As an employer or business owner in Oklahoma, understanding the workers' compensation exemption form is crucial to ensure compliance with state regulations. Workers' compensation insurance is designed to provide financial assistance to employees who suffer work-related injuries or illnesses. However, some businesses may be exempt from carrying this type of insurance. In this article, we will delve into the details of the Oklahoma workers comp exemption form, its requirements, and the benefits of exemption.

What is the Oklahoma Workers Comp Exemption Form?

The Oklahoma workers comp exemption form, also known as Form 3, is a document that allows certain businesses to opt out of carrying workers' compensation insurance. This form is filed with the Oklahoma Workers' Compensation Commission (OWCC) and is typically required for businesses that meet specific exemption criteria.

Who is Eligible for Exemption?

Not all businesses in Oklahoma are eligible for exemption from workers' compensation insurance. To qualify for exemption, a business must meet one of the following criteria:

- The business has five or fewer employees, including the owner.

- The business is a sole proprietorship or a partnership with no employees.

- The business is a limited liability company (LLC) with no employees.

- The business is a corporation with no employees.

Additionally, certain types of businesses may be exempt from carrying workers' compensation insurance, such as:

- Agricultural employers with three or fewer employees.

- Domestic employers with three or fewer employees.

- Employers of casual laborers.

Benefits of Exemption

While carrying workers' compensation insurance is essential for most businesses, exemption can provide several benefits, including:

- Reduced insurance premiums.

- Increased flexibility in managing employee benefits.

- Simplified administrative processes.

However, it's essential to note that exemption from workers' compensation insurance may not be suitable for all businesses. If an exempt business has an employee who suffers a work-related injury, the employer may be held liable for the employee's medical expenses and lost wages.

Requirements for Filing the Exemption Form

To file the Oklahoma workers comp exemption form, businesses must meet the eligibility criteria mentioned earlier. The form must be completed and signed by the business owner or authorized representative. The following information is typically required:

- Business name and address.

- Type of business.

- Number of employees.

- Business owner's name and contact information.

Filing the Exemption Form

The Oklahoma workers comp exemption form can be filed with the OWCC online or by mail. The form must be accompanied by the required documentation, such as:

- Proof of business ownership.

- Proof of employee status (if applicable).

- Proof of business type (if applicable).

Consequences of Non-Compliance

Failure to file the exemption form or comply with workers' compensation regulations can result in penalties, fines, and even lawsuits. Businesses that fail to carry workers' compensation insurance or obtain exemption may be subject to:

- Fines of up to $1,000 per day.

- Penalties of up to $10,000.

- Lawsuits from injured employees.

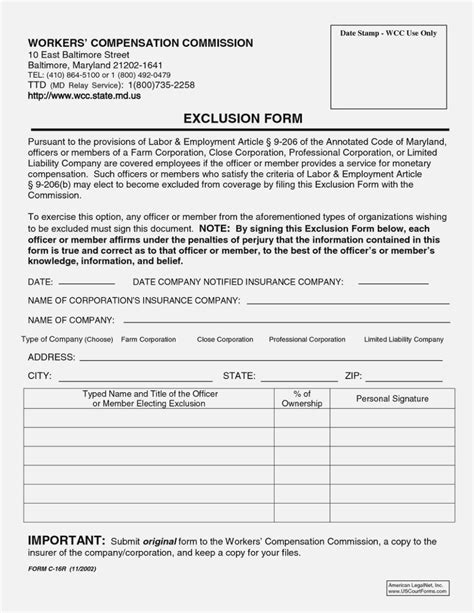

Images

Steps to File the Exemption Form

Filing the Oklahoma workers comp exemption form involves several steps:

Step 1: Determine Eligibility

Determine if your business meets the eligibility criteria for exemption. Review the requirements mentioned earlier and ensure your business qualifies.

Step 2: Gather Required Documentation

Gather the required documentation, such as proof of business ownership, proof of employee status (if applicable), and proof of business type (if applicable).

Step 3: Complete the Exemption Form

Complete the Oklahoma workers comp exemption form, providing all required information. Ensure the form is signed by the business owner or authorized representative.

Step 4: File the Exemption Form

File the exemption form with the OWCC online or by mail. Ensure the form is accompanied by the required documentation.

Common Mistakes to Avoid

When filing the Oklahoma workers comp exemption form, avoid the following common mistakes:

- Failure to meet eligibility criteria.

- Incomplete or inaccurate information.

- Failure to provide required documentation.

Images

Conclusion

In conclusion, the Oklahoma workers comp exemption form is a crucial document for businesses that meet specific exemption criteria. By understanding the requirements, benefits, and consequences of non-compliance, businesses can ensure compliance with state regulations and avoid costly penalties. Remember to file the exemption form accurately and provide all required documentation to avoid common mistakes.

FAQ Section

Who is eligible for exemption from workers' compensation insurance in Oklahoma?

+B businesses with five or fewer employees, sole proprietorships, partnerships with no employees, LLCs with no employees, and corporations with no employees may be eligible for exemption.

What is the penalty for non-compliance with workers' compensation regulations in Oklahoma?

+Failure to comply with workers' compensation regulations can result in fines of up to $1,000 per day, penalties of up to $10,000, and lawsuits from injured employees.

How do I file the Oklahoma workers comp exemption form?

+The exemption form can be filed online or by mail with the OWCC. Ensure the form is accompanied by the required documentation.