As a student or parent, navigating the world of higher education can be overwhelming, especially when it comes to financial aid and taxes. At Penn State, one document that can be particularly confusing is the 1098-T form. In this article, we will break down the 1098-T form and provide you with 5 key facts to help you understand its purpose, benefits, and requirements.

What is the 1098-T Form?

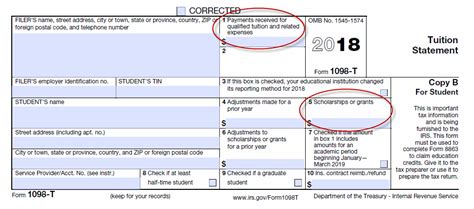

The 1098-T form, also known as the Tuition Statement, is a document provided by Penn State to students and the Internal Revenue Service (IRS) that reports tuition payments and financial aid received during the tax year. The form is used to help students and their families claim education-related tax credits and deductions on their tax returns.

Who Receives the 1098-T Form?

Penn State is required by the IRS to provide the 1098-T form to students who have paid qualified tuition and related expenses during the tax year. This includes:

- Students who have enrolled in courses at Penn State during the tax year

- Students who have paid tuition and fees during the tax year

- Students who have received financial aid, such as scholarships, grants, and loans, during the tax year

5 Key Facts About the 1098-T Form at Penn State

- Reporting Requirements: Penn State is required to report the following information on the 1098-T form:

- Student's name, address, and taxpayer identification number (TIN)

- Amounts paid for qualified tuition and related expenses

- Amounts of scholarships, grants, and other forms of financial aid

- Qualified Tuition and Related Expenses: The 1098-T form reports payments made for qualified tuition and related expenses, which include:

- Tuition and fees

- Course materials and equipment

- Room and board (only if the student is enrolled at least half-time)

- Box 1 vs. Box 2: The 1098-T form has two boxes that report tuition payments: Box 1 and Box 2. Box 1 reports the amount of payments received for qualified tuition and related expenses, while Box 2 reports the amount of tuition and fees billed during the tax year.

- Impact on Tax Credits and Deductions: The information reported on the 1098-T form can impact a student's eligibility for education-related tax credits and deductions, such as the American Opportunity Tax Credit and the Lifetime Learning Credit.

- Availability and Accessibility: Penn State provides the 1098-T form to students electronically through the Student Information System (SIS) or by mail. Students can access their 1098-T form online or request a paper copy from the Penn State Bursar's Office.

How to Use the 1098-T Form

To use the 1098-T form, students and their families should follow these steps:

- Review the Form: Carefully review the 1098-T form for accuracy and completeness.

- Claim Tax Credits and Deductions: Use the information reported on the 1098-T form to claim education-related tax credits and deductions on your tax return.

- Consult a Tax Professional: If you are unsure about how to use the 1098-T form or have questions about your tax return, consult a tax professional.

Additional Resources

For more information about the 1098-T form and its impact on tax credits and deductions, students and their families can consult the following resources:

- Penn State Bursar's Office

- IRS Website (irs.gov)

- Tax professionals and financial advisors

We hope this article has provided you with a better understanding of the 1098-T form and its importance for students and families at Penn State. If you have any questions or concerns, please don't hesitate to reach out to the Penn State Bursar's Office or a tax professional.

What is the 1098-T form?

+The 1098-T form, also known as the Tuition Statement, is a document provided by Penn State to students and the Internal Revenue Service (IRS) that reports tuition payments and financial aid received during the tax year.

Who receives the 1098-T form?

+Penn State provides the 1098-T form to students who have paid qualified tuition and related expenses during the tax year.

What information is reported on the 1098-T form?

+The 1098-T form reports the student's name, address, and taxpayer identification number (TIN), as well as the amounts paid for qualified tuition and related expenses and the amounts of scholarships, grants, and other forms of financial aid.