Filling out the SEC Form 1 correctly is a crucial step for companies seeking to register with the Securities and Exchange Commission (SEC). The SEC Form 1, also known as the Form 1-A, is a complex document that requires careful attention to detail to ensure accuracy and completeness. In this article, we will provide a comprehensive guide on how to fill out the SEC Form 1 correctly, highlighting the key sections and requirements.

Understanding the SEC Form 1

The SEC Form 1 is a registration statement used by companies to register their securities with the SEC. The form is required for companies that want to offer and sell securities to the public, and it provides investors with important information about the company, its financial condition, and the securities being offered.

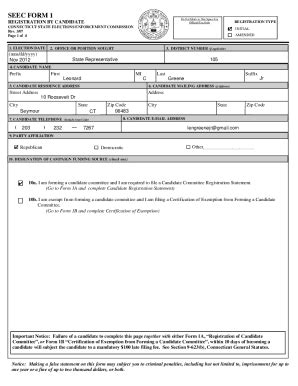

Section 1: Cover Page and Table of Contents

The cover page and table of contents are the first sections of the SEC Form 1. The cover page should include the company's name, address, and contact information, as well as the title and number of the form. The table of contents should provide a detailed outline of the form's contents, including the page numbers where each section can be found.

Key Requirements:

- The company's name and address should match the information on file with the SEC.

- The cover page should include the correct form title and number.

- The table of contents should be accurate and complete.

Section 2: Summary

The summary section provides an overview of the company, its business, and the securities being offered. This section should include a brief description of the company's products or services, its target market, and the use of proceeds from the offering.

Key Requirements:

- The summary should be concise and accurate.

- The company should provide a clear description of its business and products or services.

- The use of proceeds should be clearly stated.

Section 3: Risk Factors

The risk factors section identifies the potential risks and uncertainties associated with the company and the securities being offered. This section should include a discussion of the company's financial condition, market risks, and regulatory risks.

Key Requirements:

- The company should identify all material risks and uncertainties.

- The discussion of risk factors should be detailed and accurate.

- The company should provide a clear explanation of the potential impact of each risk factor.

Section 4: Business

The business section provides a detailed description of the company's business, including its products or services, target market, and competitive landscape.

Key Requirements:

- The company should provide a clear and detailed description of its business.

- The discussion of products or services should include information about pricing, distribution, and sales.

- The company should provide information about its target market, including demographics and market trends.

Section 5: Management's Discussion and Analysis

The management's discussion and analysis (MD&A) section provides an analysis of the company's financial condition and results of operations.

Key Requirements:

- The MD&A should provide a clear and detailed analysis of the company's financial condition and results of operations.

- The discussion should include information about the company's liquidity, capital resources, and results of operations.

- The company should provide a clear explanation of any material trends or uncertainties.

In conclusion, filling out the SEC Form 1 correctly requires careful attention to detail and a thorough understanding of the company's business and financial condition. By following the key requirements outlined in this article, companies can ensure that their registration statement is accurate and complete, and that they are providing investors with the information they need to make informed investment decisions.

We encourage you to comment below and share your experiences with filling out the SEC Form 1. Have you encountered any challenges or difficulties? What tips or advice do you have for others who are seeking to register with the SEC?

What is the purpose of the SEC Form 1?

+The SEC Form 1 is a registration statement used by companies to register their securities with the Securities and Exchange Commission (SEC).

What are the key sections of the SEC Form 1?

+The key sections of the SEC Form 1 include the cover page and table of contents, summary, risk factors, business, and management's discussion and analysis.

What are the consequences of not filling out the SEC Form 1 correctly?

+If a company does not fill out the SEC Form 1 correctly, it may face delays or rejection of its registration statement, as well as potential fines or penalties.