Illinois is one of the most populous states in the United States, with a diverse economy that ranges from manufacturing to finance. If you're a business owner or an individual with tax obligations in Illinois, you're likely familiar with the various tax forms and requirements. One such form is the RUT-50, which is used for vehicle registration and title fees. In this comprehensive guide, we'll walk you through the process of filing the Illinois Tax Form RUT-50, providing you with essential information and step-by-step instructions.

Understanding the RUT-50 Form

The RUT-50 form is used to report and pay vehicle registration and title fees in Illinois. It's a critical document for vehicle owners, dealerships, and leasing companies, as it helps the state track and collect taxes on vehicle transactions. The form requires filers to provide detailed information about the vehicle, including its make, model, year, and Vehicle Identification Number (VIN).

Who Needs to File the RUT-50 Form?

Not everyone needs to file the RUT-50 form. It's primarily required for individuals and businesses that engage in vehicle transactions, such as:

- Vehicle dealerships

- Leasing companies

- Private party sales

- Vehicle rentals

If you're unsure whether you need to file the RUT-50 form, consult with the Illinois Department of Revenue or a qualified tax professional.

Step-by-Step Filing Guide

Filing the RUT-50 form can be a complex process, but breaking it down into smaller steps can make it more manageable. Here's a step-by-step guide to help you file the form correctly:

Step 1: Gather Required Documents

Before you start filing the RUT-50 form, make sure you have the necessary documents and information:

- Vehicle title or registration

- VIN (Vehicle Identification Number)

- Vehicle make, model, and year

- Purchase price or lease agreement

- Sales tax exemption certificate (if applicable)

Step 2: Determine Your Filing Frequency

The Illinois Department of Revenue requires RUT-50 filers to submit their forms on a monthly or quarterly basis, depending on their filing frequency. If you're unsure about your filing frequency, consult with the department or a tax professional.

Step 3: Complete the RUT-50 Form

The RUT-50 form is a multi-page document that requires you to provide detailed information about the vehicle and the transaction. Make sure you complete all required fields, including:

- Vehicle information (VIN, make, model, year)

- Transaction information (purchase price, lease agreement, sales tax exemption)

- Filer information (name, address, tax ID number)

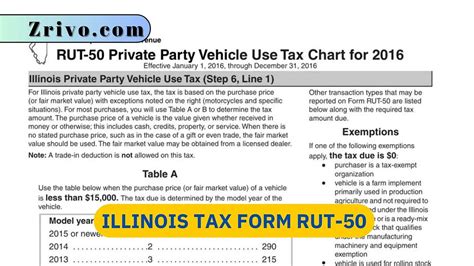

Step 4: Calculate Your Tax Liability

Once you've completed the RUT-50 form, calculate your tax liability using the Illinois Department of Revenue's tax tables or a tax calculator. Make sure you account for any applicable sales tax exemptions or credits.

Step 5: Submit Your Form and Payment

Submit your completed RUT-50 form and payment to the Illinois Department of Revenue by the designated filing deadline. You can file online, by mail, or in person.

Common Mistakes to Avoid

When filing the RUT-50 form, it's essential to avoid common mistakes that can lead to delays, penalties, or even audits. Here are some mistakes to watch out for:

- Incomplete or inaccurate information

- Incorrect tax calculations

- Missed filing deadlines

- Failure to report all vehicle transactions

Penalties for Non-Compliance

Failure to comply with Illinois tax laws and regulations can result in penalties, fines, and even audits. Make sure you understand the consequences of non-compliance and take steps to avoid them.

Conclusion

Filing the Illinois Tax Form RUT-50 requires attention to detail, accuracy, and compliance with state tax laws and regulations. By following this comprehensive guide, you can ensure that you file your form correctly and avoid common mistakes. Remember to stay up-to-date with Illinois tax laws and regulations, and consult with a qualified tax professional if you're unsure about any aspect of the filing process.

What is the RUT-50 form used for?

+The RUT-50 form is used to report and pay vehicle registration and title fees in Illinois.

Who needs to file the RUT-50 form?

+Individuals and businesses that engage in vehicle transactions, such as vehicle dealerships, leasing companies, private party sales, and vehicle rentals.

How often do I need to file the RUT-50 form?

+The Illinois Department of Revenue requires RUT-50 filers to submit their forms on a monthly or quarterly basis, depending on their filing frequency.