As an employer in the state of Wisconsin, it's essential to understand the various tax forms and requirements that apply to your business. One of the most critical forms is the Wisconsin Form WT-6, also known as the Wisconsin Withholding Tax Deposit Coupon. In this article, we'll delve into the details of the WT-6 form, including its purpose, how to complete it, and the consequences of non-compliance.

What is the Wisconsin Form WT-6?

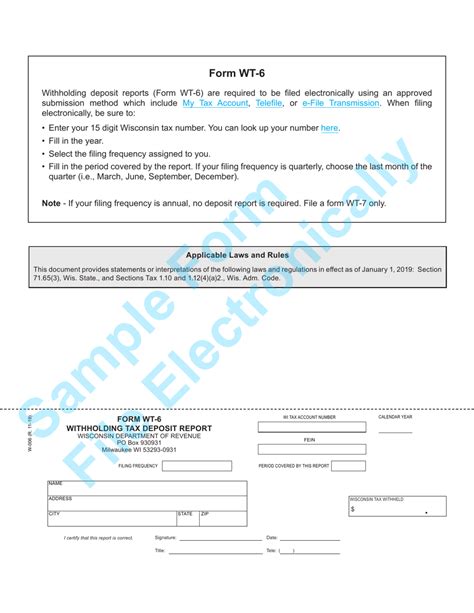

The Wisconsin Form WT-6 is a tax form used by employers to report and remit Wisconsin state income tax withholding to the Wisconsin Department of Revenue. The form is used to deposit withholding taxes, and it's typically filed quarterly. Employers who are required to withhold Wisconsin state income tax must file the WT-6 form to report the taxes withheld and pay the amount due.

Who Needs to File the WT-6 Form?

Not all employers are required to file the WT-6 form. The following employers are required to file:

- Employers who withhold Wisconsin state income tax from employee wages

- Employers who are required to make federal tax deposits (Form 941) are also required to file the WT-6 form

- Employers who have a Wisconsin withholding tax liability of $100 or more in a quarter

How to Complete the WT-6 Form

To complete the WT-6 form, you'll need to provide the following information:

- Your employer identification number (EIN)

- Your business name and address

- The quarter and year for which you're filing

- The total amount of Wisconsin state income tax withheld

- The amount of tax deposited for the quarter

Here are the steps to complete the form:

- Enter your EIN, business name, and address at the top of the form.

- Indicate the quarter and year for which you're filing.

- Report the total amount of Wisconsin state income tax withheld for the quarter.

- Calculate the amount of tax deposited for the quarter.

- Sign and date the form.

WT-6 Form Filing Requirements

The WT-6 form must be filed quarterly, and the due dates are as follows:

- April 30th for the first quarter (January 1 - March 31)

- July 31st for the second quarter (April 1 - June 30)

- October 31st for the third quarter (July 1 - September 30)

- January 31st of the following year for the fourth quarter (October 1 - December 31)

Consequences of Non-Compliance

Failure to file the WT-6 form or pay the required tax deposit can result in penalties and interest. The Wisconsin Department of Revenue may assess the following penalties:

- 5% of the unpaid tax for each month or part of a month the return is late

- 0.5% of the unpaid tax for each month or part of a month the payment is late

- A minimum penalty of $10

In addition to penalties, you may also be subject to interest on the unpaid tax.

WT-6 Form vs. Other Tax Forms

The WT-6 form is specific to Wisconsin state income tax withholding. There are other tax forms that employers must file, including:

- Form 941: Federal income tax withholding

- Form W-2: Employee wage and tax statement

- Form W-3: Transmittal of wage and tax statements

It's essential to understand the differences between these forms and file them correctly to avoid penalties and interest.

FAQs

Who is required to file the WT-6 form?

+Employers who withhold Wisconsin state income tax from employee wages and have a Wisconsin withholding tax liability of $100 or more in a quarter are required to file the WT-6 form.

What is the due date for the WT-6 form?

+The WT-6 form is due quarterly, and the due dates are April 30th, July 31st, October 31st, and January 31st of the following year.

What are the consequences of non-compliance?

+Failure to file the WT-6 form or pay the required tax deposit can result in penalties and interest. The Wisconsin Department of Revenue may assess a penalty of 5% of the unpaid tax for each month or part of a month the return is late, and 0.5% of the unpaid tax for each month or part of a month the payment is late.

In conclusion, the Wisconsin Form WT-6 is a critical tax form that employers must file to report and remit Wisconsin state income tax withholding. Understanding the purpose, filing requirements, and consequences of non-compliance is essential to avoid penalties and interest. If you have any questions or concerns, please don't hesitate to reach out to a tax professional or the Wisconsin Department of Revenue.

Please share your thoughts or questions in the comments section below.