The 4506-C form is a crucial document used by the Internal Revenue Service (IRS) to verify an individual's or business's income and employment status. It is a request for transcript of tax return, which provides detailed information about a taxpayer's tax return, including their income, deductions, and credits. In this article, we will delve into the details of the 4506-C form, its purpose, and its significance in various financial transactions.

What is the Purpose of the 4506-C Form?

The 4506-C form is used to verify an individual's or business's income and employment status. The form is typically used by lenders, such as mortgage companies and banks, to verify a borrower's income before approving a loan. It is also used by government agencies, such as the Department of Housing and Urban Development (HUD), to verify an individual's income for housing assistance programs.

How Does the 4506-C Form Work?

To obtain a 4506-C form, an individual or business must submit a request to the IRS. The request can be made online, by phone, or by mail. The IRS will then provide a transcript of the taxpayer's tax return, which includes detailed information about their income, deductions, and credits.

The 4506-C form typically includes the following information:

- Taxpayer's name and social security number

- Taxpayer's address

- Tax return information, including income, deductions, and credits

- Employment status and income verification

Benefits of Using the 4506-C Form

The 4506-C form provides several benefits, including:

- Income Verification: The 4506-C form provides lenders and government agencies with accurate and reliable information about an individual's or business's income.

- Employment Verification: The form verifies an individual's employment status, which is essential for loan approvals and housing assistance programs.

- Reduced Risk: The 4506-C form reduces the risk of lending and provides a higher level of assurance for lenders and government agencies.

Common Uses of the 4506-C Form

The 4506-C form is commonly used in various financial transactions, including:

- Mortgage Applications: Lenders use the 4506-C form to verify a borrower's income before approving a mortgage.

- Loan Applications: The form is used to verify an individual's or business's income and employment status for loan approvals.

- Housing Assistance Programs: Government agencies use the 4506-C form to verify an individual's income for housing assistance programs.

How to Obtain a 4506-C Form

To obtain a 4506-C form, an individual or business must submit a request to the IRS. The request can be made online, by phone, or by mail. The IRS will then provide a transcript of the taxpayer's tax return, which includes detailed information about their income, deductions, and credits.

**4506-C Form vs. 4506-T Form**

The 4506-C form and 4506-T form are both used to verify an individual's or business's income and employment status. However, there are some key differences between the two forms.

- Purpose: The 4506-C form is used to verify an individual's or business's income and employment status, while the 4506-T form is used to verify an individual's or business's income and employment status for a specific tax year.

- Information Provided: The 4506-C form provides detailed information about an individual's or business's income, deductions, and credits, while the 4506-T form provides a transcript of the taxpayer's tax return for a specific tax year.

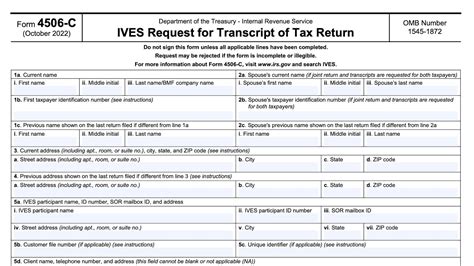

**How to Fill Out the 4506-C Form**

To fill out the 4506-C form, an individual or business must provide the following information:

- Taxpayer's Name and Social Security Number: The taxpayer's name and social security number must be provided on the form.

- Taxpayer's Address: The taxpayer's address must be provided on the form.

- Tax Return Information: The taxpayer's tax return information, including income, deductions, and credits, must be provided on the form.

- Employment Status and Income Verification: The taxpayer's employment status and income verification must be provided on the form.

**FAQs**

Q: What is the purpose of the 4506-C form? A: The 4506-C form is used to verify an individual's or business's income and employment status.

Q: How do I obtain a 4506-C form? A: To obtain a 4506-C form, an individual or business must submit a request to the IRS. The request can be made online, by phone, or by mail.

Q: What information is provided on the 4506-C form? A: The 4506-C form provides detailed information about an individual's or business's income, deductions, and credits.

Q: How long does it take to receive a 4506-C form? A: The processing time for a 4506-C form varies depending on the method of submission. Online requests are typically processed within 24 hours, while mail requests may take several weeks.

**Conclusion**

The 4506-C form is a crucial document used to verify an individual's or business's income and employment status. It provides lenders and government agencies with accurate and reliable information about an individual's or business's income, which is essential for loan approvals and housing assistance programs. By understanding the purpose and significance of the 4506-C form, individuals and businesses can ensure that their financial transactions are processed smoothly and efficiently.

What is the purpose of the 4506-C form?

+The 4506-C form is used to verify an individual's or business's income and employment status.

How do I obtain a 4506-C form?

+To obtain a 4506-C form, an individual or business must submit a request to the IRS. The request can be made online, by phone, or by mail.

What information is provided on the 4506-C form?

+The 4506-C form provides detailed information about an individual's or business's income, deductions, and credits.