As the tax season approaches, many Maryland residents are likely to receive a 1099-G form in the mail. But what is this form, and how do you handle it? In this article, we will delve into the details of the 1099-G form and provide you with 5 ways to handle it in Maryland.

What is a 1099-G Form?

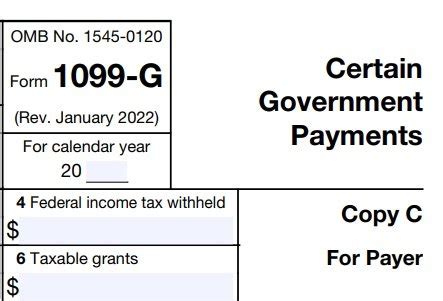

A 1099-G form is a tax document used to report certain types of income, such as unemployment benefits, state and local income tax refunds, and taxable grants. In Maryland, the 1099-G form is used to report unemployment benefits paid to individuals who received them during the tax year. The form is typically mailed to recipients by January 31st of each year.

Why is the 1099-G Form Important?

The 1099-G form is important because it reports income that is subject to federal and state income tax. Recipients of the form must report the income on their tax return and pay taxes on it. Failure to report this income can result in penalties and interest.

Benefits of the 1099-G Form

The 1099-G form provides several benefits to recipients, including:

- Accurate reporting of income for tax purposes

- Easy tracking of unemployment benefits received

- Convenient way to report income to the IRS and state tax authorities

5 Ways to Handle a 1099-G Form in Maryland

Here are 5 ways to handle a 1099-G form in Maryland:

1. Review the Form for Accuracy

When you receive your 1099-G form, review it carefully to ensure that the information is accurate. Check the amount of unemployment benefits reported and the tax year to which it applies. If you find any errors, contact the Maryland Department of Labor, Licensing and Regulation (DLLR) to report the issue.

2. Report the Income on Your Tax Return

You must report the income from the 1099-G form on your federal and state tax returns. Use the information from the form to complete your tax return, and make sure to report the income in the correct tax year.

3. Keep a Copy of the Form for Your Records

It's essential to keep a copy of the 1099-G form for your records. You may need to refer to it when completing your tax return or if you are audited by the IRS or state tax authorities.

4. Contact the Maryland DLLR if You Have Questions

If you have questions about the 1099-G form or need help understanding the information reported, contact the Maryland DLLR. They can provide guidance on how to handle the form and answer any questions you may have.

5. Seek Professional Help if Needed

If you are unsure about how to handle your 1099-G form or need help with your tax return, consider seeking professional help from a tax preparer or accountant. They can provide guidance on how to report the income and ensure that you are in compliance with federal and state tax laws.

Common Mistakes to Avoid

When handling a 1099-G form in Maryland, there are several common mistakes to avoid, including:

- Failing to report the income on your tax return

- Reporting the income in the wrong tax year

- Failing to keep a copy of the form for your records

Conclusion

Handling a 1099-G form in Maryland requires attention to detail and an understanding of the tax laws that apply. By following the 5 ways outlined in this article, you can ensure that you are in compliance with federal and state tax laws and avoid any potential penalties or interest.

What is a 1099-G form?

+A 1099-G form is a tax document used to report certain types of income, such as unemployment benefits, state and local income tax refunds, and taxable grants.

Why is the 1099-G form important?

+The 1099-G form is important because it reports income that is subject to federal and state income tax. Recipients of the form must report the income on their tax return and pay taxes on it.

What should I do if I have questions about my 1099-G form?

+If you have questions about your 1099-G form, contact the Maryland Department of Labor, Licensing and Regulation (DLLR) for guidance.