The tax season is upon us, and businesses are gearing up to file their tax returns. For corporations, the Form 1120 is a crucial document that must be submitted to the Internal Revenue Service (IRS) on time. However, preparing and filing this form can be a daunting task, especially for small businesses or those without extensive accounting experience. In this article, we will explore five ways to e-file Form 1120 easily, making the tax filing process less stressful and more efficient.

Understanding Form 1120

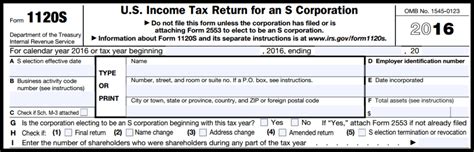

Before we dive into the ways to e-file Form 1120, let's take a brief look at what this form is all about. Form 1120, also known as the U.S. Corporation Income Tax Return, is the tax return form used by corporations to report their income, gains, losses, deductions, and credits. The form requires businesses to provide detailed financial information, including income statements, balance sheets, and supporting schedules.

Benefits of E-Filing Form 1120

E-filing Form 1120 offers several benefits over traditional paper filing. Some of the advantages include:

- Faster processing times: E-filed returns are typically processed within 24-48 hours, compared to 6-8 weeks for paper returns.

- Reduced errors: E-filing software checks for errors and inaccuracies, reducing the risk of rejection or delayed processing.

- Increased security: E-filed returns are transmitted securely to the IRS, reducing the risk of identity theft or lost documents.

- Environmentally friendly: E-filing eliminates the need for paper and reduces waste.

5 Ways to E-File Form 1120 Easily

1. IRS Free File

The IRS offers a free e-filing option for businesses with annual revenues of $60,000 or less. This program, called IRS Free File, allows eligible businesses to prepare and e-file their tax returns for free. However, this option is only available through the IRS website and requires businesses to meet specific eligibility criteria.

2. Tax Preparation Software

Tax preparation software, such as TurboTax or H&R Block, can help businesses e-file Form 1120 easily. These programs guide users through the tax preparation process, checking for errors and inaccuracies along the way. They also offer e-filing options, making it easy to transmit the return to the IRS.

3. Accounting Software

Accounting software, such as QuickBooks or Xero, can also help businesses e-file Form 1120. These programs allow users to prepare and manage their financial statements, making it easier to complete the tax return. Many accounting software programs also offer e-filing options, integrating with the IRS system to transmit the return.

4. Tax Professionals

Tax professionals, such as certified public accountants (CPAs) or enrolled agents (EAs), can also help businesses e-file Form 1120. These professionals have extensive knowledge of tax laws and regulations, ensuring that the return is accurate and complete. They can also e-file the return on behalf of the business, making the process even easier.

5. Online Tax Filing Services

Online tax filing services, such as TaxAct or Credit Karma Tax, offer a convenient and affordable way to e-file Form 1120. These services guide users through the tax preparation process, offering support and guidance along the way. They also offer e-filing options, making it easy to transmit the return to the IRS.

Additional Tips for E-Filing Form 1120

To ensure a smooth e-filing experience, here are some additional tips to keep in mind:

- Gather all necessary documents and information before starting the e-filing process.

- Use e-filing software or services that are approved by the IRS.

- Double-check the return for errors and inaccuracies before transmitting it to the IRS.

- Keep a copy of the e-filed return for your records.

- Be aware of the IRS e-file deadline, which is typically March 15th for corporations.

Stay Ahead of the Tax Filing Game

E-filing Form 1120 can be a daunting task, but with the right tools and resources, it can be a breeze. By following the tips and options outlined in this article, businesses can ensure a smooth and efficient tax filing experience. Don't wait until the last minute – start preparing your tax return today and stay ahead of the game.

Now that you've read our article, share your thoughts and experiences with e-filing Form 1120 in the comments below. Have you used any of the methods outlined in this article? Do you have any tips or advice to share with others?

What is the deadline for e-filing Form 1120?

+The deadline for e-filing Form 1120 is typically March 15th for corporations.

Can I e-file Form 1120 for free?

+Yes, the IRS offers a free e-filing option for businesses with annual revenues of $60,000 or less.

What is the benefit of e-filing Form 1120?

+E-filing Form 1120 offers several benefits, including faster processing times, reduced errors, increased security, and environmental friendliness.