minnesota Tax Withholding Form?

+Failure to file the form or filing incorrect information can result in penalties and fines, including $50 penalty for each employee who is not provided with a completed Form W-4MN and $100 penalty for each employer who fails to file the form with the Minnesota Department of Revenue.