The USDA 3555-21 form is a crucial document for individuals seeking to purchase, build, or improve a dwelling in a rural area with a USDA loan. The United States Department of Agriculture (USDA) offers this loan program to promote rural development and provide affordable housing options for low-to-moderate-income borrowers. To navigate the application process successfully, it is essential to understand the requirements and properly complete the USDA 3555-21 form.

Understanding the USDA 3555-21 Form

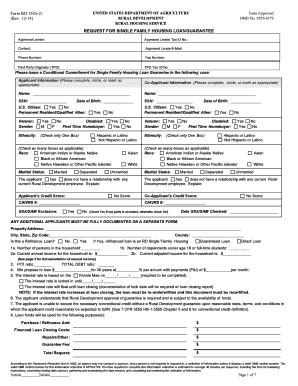

The USDA 3555-21 form, also known as the "Request for Single Family Housing Loan Guarantee," is the primary application document for the USDA's Rural Development Single Family Housing Guaranteed Loan Program. This program aims to provide affordable housing options for borrowers who wish to purchase, build, or improve a dwelling in a rural area.

Step 1: Determine Eligibility

Before completing the USDA 3555-21 form, it is crucial to determine your eligibility for the loan program. To qualify, you must meet the USDA's income and credit requirements, as well as the property's location and type. The property must be located in a rural area, as defined by the USDA, and be used as your primary residence.

To check your eligibility, you can use the USDA's Income and Property Eligibility Site. This tool allows you to enter your income, household size, and property location to determine if you meet the program's requirements.

Step 2: Gather Required Documents

To complete the USDA 3555-21 form, you will need to gather various documents, including:

- Identification: driver's license, state ID, or passport

- Income verification: pay stubs, W-2 forms, and tax returns

- Credit reports: from all three major credit reporting agencies (Equifax, Experian, and TransUnion)

- Property information: address, property type, and purchase price (if applicable)

- Bank statements: to verify assets and income

Step 3: Complete the USDA 3555-21 Form

Once you have gathered the required documents, you can begin completing the USDA 3555-21 form. The form consists of several sections, including:

- Section 1: Borrower Information

- Section 2: Property Information

- Section 3: Loan Information

- Section 4: Income and Employment

- Section 5: Assets and Credit

Make sure to carefully review each section and provide accurate and complete information. Incomplete or inaccurate applications may be delayed or denied.

Step 4: Submit the Application

After completing the USDA 3555-21 form, submit it to your lender or the USDA's Rural Development office. Be sure to include all required documents and attachments.

Your lender will review your application and order an appraisal, if necessary. The USDA will then review your application and issue a loan guarantee, if approved.

Step 5: Close the Loan

Once your application is approved, you can close the loan and finalize the purchase of your home. This typically involves signing the loan documents and transferring the ownership of the property.

In conclusion, completing the USDA 3555-21 form requires careful attention to detail and a thorough understanding of the program's requirements. By following these 5 steps, you can successfully navigate the application process and secure a USDA loan for your rural home.

What is the USDA 3555-21 form?

+The USDA 3555-21 form is the primary application document for the USDA's Rural Development Single Family Housing Guaranteed Loan Program.

What are the eligibility requirements for the USDA loan program?

+To be eligible, you must meet the USDA's income and credit requirements, as well as the property's location and type requirements.

How do I submit the USDA 3555-21 form?

+Submit the completed form to your lender or the USDA's Rural Development office, along with all required documents and attachments.