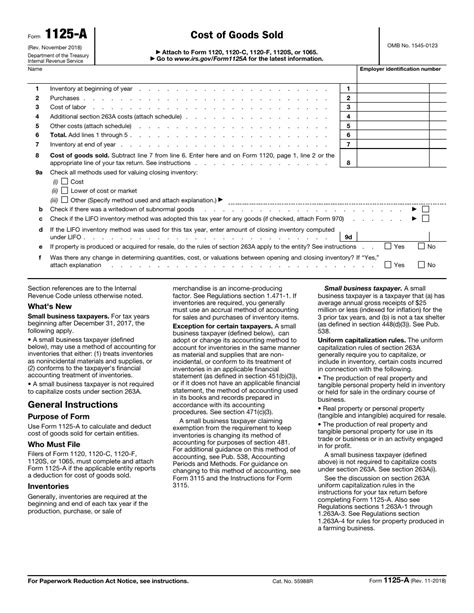

The 1125-A tax form, also known as the Cost of Goods Sold, is a crucial component of a business's tax return. It's used to calculate the cost of producing or purchasing the goods sold by a business, which is then subtracted from the business's total revenue to determine its gross profit. If you're a business owner, understanding how to file the 1125-A tax form correctly is essential to ensure you're taking advantage of all the deductions you're eligible for. In this article, we'll provide you with 5 tips for filing the 1125-A tax form.

Understanding the 1125-A Tax Form

Before we dive into the tips, let's take a brief look at what the 1125-A tax form is and what it's used for. The 1125-A tax form is a supplemental form that's filed in conjunction with a business's tax return (Form 1120 or Form 1065). It's used to calculate the cost of goods sold, which includes the direct costs of producing or purchasing the goods sold by the business. This can include the cost of raw materials, labor, and overhead.

Tip 1: Keep Accurate Records

To file the 1125-A tax form correctly, you'll need to keep accurate records of your business's inventory, purchases, and production costs. This can include records of:

- Beginning and ending inventory levels

- Purchases of raw materials and supplies

- Labor costs, including employee wages and benefits

- Overhead costs, such as rent and utilities

By keeping accurate records, you'll be able to calculate the cost of goods sold correctly and avoid errors on your tax return.

Tip 2: Calculate Cost of Goods Sold Correctly

The cost of goods sold is calculated by adding up the beginning inventory, purchases, and production costs, and then subtracting the ending inventory. Here's a simple example:

- Beginning inventory: $10,000

- Purchases: $50,000

- Production costs: $20,000

- Ending inventory: $15,000

Cost of goods sold: $10,000 + $50,000 + $20,000 - $15,000 = $65,000

By calculating the cost of goods sold correctly, you'll be able to deduct the correct amount on your tax return.

Tip 3: Consider Using the Simplified Method

The IRS offers a simplified method for calculating the cost of goods sold, which can be easier to use than the traditional method. Under the simplified method, you can estimate the cost of goods sold based on the business's gross receipts and cost of goods sold percentage.

To use the simplified method, you'll need to:

- Determine the business's gross receipts

- Determine the cost of goods sold percentage

- Multiply the gross receipts by the cost of goods sold percentage

For example:

- Gross receipts: $100,000

- Cost of goods sold percentage: 60%

Cost of goods sold: $100,000 x 0.60 = $60,000

By using the simplified method, you can avoid the complexity of the traditional method and still get an accurate estimate of the cost of goods sold.

Tip 4: Keep Supporting Documentation

When filing the 1125-A tax form, it's essential to keep supporting documentation to back up the numbers on your tax return. This can include:

- Inventory records

- Purchase invoices

- Production cost records

- Employee payroll records

By keeping supporting documentation, you'll be able to prove the accuracy of your tax return in case of an audit.

Tip 5: Seek Professional Help

Filing the 1125-A tax form can be complex, especially if you're new to business tax returns. To ensure accuracy and avoid errors, it's a good idea to seek professional help from a tax accountant or enrolled agent.

A tax professional can help you:

- Understand the tax laws and regulations

- Keep accurate records and calculate the cost of goods sold correctly

- Prepare and file the 1125-A tax form correctly

- Represent you in case of an audit

By seeking professional help, you can ensure that your tax return is accurate and complete, and avoid any potential penalties or fines.

Final Thoughts

Filing the 1125-A tax form can be a complex task, but by following these 5 tips, you can ensure that you're taking advantage of all the deductions you're eligible for. Remember to keep accurate records, calculate the cost of goods sold correctly, consider using the simplified method, keep supporting documentation, and seek professional help when needed.

By following these tips, you can avoid errors on your tax return and ensure that your business is in compliance with the tax laws and regulations.

What is the purpose of the 1125-A tax form?

+The 1125-A tax form is used to calculate the cost of goods sold, which is then subtracted from the business's total revenue to determine its gross profit.

What records do I need to keep to file the 1125-A tax form?

+You'll need to keep accurate records of your business's inventory, purchases, and production costs, including beginning and ending inventory levels, purchase invoices, and production cost records.

Can I use the simplified method to calculate the cost of goods sold?

+Yes, the IRS offers a simplified method for calculating the cost of goods sold, which can be easier to use than the traditional method. Under the simplified method, you can estimate the cost of goods sold based on the business's gross receipts and cost of goods sold percentage.